sur KERLINK (EPA:ALKLK)

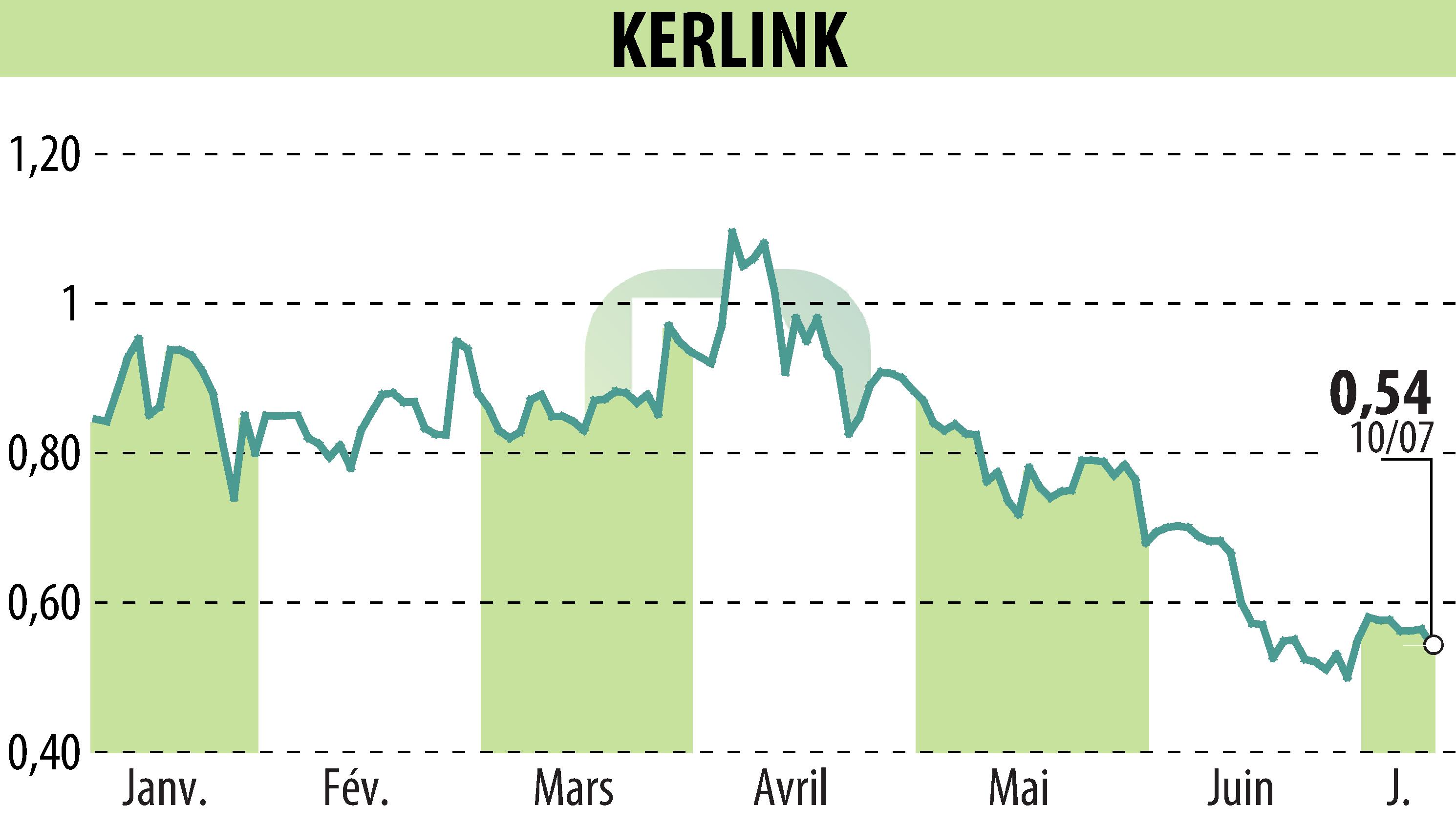

Kerlink Reports 6% Revenue Decline Amid Wait-and-See Market

Kerlink, a French network and IoT solutions provider, announced a 6% drop in H1 2024 revenue to €6.2m compared to €6.6m in H1 2023. The decline is attributed mainly to the termination of two Network as a Service (NaaS) contracts due to economic difficulties faced by clients.

Despite the revenue fall, sales of network infrastructure equipment rose by 5%, reaching €4.8m. This increase offsets a 29% dip in services revenue, which fell to €1.5m. Kerlink attributed this shift to integrating value-added solutions into infrastructure products, favoring equipment sales.

The group's cash position improved from €4m at the end of December 2023 to €5.3m by the end of June 2024, thanks to measures implemented last year. Although Kerlink remains optimistic about future prospects, it revised its 2024 financial goals due to current market uncertainties.

R. E.

Copyright © 2024 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de KERLINK