par Bluejay Mining PLC (NASDAQ:BLLYF)

Bluejay Mining PLC Announces Finland Strategy & Operational Update

Operational and Strategic Update on Bluejay's Finland Projects &

Positive Visual Indications from Drilling at the Hammaslahti Cu-Zn-Au-Ag Project

LONDON, UK / ACCESSWIRE / July 24, 2023 / Bluejay Mining plc (AIM:JAY) ('Bluejay', the 'Group' or the 'Company'), the AIM, FSE-listed and OTCQB traded exploration and development company with projects in Greenland and Finland, is pleased to provide an operational and strategic update on the Company's portfolio of exploration projects in eastern Finland, namely the Hammaslahti copper-zinc-gold-silver ('Cu-Zn-Au-Ag') Project, the Enonkoski nickel-copper-cobalt ('Ni-Cu-Co') Project, the Outokumpu copper-zinc-nickel-cobalt-silver-gold ('Cu-Zn-Ni-Co-Ag-Au') Project and the Paltamo and Rautavaara nickel-zinc-copper-cobalt ('Ni-Zn-Cu-Co') projects.

All projects are held by Bluejay's 100% owned subsidiaries, FinnAust Mining Finland Oy, and FinnAust Mining Northern Oy (hereafter collectively 'FinnAust').

Highlights

- Geochemical assay results from Phase 1 of recent diamond drilling programme at Hammaslahti Cu-Zn-Au-Ag Project are expected shortly. A short programme of follow up drilling is due to commence August 2023 with a view to develop a maiden Mineral Resource Estimate ('MRE') for the East-lode ('E-lode') as well as the down plunge extensions to previously mined ore lodes.

- All seven Phase 1 drill holes intersected broad zones of disseminated to semi-massive sulphide mineralisation corresponding to the E-lode orebody, some of which exceeded 10 metres ('m') in width.

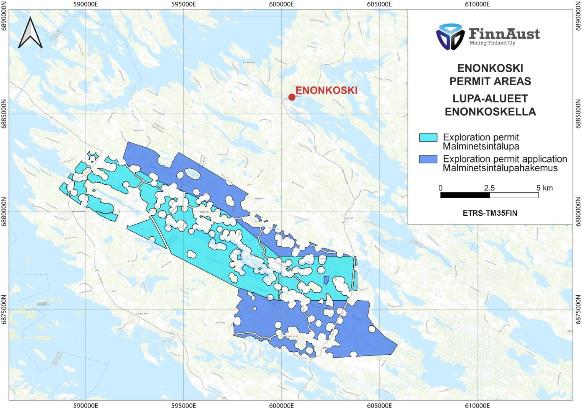

- Bluejay and Rio Tinto have concluded their Joint Venture Agreement and Earn-in Agreement ('JV') on the Enonkoski Ni-Cu-Co Project. Bluejay retains its 100% ownership of the Project with Rio Tinto having invested a total of US$4.65 million. The Company's focus will now be to assess numerous as-yet-untested targets that have been identified along the Enonkoski Belt.

- Drilling of up to 1,500m planned in late 2023 to test the Makkola, Hälvalä and Kiislampi targets (subject to availability of funding and drilling contractor).

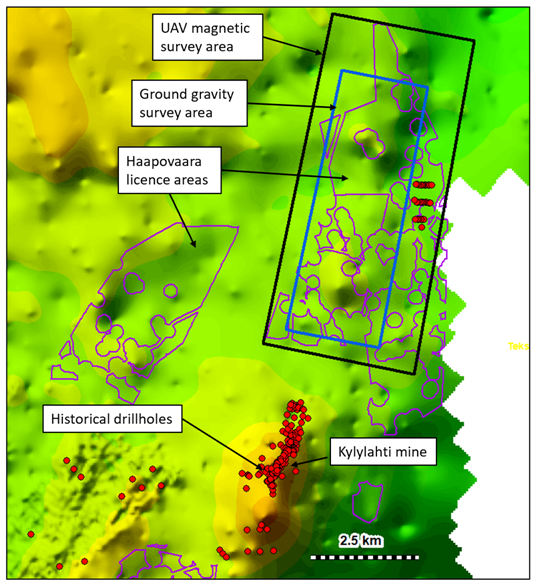

- Detailed ground gravity and airborne magnetic surveys planned for the Outokumpu Cu-Zn-Ni-Co-Ag-Au Project to progress the high-priority Haapovaara target (subject to availability of funding).

- Haapovaara is located only a few kilometres ('km') along strike, to the North East, of Boilden's Kylylahti Mine. The target is coincident with two gravity highs in existing regional gravity data that have never been drill tested.

