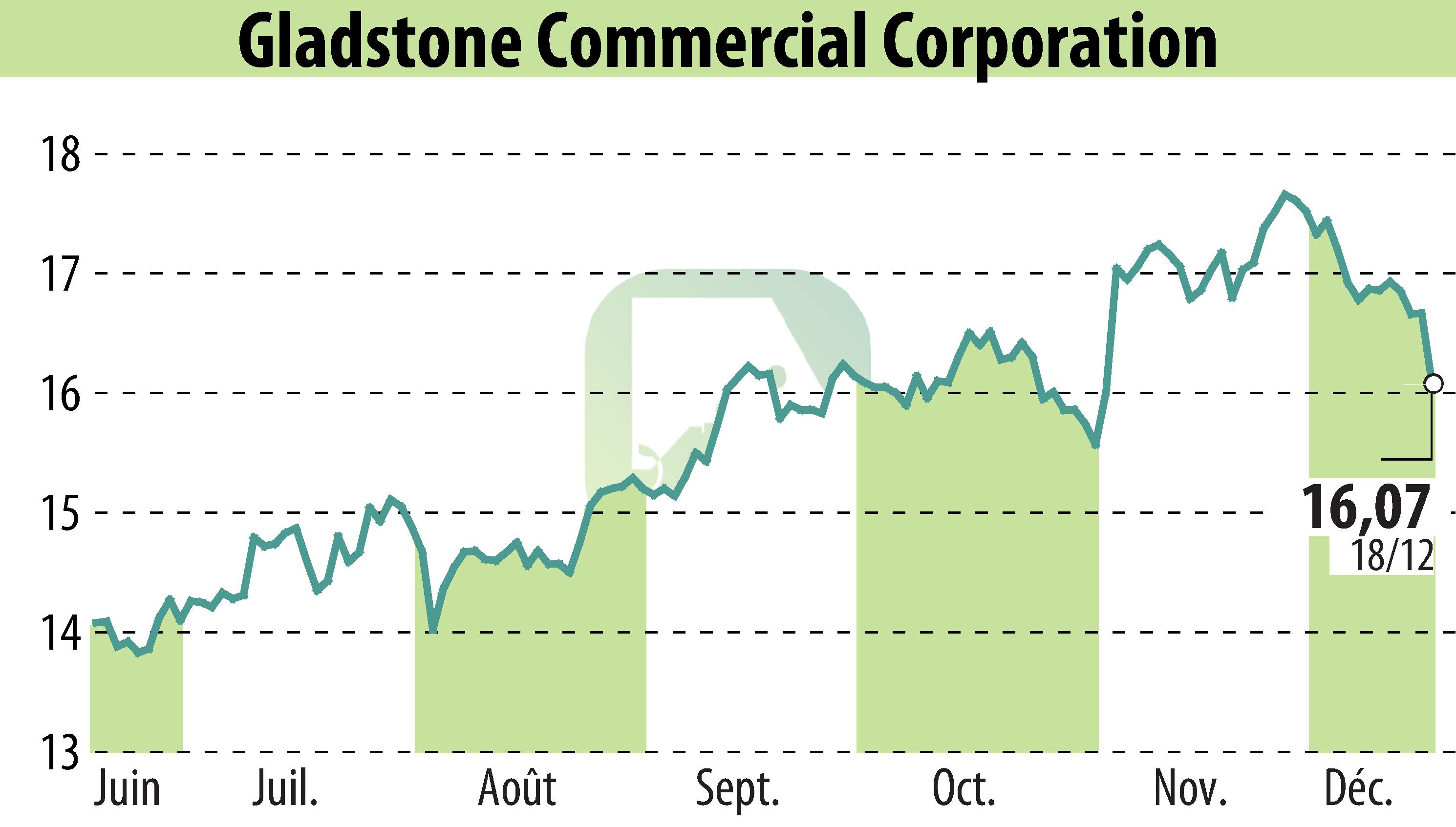

sur Gladstone Commercial Corporation (NASDAQ:GOOD)

Gladstone Commercial Secures $75 Million in Debt Notes

Gladstone Commercial Corporation, based in McLean, VA, announced its subsidiary, Gladstone Commercial Limited Partnership, has issued $75 million in senior unsecured notes. These notes bear a 6.47% interest rate and are due by December 18, 2029. The transaction was a private placement with institutional investors.

The proceeds will be directed towards repaying existing debts under their unsecured revolving credit facility, partially pre-paying a $60 million Term Loan B, and for other corporate needs. Buzz Cooper, the company's President, remarked on this strategic shift towards long-term unsecured debt markets.

KeyBanc Capital Markets Inc. led the placement, with several other financial institutions co-acting. Legal counsel for the transaction was provided by multiple firms including Squire Patton Boggs and Venable LLP.

R. E.

Copyright © 2024 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de Gladstone Commercial Corporation