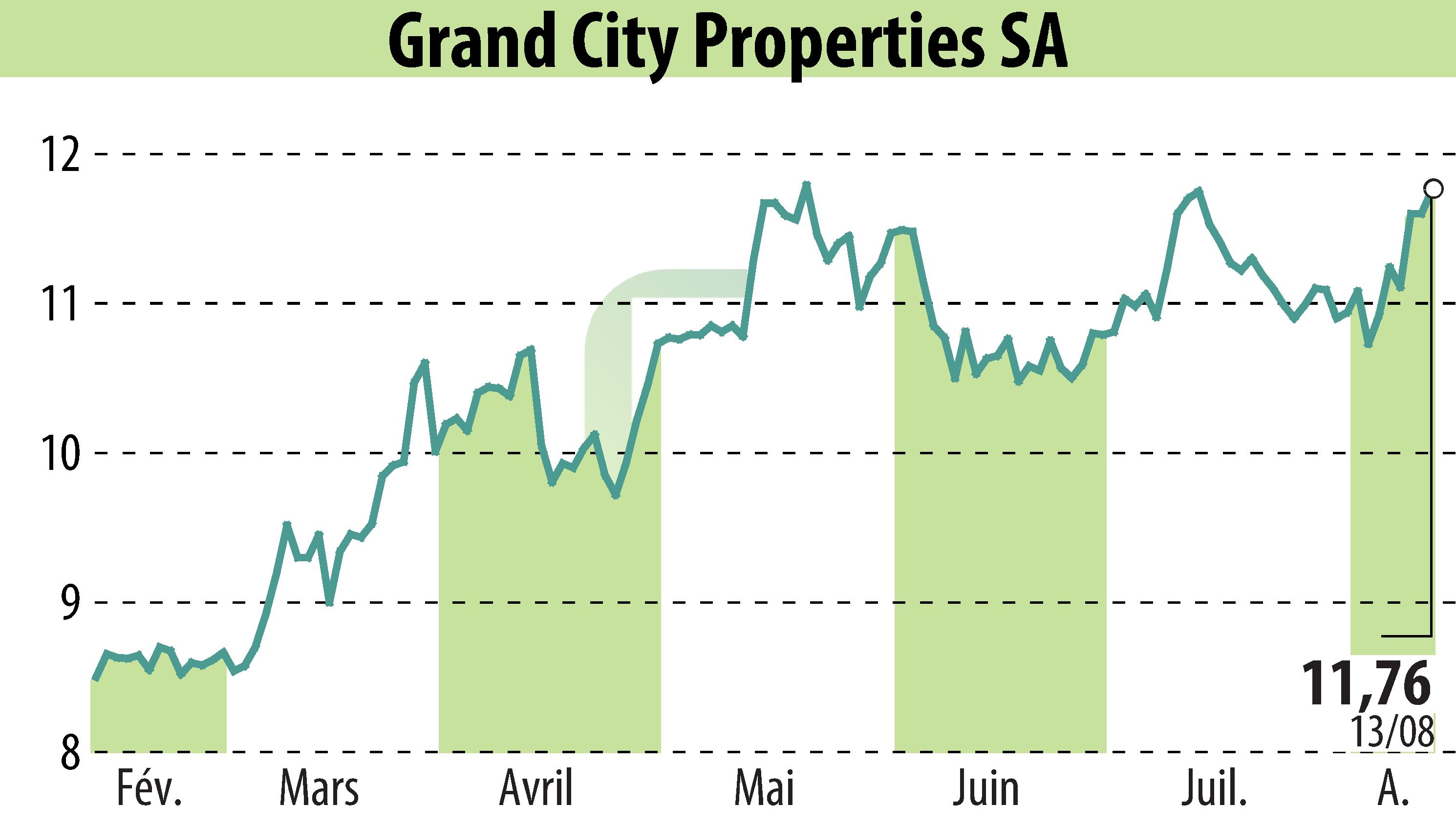

sur Grand City Properties S.A., (isin : LU0775917882)

Grand City Properties S.A. Reports H1 2024 Results and Raises Guidance

Grand City Properties S.A. ("GCP") announced its financial results for the first half of 2024. Net rental income reached €212 million, marking a 3% increase from €204 million in H1 2023. This growth is attributed to a 3.4% like-for-like rental increase driven by in-place rent growth. Adjusted EBITDA rose by 4% year-over-year to €166 million.

Funds from operations (FFO I) remained stable at €94 million or €0.54 per share. Despite property revaluations resulting in a net loss of €74 million, the company's operational performance was strong. As of June 2024, the valuation of the full portfolio showed a 2% decline, with a net rental yield of 5.0%.

GCP maintained a strong liquidity position with €1.1 billion in cash and liquid assets, representing 26% of total debt. The company's loan-to-value ratio stood at 37%, and the interest coverage ratio was 6.0x. The firm's balance sheet remained robust with €6.1 billion of unencumbered assets.

Successful capital market transactions were executed, and FY 2024 guidance for FFO I was increased to €180-€190 million, reflecting confidence in the company's growth prospects.

R. E.

Copyright © 2024 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de Grand City Properties S.A.,