- Bluejay recently increased its licence areas and is now the largest landholder on the highly prospective Outokumpu belt, that hosts three past producing high-grade, polymetallic mines.

- Divestment of the Company's non-core Finnish projects is progressing with the first day of trading of Metals One plc on the AIM expected on 31 July 2023. Bluejay to receive cash and shares valued in excess of £4 million GBP in exchange for the Paltamo and Rautavaara Black Schist projects. Following its admission to the AIM, Bluejay is expected to hold 29.01% of the issued share capital in Metals One.

Executive Chairman of Bluejay Mining plc, Robert Edwards, commented:

"Bluejay remains convinced that our portfolio of base metal projects in Greenland and Finland present commercial opportunities to generate value well in excess of outlay. As we have previously stated, we have been keen to advance our Finnish exploration portfolio in 2023 as we believe that the opportunities merit expenditure due to the geological opportunity combined with the relative ease and low cost of execution. Bluejay's exploration activities in Finland are supported by our in-country exploration office, core storage and logging facilities located in the town of Outokumpu.

"Firstly, the Strategic Review (see Bluejay press release dated: 14 February 2023) highlighted that the near-mine targets at Hammaslahti represents a clear opportunity that can be advanced at modest cost. Having drilled and logged the cores drilled to date, we await assay results. Further drilling is planned in early August after which a wider drilling program may be embarked on if warranted. Hammaslahti is a former operating mine within a belt that we control. We know from other districts around the world that Volcanic Massive Sulphide (VMS) deposits almost always occur in clusters, not singularly. Our strategy is to develop a footprint within the belt that would ultimately support commercial mine development.

"Secondly, Bluejay will retain its 100% interest in the 15 km long Enonkoski Belt post the conclusion of the RTX JV agreement. Like Hammaslahti, the licence area hosts former producing mines as well as high ranking targets which we aim to pursue, subject to availability of funding. Quite a significant body of work was completed under the JV including diamond drilling, top of bedrock diamond drilling, extensive geophysical surveys and a significant amount of analyses, measurements and relogging of historic drill core that highlights several mafic-ultramafic intrusions within the belt. Of highest priority to Bluejay is the Makkola intrusion which is located close to the former Hälvälä Ni-Cu-Co Mine. This target ranked top in the recent belt scale prospectivity assessment of all known intrusions. The recent work, including a detailed ground gravity survey and analysis, measurements and relogging of historic drill core, indicates the potential for the presence of shallow mineralisation at Makkola which the Company intends to drill test in the near future.

"Thirdly, the Outokumpu Project which also hosts former high-grade polymetallic mines, presents an exciting exploration opportunity. Some shallow drill targets remain untested despite their proximity to a recently operating mine, e.g., the Haapovaara target. Much of the deeper parts of the region remain essentially unexplored. The consistently high grades and unique metal basket that Outokumpu-type ore provides make it compelling exploration target in the context of increasing demand for base metals related to the battery industrial ecosystems, electrification, and the green energy transition. Bluejay has recently increased its land package and is now the largest land holder on the Outokumpu Belt. Low-cost ground gravity and magnetic surveys are the next stage of work to be completed, after which Bluejay will develop an optimal strategy for development. When the opportunity arises, Bluejay will continue to hone its focus on opportunities that provide for commercial investment, or divestment."

Enonkoski Ni-Cu-Co Project:

Drilling planned (subject to availability of funding)

On 24 July 2023, Bluejay announced that in regard to the previously announced JV Agreement (see Bluejay's press release dated: 10 November 2020) through which Rio Tinto Exploration Finland Oy ('Rio Tinto') and Bluejay have been performing exploration of the Enonkoski Ni-Cu-Co Project ('Enonkoski'), the Company and Rio Tinto have ended the JV with immediate effect (see Bluejay press release dated: 24 July 2023). Consequently, Rio Tinto will cease to have any interest in the Enonkoski Project. Bluejay will retain 100% ownership of the Project (through the Company's subsidiary FinnAust Mining Finland Oy) along with all data, samples and drill cores collected during the JV Agreement with Rio Tinto.

The JV has enabled Bluejay to significantly advance the Enonkoski Project through US$ 4.65 million in exploration expenditure. It has opened the potential of targets close to the historic Hälvälä Ni-Cu-Co Mine, as well as multiple high priority targets within less explored parts of the belt that remain untested. The exploration programmes carried out to date have strengthened the Company's belief in the prospectivity of the Project, and Senior Management firmly believes that Enonkoski will continue to augment Bluejay's portfolio of assets. Bluejay's focus will now be to assess numerous as-yet-untested targets that have been identified along the Enonkoski Belt through the various regional geophysical surveys, top of bedrock drilling and geological mapping programmes completed under the JV (summarised in the section below "Highlights of exploration completed under the JV with Rio Tinto").

