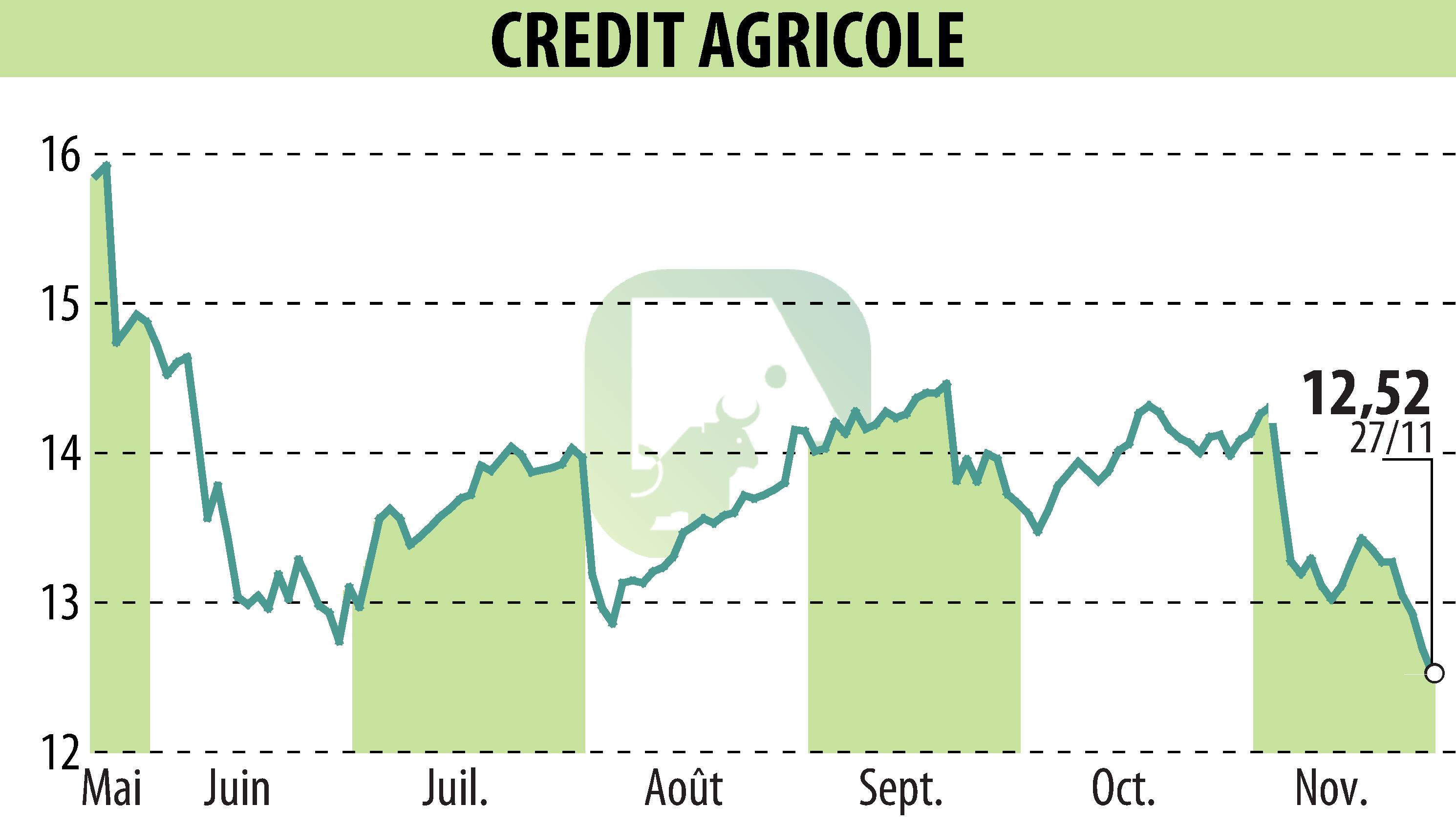

sur CREDIT AGRICOLE (EPA:ACA)

Crédit Agricole designated as G-SIB category 2

On November 27, 2024, Crédit Agricole was designated as a Category 2 Global Systemically Important Institution (G-SIB) by the French Prudential Supervision and Resolution Authority (ACPR). This ranking is based on a score calculated from data from the end of 2023, highlighting the group's growth and leading position internationally.

This designation results in an increase in the additional capital requirement, or "GSIB buffer," from 1% to 1.5%, effective January 1, 2026. The current 1% requirement remains in effect until that date.

The Group stands out for its solid capitalization level, posting a CET1 ratio of 17.4% as of September 30, 2024. This represents a margin of 760 basis points compared to the SREP capital requirement as of the same date, giving it a robust position among European G-SIBs.

R. E.

Copyright © 2024 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de CREDIT AGRICOLE