sur Biophytis (EPA:ALBPS)

Biophytis Announces Reverse Stock Split on Euronext Growth

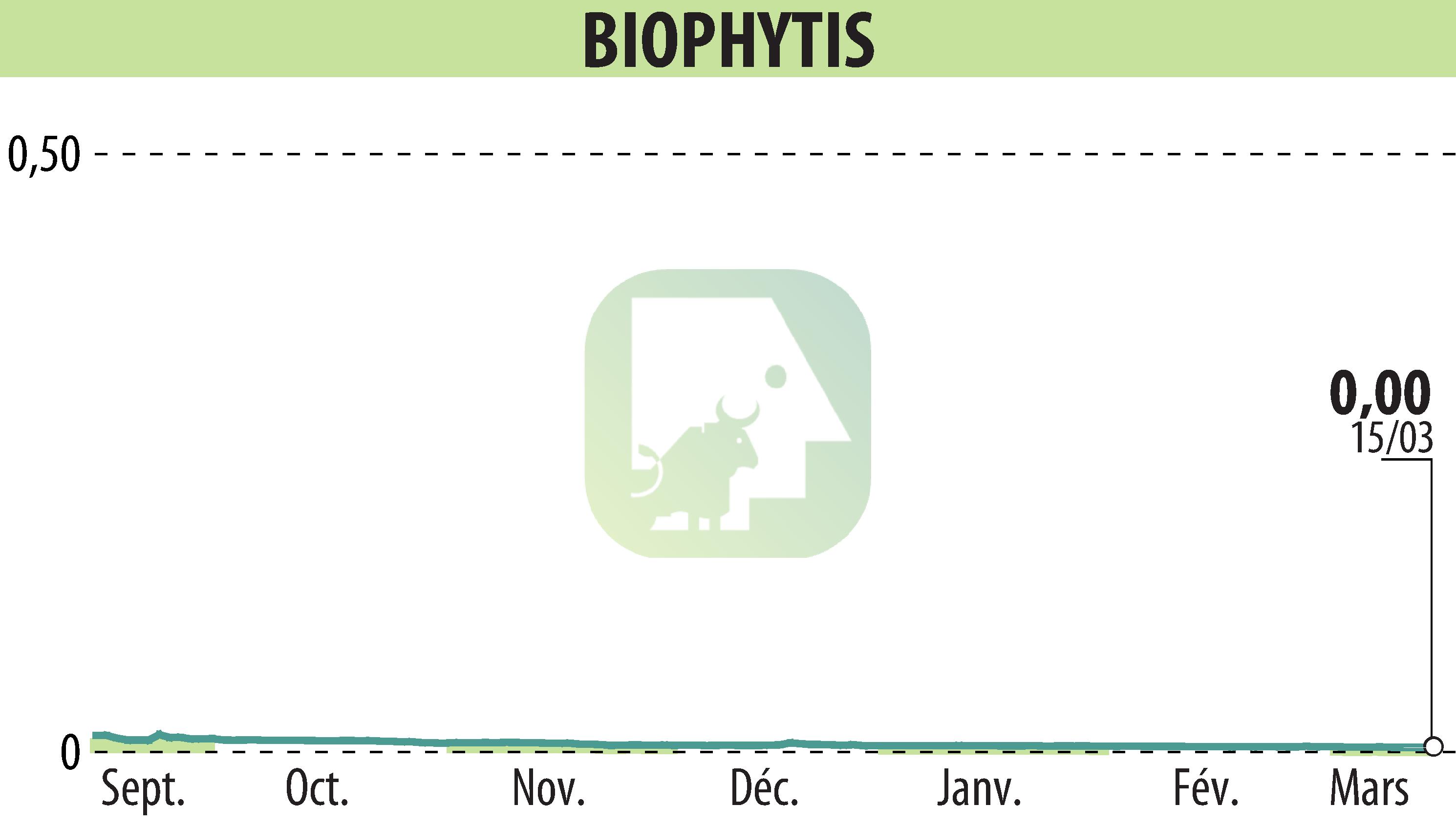

Biophytis SA, a clinical-stage biotechnology firm, announced a reverse stock split of its ordinary shares on Euronext Growth, effective April 2, 2024. This move, decided by the CEO following the Combined General Meeting and Board of Directors' resolutions, aims to reduce share price volatility and align with the company's development strategy. The reverse split involves issuing 1 new ordinary share with a par value of €0.80 for every 400 existing shares, each currently valued at €0.002.

This technical exchange will not impact the company's capital amount but will alter the par value and quantity of shares in circulation. Shareholders will automatically receive 1 new share for every 400 held, with financial intermediaries adjusting holdings for fractional shares. Operations commence on April 2, with a 30-day period for the consolidation of shares. During this timeframe, shareholders can rectify fractional shares, leading up to the delisting of old shares and initiation of new shares' trading under ISIN code FR001400OLP5.

The new shares will immediately qualify for double voting rights under certain conditions. Furthermore, a centralization agent, Uptevia, will manage the reverse split transactions, including the sale of fractional rights on the stock market, with proceeds distributed accordingly. This restructuring aims to enhance shareholder value and market stability.

R. P.

Copyright © 2024 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de Biophytis