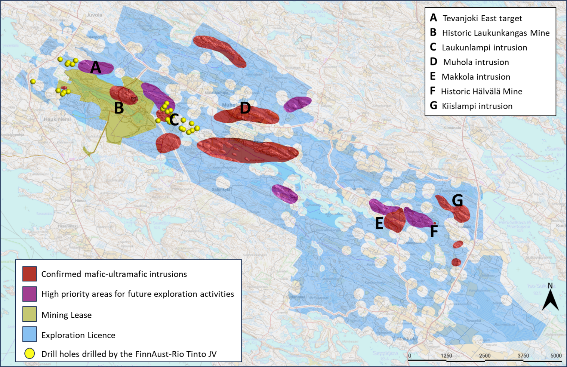

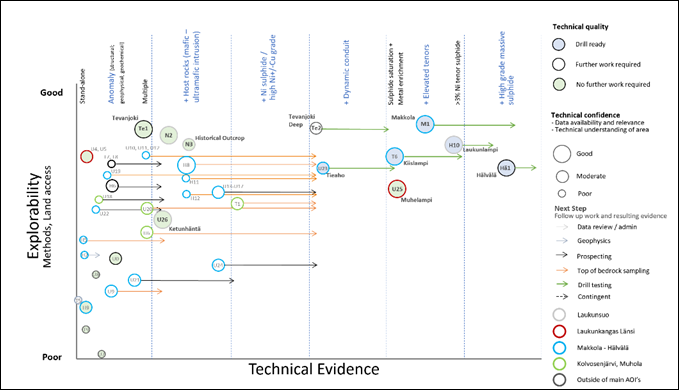

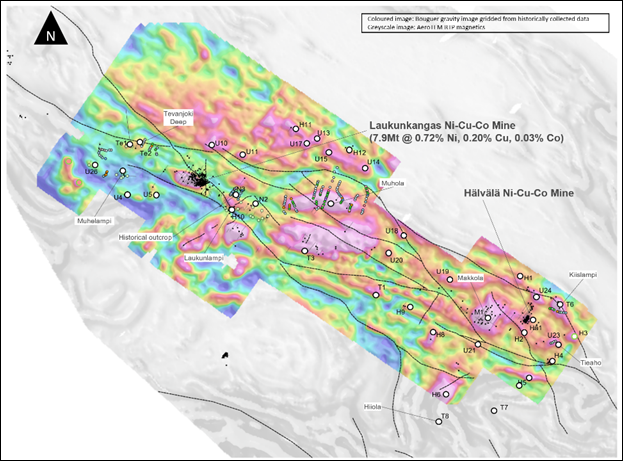

The highest priority target is the Makkola intrusion (see 'E' in Figure 2), which is located close to the Hälvälä Ni-Cu-Co Mine (see 'F' in Figure 2) in the eastern part of the >15 km long Belt. Makkola ranked very highly in the recent belt scale prospectivity assessment of all known intrusions. A 747-station ground gravity survey, covering a 2 square kilometre ('sq km') area of Makkola-Hälvälä was completed late last year, along with reference logging and sampling of historical drill cores. This work supports the potential for the presence of shallow mineralisation.

At Kiislampi (see 'G' in Figure 2), recent 3D inversion of historic ground gravity data has identified a highly anomalous zone of high density that warrants drill testing. A shallow historical drillhole, M421102R350, drilled by the Geological Survey of Finland ('GTK') confirmed that the Kiislampi target is located within a mafic-ultramafic intrusion (the hole intersected noritic - pyroxenitic rocks). This was further confirmed in recent top of bedrock ('ToB') shallow drillholes that intersected gabbroic and noritic rocks. A massive pyrrhotite-chalcopyrite vein with 0.2% Ni was observed in norite during Bluejay's reference logging of hole M421102R350. However, all historical drilling at Kiislampi did not reach the highly anomalous zone of high density identified from the recent 3D inversion.

Bluejay intends carry out a drill programme of up to 1,500 m testing the Makkola, Hälvalä near-mine and Kiislampi targets in late 2023 to (subject to availability of funding and drilling contractor). Alongside these activities, we will be assessing strategies for the Project going forward for the best outcome for our shareholders.

Highlights of exploration completed at Enonkoski under the JV with Rio Tinto:

- Total exploration expenditures by Rio Tinto totalled US$ 4.65 million over a 32-month period. FinnAust were the operator under the JV and received a management fee for these services.

