sur SCHNEIDER ELECTRIC (EPA:SU)

Schneider Electric Announces Successful €750 Million Convertible Bonds Offering

Schneider Electric has completed a successful offering of senior unsecured bonds convertible into new shares and/or exchangeable for existing shares (OCEANEs) due 2031, amounting to €750 million. The bonds will be offered solely to qualified investors.

The net proceeds will go towards the repurchase of existing bonds due June 2026 and general corporate purposes. The bonds will have a fixed coupon rate of 1.625% per annum, with the first payment due on December 28, 2024.

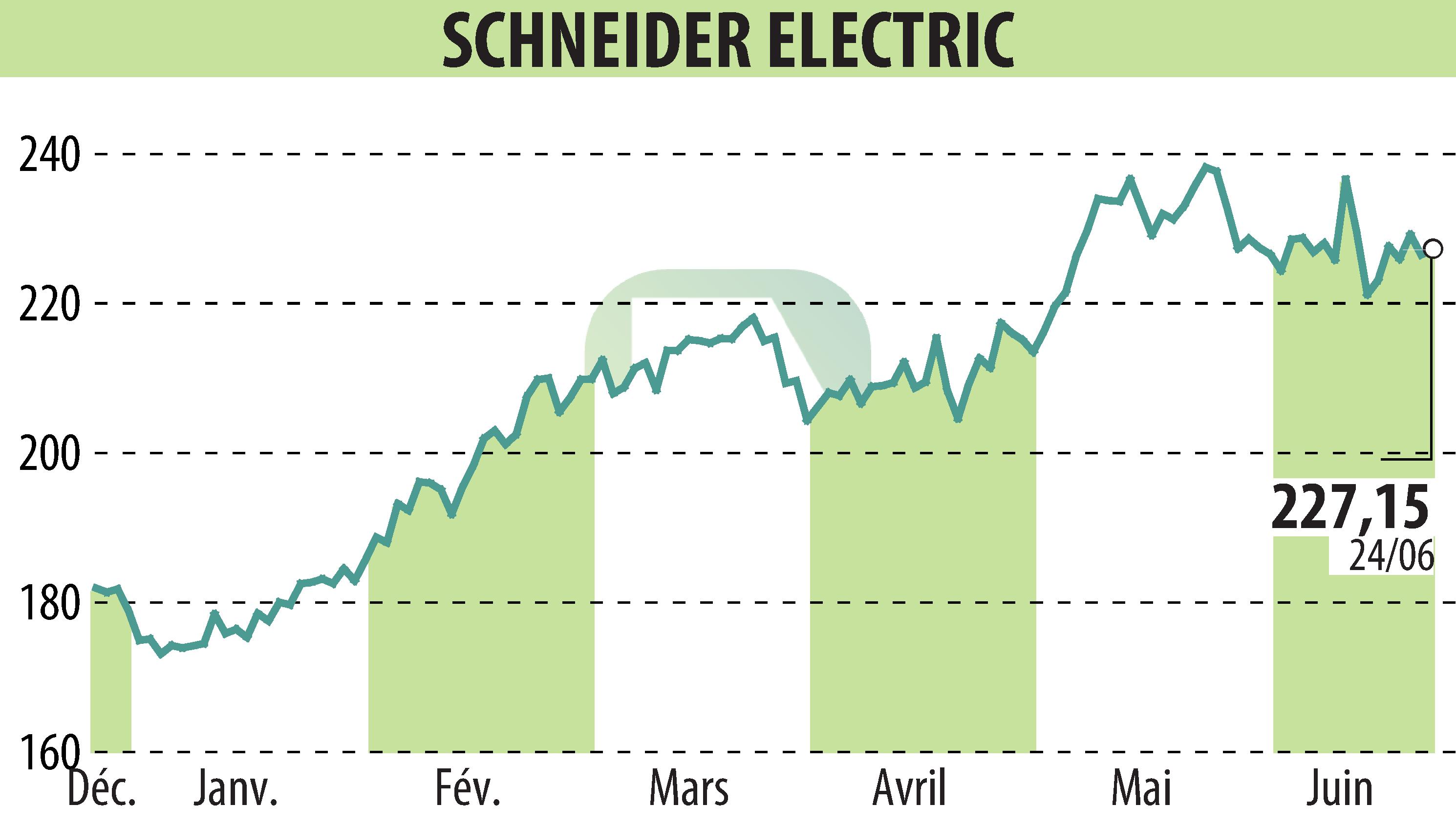

The conversion or exchange premium is set at 37.5% above Schneider's reference share price on Euronext Paris. Settlement is expected on June 28, 2024, with bonds redeemable at par on June 28, 2031.

This offering is part of Schneider Electric's strategy to limit dilution and maintain strong investment-grade metrics. The bonds, with a nominal value of €100,000 each, are aimed at achieving efficient financing and credit ratings for the company.

R. E.

Copyright © 2024 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de SCHNEIDER ELECTRIC