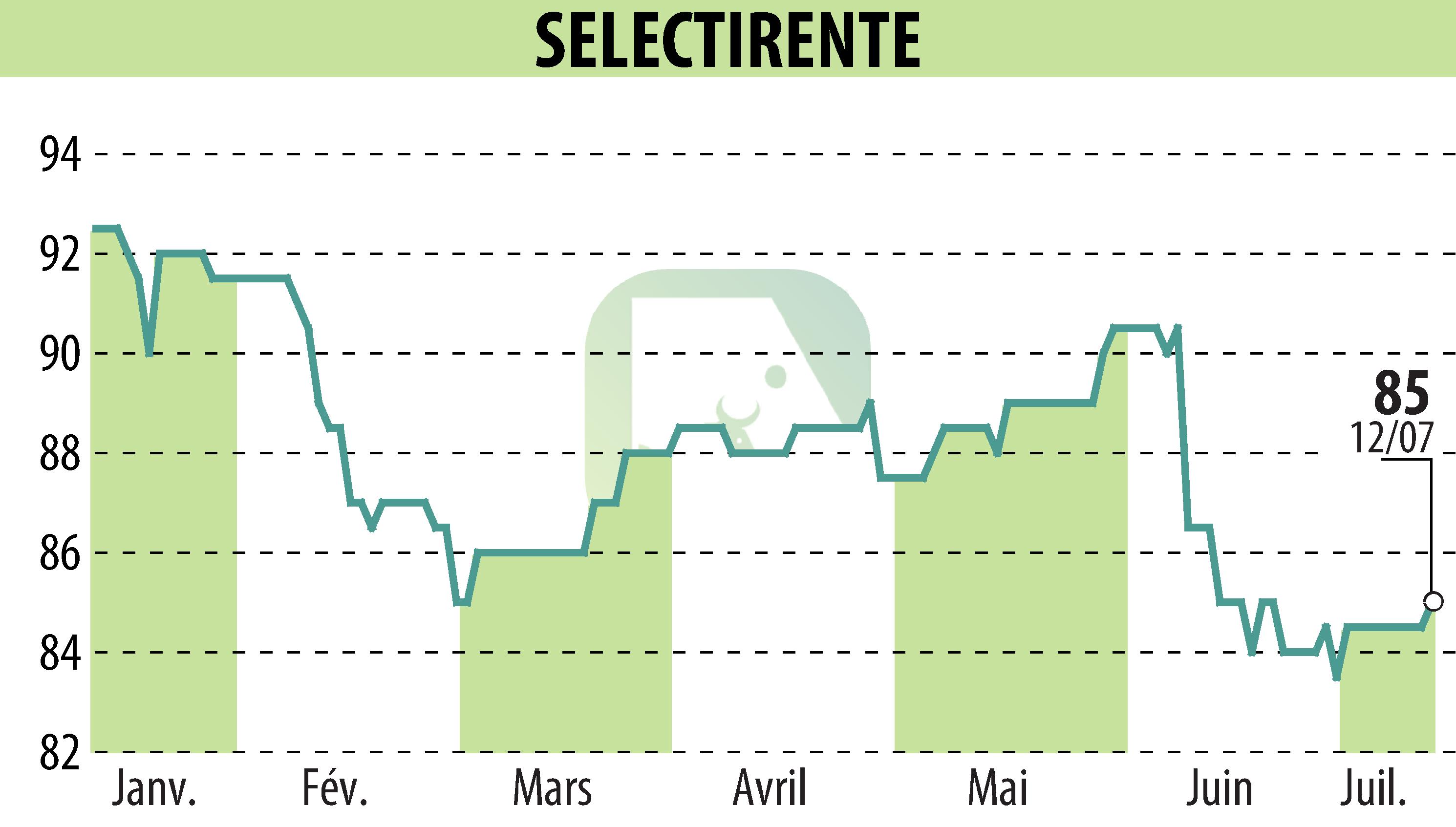

sur SELECTIRENTE (EPA:SELER)

SELECTIRENTE successfully concludes an 80 MEUR refinancing

SELECTIRENTE, a company specializing in local retail real estate, announces that it has signed a refinancing of 80 million euros with its historic banking partners. This amount represents more than 35% of its current debt and postpones any significant debt maturity until 2027.

The company finalized this agreement by nine months ahead of its current deadline. The transaction includes two lines of credit: €50 million in mortgage credit over five years, with two extension options, and a new RCF of €30 million over three years, also extendable.

The refinancing allows SELECTIRENTE to extend the maturity of its debt to almost five years and to strengthen its financial structure. Available liquidity is now at €25 million, with a competitive average cost of debt.

Société Générale, Banque Européenne du Crédit Mutuel and HSBC Continental Europe orchestrated the operation. SELECTIRENTE is positioning itself to seize new market opportunities.

R. P.

Copyright © 2024 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de SELECTIRENTE