- 9,667 m of diamond drilling for a total of 29 new drill holes and extensions of 2 historic drill holes. The diamond drilling carried out during the JV was focussed on the Laukunlampi, Laukunsuo, Muhelampi and Tevanjoki near-mine target areas (see 'A' and 'C' in Figure 2), all surrounding the former Laukunkangas Ni-Cu-Co Mine (see 'B' in Figure 2).

- Rio Tinto's primary interest from start of the JV was on the targets previously identified by Bluejay immediately outside the Laukunkangas Mining Lease. All diamond drill holes drilled during the JV were within a maximum distance of 1.3 km from the Mining Lease and most drill holes are only a few hundred metres away from the Mining Lease boundary. Much of the >15 km long Enonkoski Belt remains largely untested by drilling (see Figure 2).

- Re-logging and sampling historical drill cores drilled by the Finnish state mining company, Outokumpu Oy, the GTK and FinnAust, totalling 65 drill holes for >16,750 m, including comprehensive lithogeochemistry of selected intervals, totalling >1,000 drill-core samples; specific gravity, magnetic susceptibility, conductivity, and portable x-ray fluorescence ('pXRF') measurements; and detailed core photography.

- 160 ToB diamond drill holes for a total of 1,633.5 m of drilling over 7 targets.

- 161.5 line-kilometres ('line-km') of ground magnetics over 2 targets (see Figure 3).

- 2018 line-km of three component ('3C') UAV magnetics surveys, covering 50.2 sq km (see Figure 3).

- A 747-station ground gravity survey, covering a 2 sq km area at the Makkola-Hälvälä target (see Figure 3).

- Downhole electromagnetic ('DHEM') surveys were completed on a total of more than 50 drillholes for a total of >22,000m including measurements of both historic and new drill holes with several loop configurations.

- 2.5D airborne electromagnetic inversion processing completed on 1,055 line-km of HeliTEM data by Intrepid Geophysics.

- Geological, geophysical and geochemical modelling (Leapfrog Geo/Edge, ioGAS).

- Lithogeochemical and petrological studies by consultant geologist, Dr Hannu Makkonen.

- Prospectivity analysis and ranking of all known intrusions.

- Geological mapping and outcrop sampling.

- LIBS (Laser Induced Breakdown Spectroscopy) scanning of selected drill core.

Hammaslahti Cu-Zn-Au-Ag Project: Drill Programme Successfully Completed

Bluejay is pleased to share the preliminary results from the first exploration programme of 2023 at the Hammaslahti Cu-Zn-Au-Ag Project ('Hammaslahti') in eastern Finland. Bluejay's most recent fund raise of £1.3 million ($1.65 million) announced on 28 June (see Bluejay press release dated: 28 June 2023) will be focussed on the further development of the 100% owned Hammaslahti Project where the Company completed Phase 1 of a diamond drilling programme in May-June.

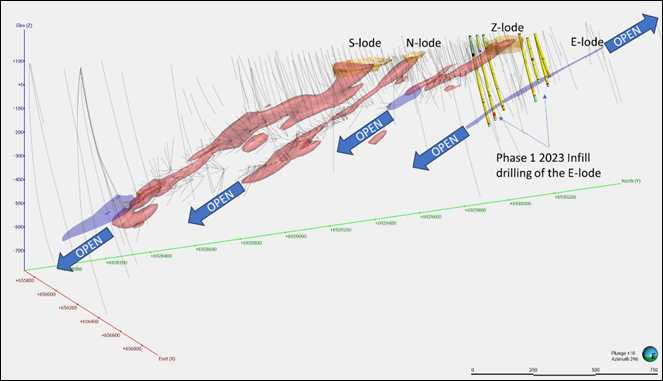

- During Phase 1, seven diamond drill holes (see Figure 7) for a total of 1,935.7 m were completed at Hammaslahti during May-June, targeting extensions of the E-lode mineralisation discovered by the Company during previous exploration drilling testing favourable geological contacts close to the historic Hammaslahti Cu-Zn-Au-Ag Mine (see Figure 6).

- Encouragingly all seven drill holes intersected sulphide mineralisation corresponding to the E-lode orebody. Mineralised zones of disseminated to semi-massive sulphide (pyrrhotite, sphalerite, chalcopyrite, with subordinate galena and pyrite), some of which are in excess of 10 m width, have been intersected. Systematic measurements using a handheld pXRF (portable X-ray fluorescence) instrument confirm the presence of anomalous copper, zinc and lead within the mineralised intervals. Mineralisation is associated with strong sericite, carbonate and tremolite alteration and silicification.

- Selected drill core samples from the mineralised zones have been submitted for geochemical analysis at ALS Laboratories in Outokumpu (Finland) and Loughrea (Ireland). Assays results are pending.

