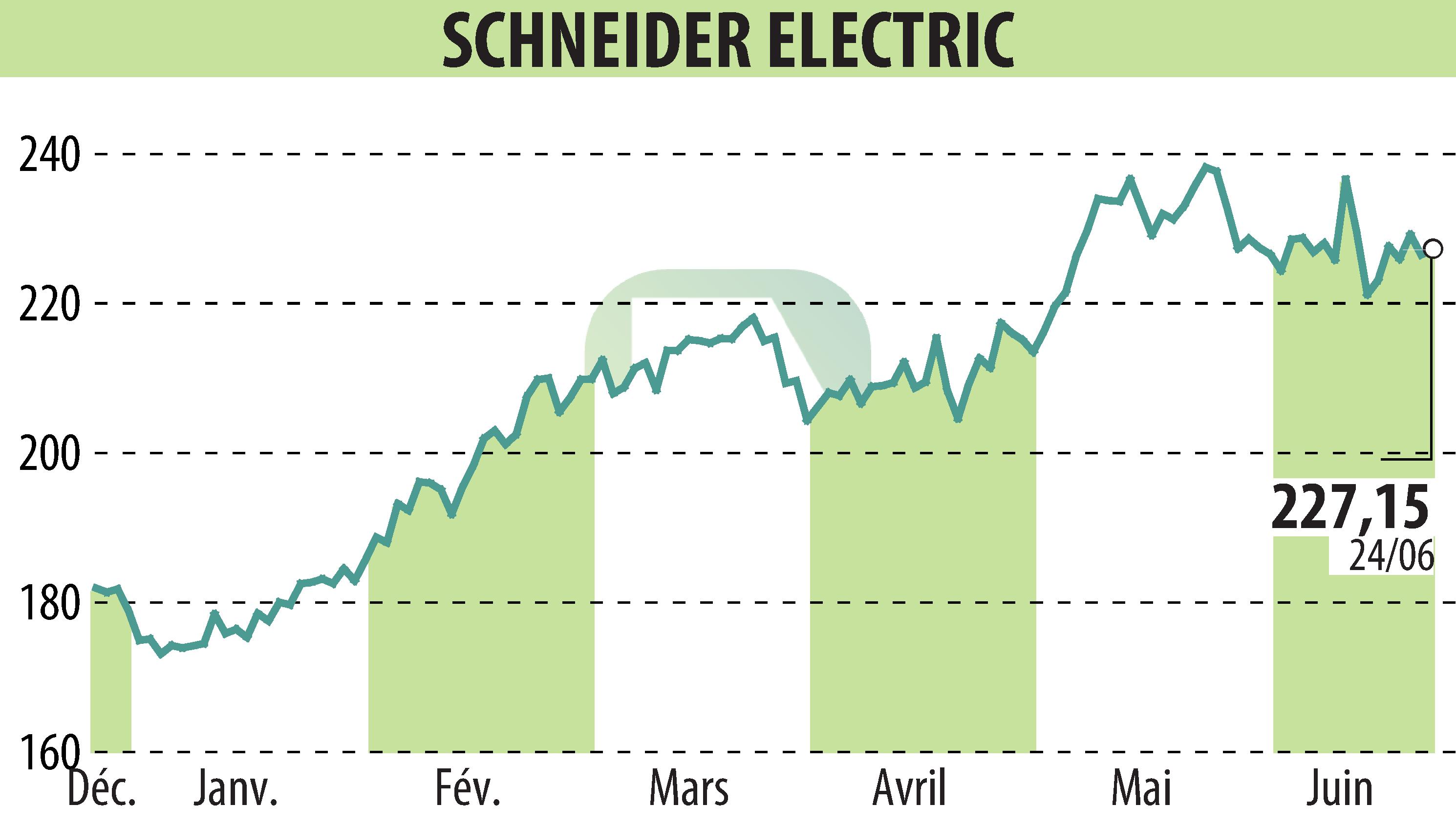

sur SCHNEIDER ELECTRIC (EPA:SU)

Schneider Electric Announces €750 Million Convertible Bond Offering and Repurchase Initiative

Schneider Electric unveiled a €750 million bond offering to qualified investors. The bonds, due 2031, can be converted into new shares or exchanged for existing ones. Concurrently, the company will repurchase its outstanding bonds due 2026 via a reverse bookbuilding process.

The net proceeds will primarily fund the repurchase of its 2026 bonds, with any remaining funds used for corporate purposes. With this move, Schneider Electric aims to mitigate potential dilution risks and optimize its financing strategy.

The bonds, with a €100,000 denomination each, are expected to offer a fixed coupon rate between 1.375% and 1.875% per annum. The final terms will be determined after the bookbuilding process, with settlement set for 28 June 2024.

R. H.

Copyright © 2024 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de SCHNEIDER ELECTRIC