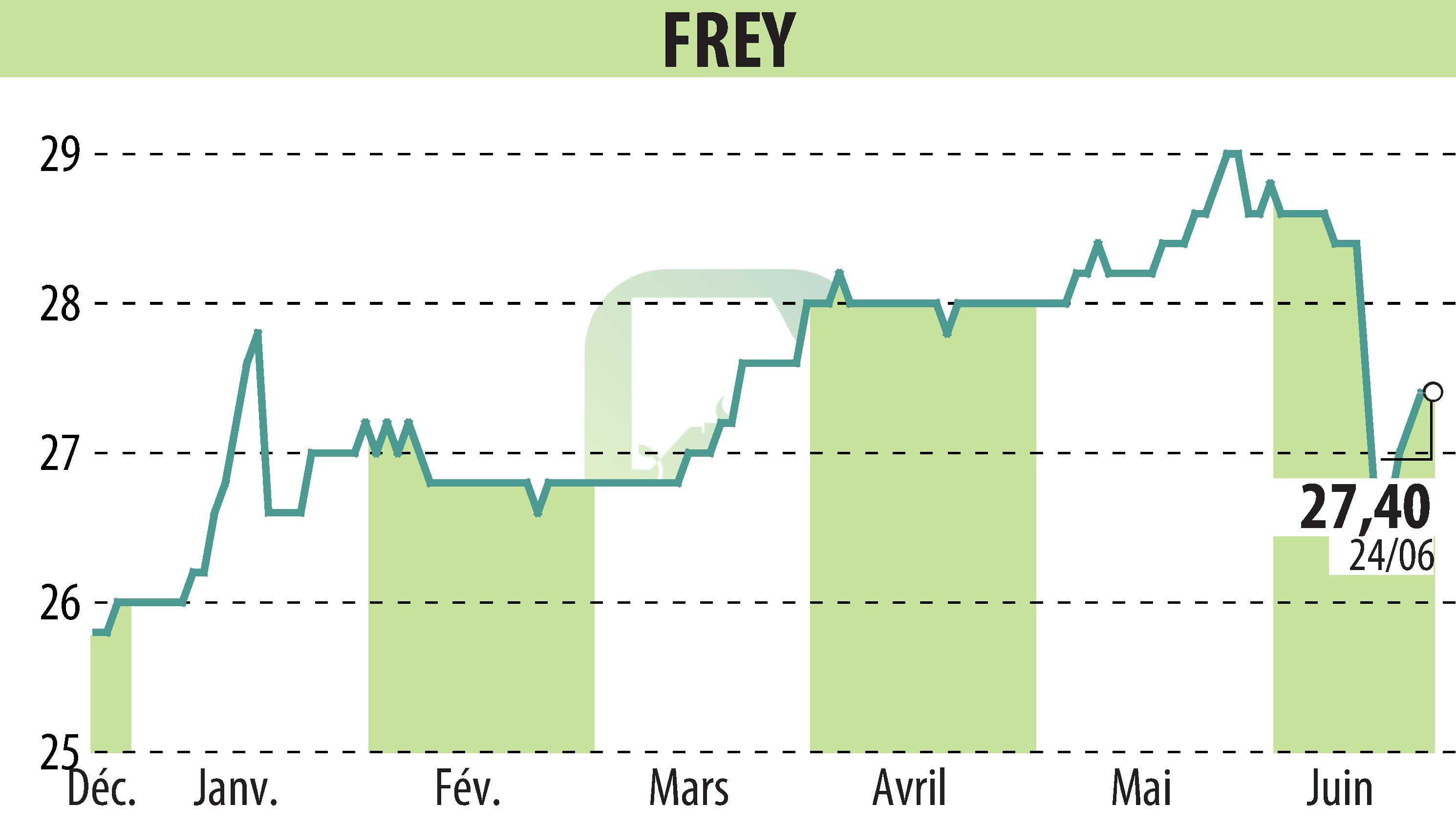

sur FREY (EPA:FREY)

FREY Signs New Financing for €400m

FREY has secured €400m in corporate financings to extend the maturity of its debt, ensuring fresh financial resources for its growth strategy and its ambition to lead Europe's open-air retail sector.

The refinancing, comprising 40% of the Group's debt, includes bullet loans with a five-year maturity, with two possible one-year extensions. This move extends the Group's debt maturity to over four years, with no significant maturities before 2027, which are covered by existing liquidities.

The agreement gives FREY €120m in new undrawn credit lines available for acquisitions, increasing its total available liquidity to over €280m. The cost of the financing aligns with previous terms, maintaining a competitive average cost of debt.

FREY was supported by its partner banks and new lenders, including Crédit Mutuel Arkéa, Banque Postale, BNP Paribas, and Société Générale. Legal advice was provided by De Pardieu Brocas Maffei. The financing incorporates three ESG performance indicators: environmental certification, mobility, and greenhouse gas emissions, maintaining a 100% bank financing ratio with ESG criteria.

R. P.

Copyright © 2024 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de FREY