- Prospect of a further short drill programme to be carried out in August, followed by 3D resource modelling of the E-lode once all assay results have been received with a view to developing a maiden MRE for the E-lode as well as the down-plunge extensions to previously mined ore-lodes that were drilled by the Company in earlier drilling campaigns.

- The Project has the potential to provide meaningful value to shareholders in a short timeframe.

The Phase 1 programme undertaken in May-June 2023 focused on infill drilling with the aim to get a better understanding of the volume and grades of the E-lode mineralisation. The E-lode remains open up plunge, but the true potential to increase the volume of the mineralisation after the Phase 1 drilling is located down plunge from the southernmost drill hole drilled in 2014, intersecting the E-lode mineralisation at a vertical depth of approximately 300 m.

All historic ore bodies are located close to the same contact between black schist and strongly hydrothermally altered rocks, but the E-lode is so far the only significant mineralisation found east of the former mine on the other side of a large fold structure. No drilling targeting possible structural repetitions of the E-lode have so far been conducted, providing significant further potential to the Project.

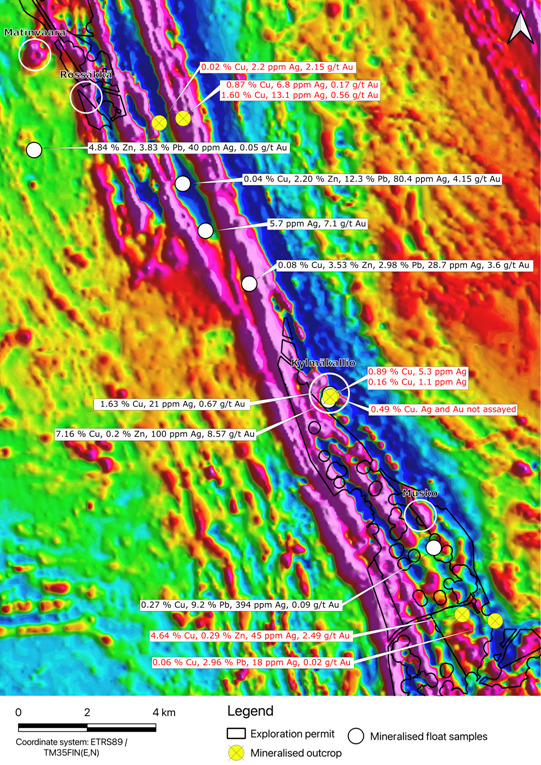

Two distinct gravity anomalies north-northeast of the E-lode, within FinnAust's Exploration Licence areas, will be tested by shallow drilling during the next phase of drilling, these anomalies could represent near surface parts of previously unidentified sulphide mineralisation close to the E-lode mineralisation. The gravity anomalies are furthermore located in a favourable structural position within a hinge zone interpreted from airborne magnetics, considered by the Company to significantly increase the prospectivity of these targets.

The Company will now finalise the geochemical analysis of selected mineralised intervals from the seven holes drilled during Phase 1 of the Hammaslahti drill programme, followed by detailed 3D modelling and interpretation once the assay results have been received. Follow up drilling has been planned to commence early August.

Commenting on the results of the recent drilling programme at Hammaslahti, Thomas Levin, Chief Operating Officer of Bluejay subsidiary FinnAust Mining Finland Oy, stated:

"The E-lode mineralisation that was discovered by the Company during a near-mine drilling campaign almost a decade ago has since then been a drill ready exploration target, and I am delighted to report that the first phase of the follow up drilling has now been successfully completed.

"The majority of the assay results are still pending, but visually we have been able to confirm extensions of the E-lode copper-zinc ± gold-silver-lead sulphide mineralisation within the new drill core. The visual observations have also been confirmed by data from pXRF measurements. All seven new drill holes intersected the mineralisation, with five out of seven drill holes showing anomalous sulphide content over intervals in excess of 10 m. The accuracy of the depths at which we intersected the E-lode, relative to the expected depths validates that our geological model for the E-lode is robust - an important step as we move towards undertaking a maiden MRE.

"The conducted infill drilling focused on up-dip and down-dip extensions of the mineralisation, with the aim to get a better understanding of the volume and grades of the E-lode. Previous drilling targeting the E-lode consisted mainly of single drill holes on sections 50-100 m apart, with most of these historic drill holes also intersecting mineralisation. Future drilling will focus on the possible down plunge and up plunge extensions, as well as possible structural repetitions of the E-lode.

"Two distinct gravity anomalies have been identified close to a fold closure along strike from the historic mine and the E-lode, and these targets are of very high priority for future drilling since they might represent shallow parts of previously unknown areas of mineralisation.

