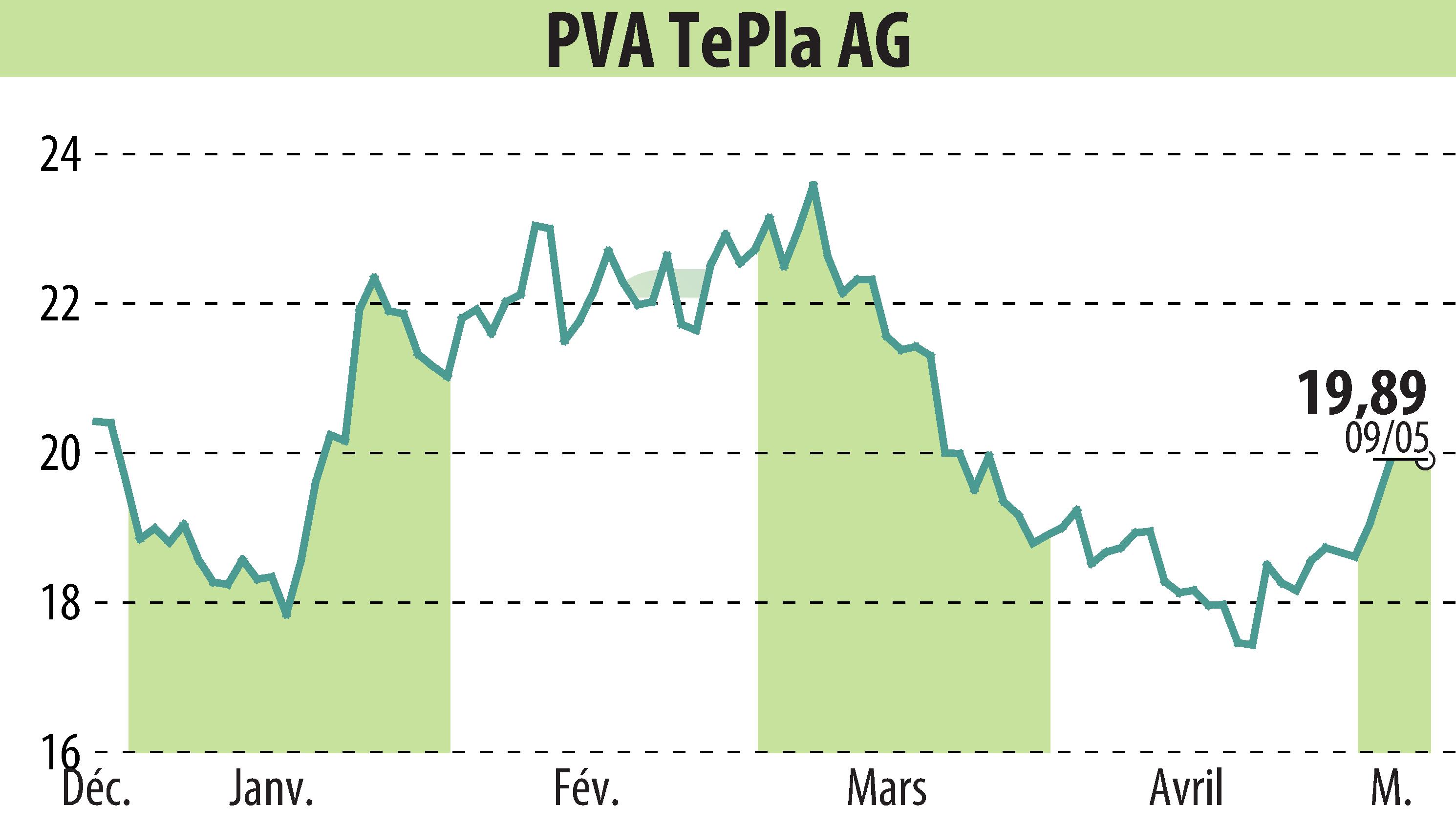

sur PVA TePla AG (isin : DE0007461006)

Edison Initiates Coverage on PVA TePla with Positive Outlook

Edison Investment Research has initiated coverage on PVA TePla AG (TPE), a company that has evolved from a simple industrial systems seller to a significant player in materials technology and metrology solutions. PVA TePla is expected to achieve revenues close to €280 million in FY24, primarily fueled by its strong ties to the expanding semiconductor industry. This sector accounts for over two-thirds of its sales and is enhanced by demands from artificial intelligence, digitization, and e-mobility sectors.

The company benefits particularly from a surge in capital intensity within the semiconductor industry and widening end markets. However, despite its strategic positioning and growth trajectory, PVA TePla's market valuation still lags behind its peers. Currently, it trades at an FY25e EV/EBITDA of 6.8x, significantly lower than the averages of other European semiconductor equipment makers and advanced materials firms.

Edison's detailed analysis suggests that the market has not yet fully appreciated PVA TePla's transformation and growth potential, with their DCF valuation indicating a fair share price of €35.26. This undervaluation presents a unique angle for investors, particularly those interested in the high-tech industrial and semiconductor sectors.

R. P.

Copyright © 2024 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de PVA TePla AG