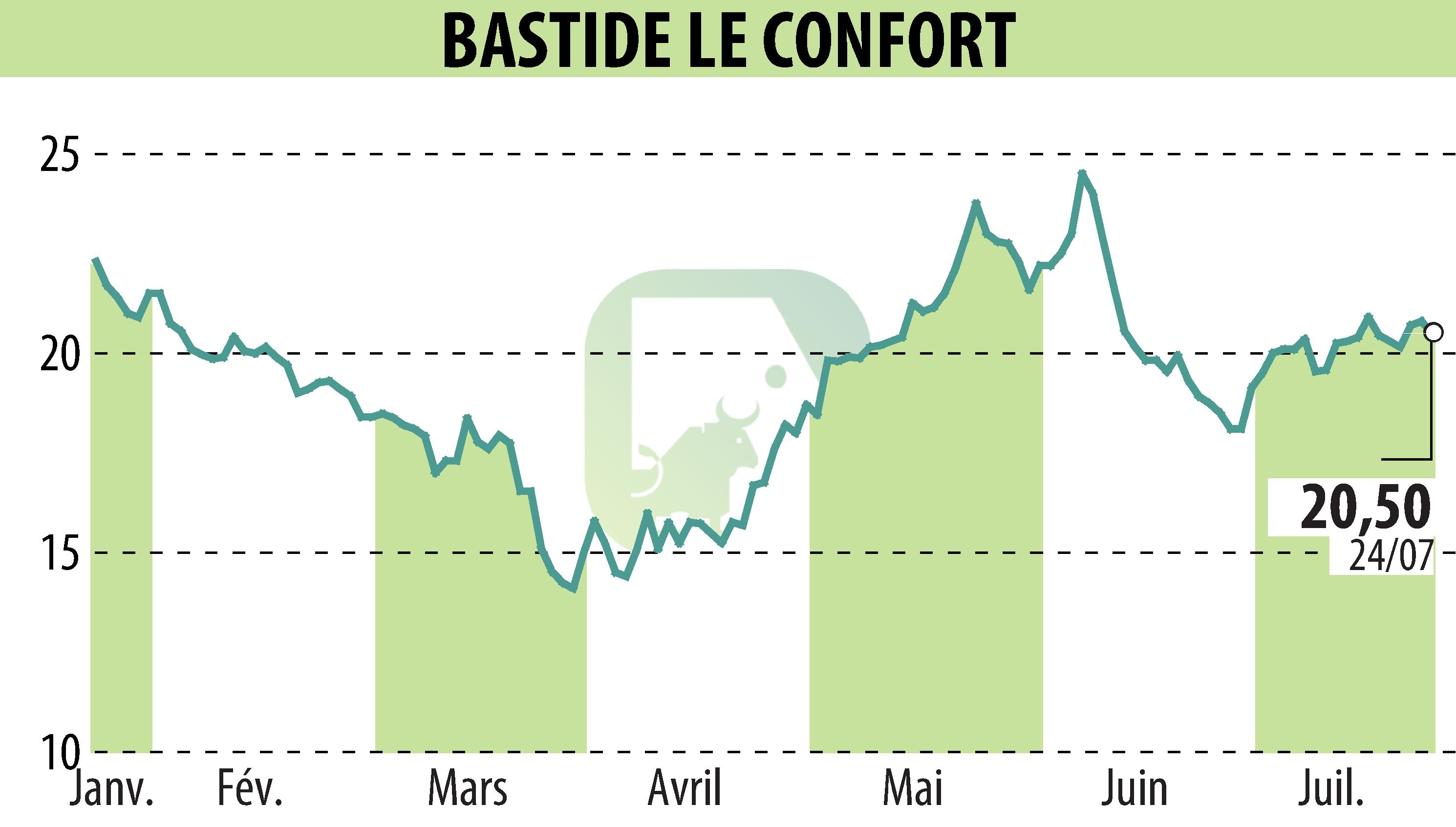

sur BASTIDE (EPA:BLC)

The Bastide Group secures its financing with a new syndicated loan

The Bastide Group announces the conclusion of a €375 million financing contract, including a syndicated loan and a revolving loan. This replaces the November 2021 syndicated credit of €270.5 million and bilateral loans of €38.8 million.

The new credit is divided into three tranches: a first of €35 million, amortizable over 5 years, a second of €215 million with maturity in July 2029, and a third of €75 million with maturity in July 2030. A revolving credit of €50 million over 5 years finances investments and growth.

The financing is conditional on a leverage ratio of 4.5 as of December 31, 2024, gradually decreasing to 4.00 as of June 30, 2027. The cost of this debt will be approximately 140 basis points higher than currently.

The Bastide Group mobilizes Natixis, Société Générale and BNP as lead managers. The banking pool includes 10 establishments and three institutional investors. The confidence in Bastide's prospects made it possible to secure this financing without the constraint of selling assets.

R. P.

Copyright © 2024 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de BASTIDE