"I am also delighted to report that we have a drill rig secured for follow up drilling in August. Several highly interesting target areas have been identified further east of the historic Hammaslahti Mine, and modelling and reinterpretations of these targets is ongoing. Additionally, a lithogeochemical and petrological study has been commissioned by VMS expert, Dr Denis Schlatter of Helvetica Exploration Services GmbH to better constrain controls on the mineralisation. We look forward to providing further updates on all ongoing activities in due course".

Hammaslahti Project - about drilling extensions to the E-lode and testing near-mine targets

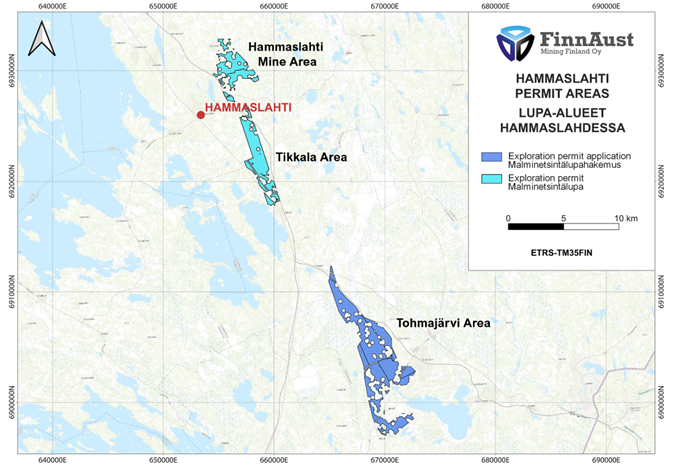

Bluejay owns 100% of the Hammaslahti Project through its wholly owned subsidiary FinnAust Mining Finland Oy ('FinnAust'). Bluejay's licence area contains the historic Hammaslahti Mine, which was operated by the Finnish state mining company, Outokumpu Oy from 1971 to 1986. The open-pit and underground mine produced a total of 7 million tonnes grading 1.16% Cu, 1.55% Zn, 0.59 grammes per tonne ('g/t') Au and 5.2 g/t Ag (Geological Survey of Finland, 2023). The polymetallic mineralisation at Hammaslahti is interpreted to be a partially re-mobilised volcanogenic massive sulphide ('VMS') type deposit. The Company's exploration permits, totalling 39.3 square kilometres ('sq km'), cover the majority of the Hammaslahti-Tohmajärvi Metallogenic Belt. The belt is considered permissive for further polymetallic VMS deposits as supported by the presence of high-grade mineralised outcrops and boulders within Bluejay's licence areas south of the former mine, providing further upside to the Project.

The Company's exploration efforts have so far mostly focused on brownfields targets in the near-mine area, with only minor exploration conducted elsewhere on the belt to date. Drilling by FinnAust has confirmed that all previously mined ore lodes at Hammaslahti (namely, the Z-, N- and S-lodes) remain open down plunge to the South and has also resulted in the discovery of a new ore lode, the E-lode in 2014. The E-lode discovery hole (Hole ID: M424114-R325) returned 8.65 m grading 2.2% Cu, 2.0% Zn, 0.5 % Pb, 47.5 g/t Ag, and 0.5 g/t Au, including 5.60 m grading 3.2% Cu, 3.2% Zn, 81.1 g/t Ag, and 0.9 g/t Au hosted in semi-massive to massive sulphides (see FinnAust Mining press release dated: 21 July 2014). The E-lode is located approximately 200 m east from underground infrastructure of the former Hammaslahti Mine and is comparable in grade and style of mineralisation to the ore-lodes that were mined historically. The S-lode has been demonstrated in earlier drilling by FinnAust to be open down-plunge to the south, beyond 500 m depth, e.g., 15 m from 536 m grading 3.1% Cu, 0.1% Zn, 14.4 g/t Ag and 0.8 g/t Au, including 3.4 m grading 11.5% Cu, 0.4% Zn, 53.4 g/t Ag and 3.0 g/t Au. Prior to the Phase 1 drilling 2023 completed in May-June no follow up drilling had been conducted on the E-lode.

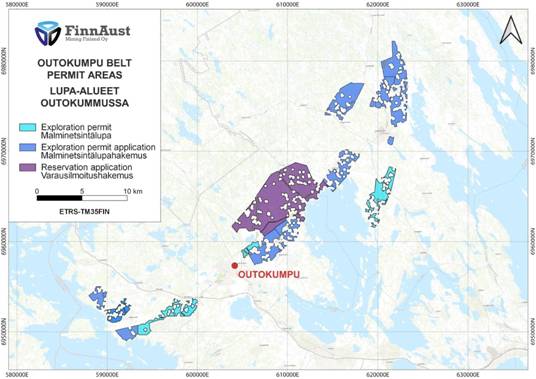

Outokumpu Cu-Zn-Ni-Co-Ag-Au Project: Ground Gravity and Airborne Magnetic Surveys Planned

Bluejay plans to undertake detailed ground gravity and 3C UAV magnetics surveys over the high-priority Haapovaara target Belt (subject to availability of funding) at its Outokumpu Cu-Zn-Ni-Co-Ag-Au Project (see Figure 12). The planned gravity survey will comprise of approximately 600 stations, covering an area of 12 sq km. The 3C UAV magnetic survey will cover the same area. Haapovaara is located immediately along strike, to the NE, of the Kylylahti Mine which was operated by Boilden (NASDAQ OMX Stockholm: BOL). Kylylahti has a resource of 8.9 million tonnes ('Mt') grading 1.3% Cu, 0.24% Co, 0.23% Ni, 0.34% Zn and 0.78 g/t Au (Geological Survey of Finland, 2022). The Kylylahti Mine was closed in late 2020.

Both the Kylylahti deposit and Bluejay's Haapovaara target are coincident with two gravity highs in existing regional gravity data. Whilst the two gravity highs over Haapovaara are weaker, this likely reflects a difference the thickness of the overlying overburden as the area is covered by glacial till. Despite its proximity to the Kylylahti Mine, the Haapovaara gravity anomaly has never been drill tested. Bluejay intends to refine the target through the planned geophysical surveys, ahead of a maiden drill programme.

About the Outokumpu Cu-Zn-Ni-Co-Ag-Au Project

Bluejay, through its subsidiary, FinnAust, is the largest licence holder on the over 40 km long Outokumpu Belt. Earlier this year, Bluejay further increased its licence area (see Bluejay press release dated: 16 January 2023), and now holds a total licence area of 8,064 hectares, comprising 12 exploration permits, permit applications and reservations along the Outokumpu Belt (Figure 11). The Outokumpu Belt is a highly prospective metallogenic belt; three former mines, Keretti, Vuonos and Kylylahti, have produced a total of approximately 39 Mt of ore at an average grade of 3.3% copper, 1.1% zinc, 0.22% cobalt, 0.14% nickel and 0.71 g/t gold between 1914 and 2020. The mines, especially Keretti, also produced a significant amount of silver. The known Outokumpu-type sulphide deposits have been previously found structurally on the culmination parts of the belt. Deeper parts of the belt are generally unexplored. Large tracts of untested prospective lithologies occur at depth along strike from the former mines as well as following the mineralised trend. In addition, some shallow targets remain untested by drilling despite their proximity to a recently producing mine, e.g., the Haapovaara targets.

The metal basket that the unique Outokumpu-type ore provides is a compelling exploration target in the context of increasing demand for base metals related to the battery industrial ecosystems, electrification and the green transition including copper, cobalt, and nickel. Cobalt grades present at Outokumpu underscore the importance of the Outokumpu Belt as a secure and sustainable domestic supply of cobalt for European markets.

Black Schist Projects:

Update on the divestment of projects to Metals One plc

In July 2021, Bluejay announced that it had signed a binding term sheet and entered into a conditional agreement for the sale of its Paltamo and Rautavaara Ni-Zn-Cu-Co projects (collectively known as 'Black Shales Projects') to Metals One plc ('Metals One') for a combination of cash and shares.

Metals One is advancing a suite of battery metal projects at brownfields sites in Finland and Norway. The consideration for the divestment has recently been increased to £4.125 million to reflect a deferred long stop date for the closure of the transaction. Metals One is progressing its listing on the Alternative Investment Market ('AIM') of the London Stock Exchange, after which Bluejay Mining will be able to reflect this divestment on its balance sheet. On completion, Bluejay shall receive £150,000 in cash, as well as the issue and allotment of 62,500,000 Ordinary Shares at the IPO price, which equates to a total of £3,125,000. Bluejay shall also receive the further issue and allotment of additional Ordinary Shares at the IPO price equating to a total of £1,000,000 at any time following the completion, along with warrants over 7,500,000 Ordinary Shares, exercisable for a period of five years from Metals One's admission to the AIM.

Upon listing, Bluejay's COO, Thomas Levin, will be appointed as Non-Executive Director to the board of Metals One. Bluejay will also support Metals One with the execution of initial exploration programmes on the Black Shales Project and will receive a 10% management fee for these services.

The expected first day of trading of Metals One on the AIM is 27 July 2023. Following admission to the AIM, Bluejay are expected to hold 29.01% of the issued share capital in Metals One. The proposed transaction with Metals One is subject to formal agreement and completion of the outstanding conditions announced on 28 July 2021. Shareholders should note that there is no guarantee that the proposed transaction with Metals One will be completed or that Bluejay will receive any further consideration in respect of Metals One.

About the (Paltamo and Rautavaara) Black Schist Projects

The Black Schist projects, currently held by FinnAust Mining Northern Oy, are located in the Kainuu (Paltamo) and Northern Savonia (Rautavaara) regions of eastern Finland within the north-south trending Kainuu Schist Belt. The belt also hosts the giant Talvivaara Mine operated by state-owned, Terrafame Ltd. Talvivaara is the largest operating nickel mine in Europe. Mineralisation within Bluejay's Black Schist projects is considered comparable to the Talvivaara black schist-hosted nickel-zinc-copper-cobalt deposits, with further untested potential for Outokumpu-style copper-cobalt-zinc-nickel massive sulphide deposits analogous to the mineralisation found within Bluejay's Outokumpu Project.

The Black Schists projects have demonstrated exploration potential with significant mineralisation already identified at both R1 at Rautavaara and P5 at Paltamo. An inferred Mineral Resource estimate of 28.1 Mt at a grade of 0.19% Ni, 0.10% Cu, 0.01% Co and 0.38% Zn has been estimated at the Rautavaara R1 Project. An Exploration Target of 16-24 Mt containing 0.18-0.27% Ni, 0.09-0.13% Cu, 0.01-0.02% Co and 0.33-0.50% Zn has been estimated at the Paltamo P5 Project. Both the MRE and the Exploration Target are defined according to the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves ('the JORC Code'). Past drilling by FinnAust has been primarily focused on these two targets and has left much of the project areas untested for Talvivaara-style mineralisation.

Comments on Nearby and Adjacent Properties

The historic mines and deposits discussed in this news release provide context for Bluejay's portfolio of exploration projects in Finland, which occur in similar geologic settings, but this is not necessarily indicative that the projects host similar quantities, grades, or styles of mineralisation.

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014 ('MAR') which has been incorporated into UK law by the European Union (Withdrawal) Act 2018.

For further information please visit http://www.bluejaymining.com or contact:

| Kevin Sheil | Bluejay Mining plc | enquiry@bluejaymining.com |

| Ewan Leggat / Adam Cowl | SP Angel Corporate Finance LLP (Nominated Adviser and Broker) | +44 (0) 20 3470 0470 |

| Tim Blythe / Megan Ray | BlytheRay (Media Contact) | +44 (0) 20 7138 3205 |

About Bluejay Mining plc

Bluejay is listed on the London AIM market and Frankfurt Stock Exchange and its shares also trade on the OTCQB Market in the US. The Company holds multiple exploration and development projects in Greenland and Finland, providing its shareholders both portfolio and commodity diversification in high quality jurisdictions.

Bluejay's Dundas Ilmenite Project in northwest Greenland is fully permitted and undergoing further optimisation studies. The Company has agreed a Master Distribution Agreement with a major Asian conglomerate for up-to 340k tonnes per annum ('tpa') of its designed 440ktpa annual output.

Bluejay, through its wholly owned subsidiary Disko Exploration Ltd., has signed a definitive Joint Venture Agreement with KoBold Metals to guide exploration for new deposits rich in the critical materials required for the green energy transition and electric vehicles (The Disko-Nuussuaq nickel-copper-cobalt-PGE Project). Disko Exploration Ltd holds two additional projects in Greenland - the 692 sq km Kangerluarsuk zinc-lead- silver Project, where historical work has recovered grades of up to 45.4% zinc, 12.4% lead and 596 g/t silver; and the 920 sq km Thunderstone Project which has the potential to host base metal and gold deposits.

In Finland, Bluejay currently holds three large scale multi-metal projects through its wholly owned subsidiary FinnAust Mining Finland Oy. The Company has identified multiple drill ready targets at the Enonkoski nickel-copper-cobalt Project in East Finland. Bluejay's drill ready Hammaslahti copper-zinc-gold-silver Project hosts high-grade VMS mineralisation and extensions of historical ore lodes have been proven. The drill ready Outokumpu copper-nickel-cobalt-zinc-gold-silver Project is located in a prolific geological belt that hosts several high-grade former mines. Bluejay has also signed a conditional agreement for a partial divestment in a fourth Finnish project.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

SOURCE: Bluejay Mining PLC

View source version on accesswire.com:

https://www.accesswire.com/769869/Bluejay-Mining-PLC-Announces-Finland-Strategy-Operational-Update