par Idaho Strategic Resources, Inc. (NASDAQ:IDR)

Idaho Strategic Announces Newly Discovered Red Star Vein and Additional Drilling Highlights from the Golden Chest Mine

Drill Hole GC 24-258 intercepted 1.8 meters (m) of the Red Star Vein that assayed 34.1 grams per tonne (gpt) gold, which was part of a larger intercept of 9.3 meters assaying 8.2 gpt gold.

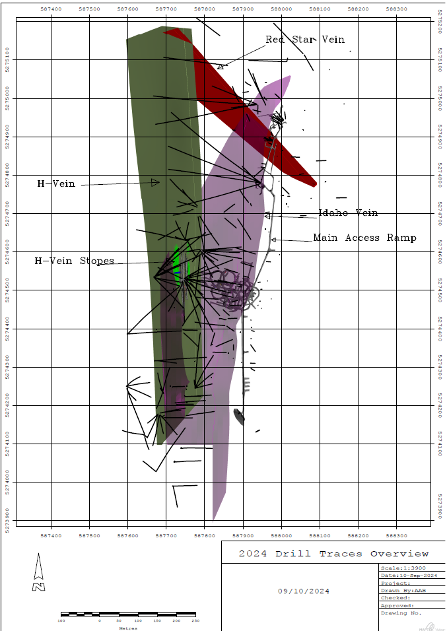

COEUR D'ALENE, ID / ACCESSWIRE / October 10, 2024 / Idaho Strategic Resources (NYSE American:IDR) ("IDR" or the "Company") is announcing a new high-grade gold discovery and preliminary highlights from the Golden Chest 2024 summer drill program. The Red Star Vein discovery occurred during a drill program targeting hangingwall veins in the Klondike area, located approximately 600 meters north of existing mining in the Skookum area at the Golden Chest mine.

The Red Star Vein, like the nearby H-Vein, does not outcrop on the surface with both high-grade veins occurring in the hanging wall of the Idaho Fault. While the tonnage and production potential of the Red Star Vein is not fully defined at this time, the Red Star Vein was first encountered in a surface drill hole GC 22-212, which demonstrated an impressive 1.3 meters (m) of 37.4 grams per tonne (gpt) gold. The Red Star Vein (Figure 1) runs roughly sub-parallel to the Red Star Fault, which is a prominent cross-fault in this area. Twelve drillholes have been completed so far, with four holes encountering high-grade gold intercepts of the Red Star Vein with impressive widths and grades. The newly discovered Red Star Vein mineralization is characterized by a sheared and folded, strongly banded quartz vein with visible gold, sphalerite, galena and chalcopyrite. The vein is locally brecciated and re-silicified.

In addition to the Red Star intercepts, several other veins have been encountered during the 2024 drill program. Select highlights for sample intervals of these veins, plus the H-Vein and Red Star Vein, are shown in the table below. Also noteworthy, the Intermediate/H-Vein (listed below) could potentially be part of the northern extension of the H-Vein based on internal modeling and projections, however further drilling is needed to determine if this is the case. The intercepts are reported in drilled thickness and in grams of gold per tonne. All the mentioned veins, except for the Popcorn, occur in the hanging wall of the Idaho Fault.

Hole | Target Vein | From (m) | From (m) | Drilled Interval (m) | Gold Assay (gpt) |

GC 24-249 | Red Star | 31.7 | 32.5 | 0.8 | 25.1 |

GC 24-258 | Red Star | 35.9 | 45.2 | 9.3 | 8.2 |

including | Red Star | 39.6 | 41.4 | 1.8 | 34.2 |

GC 24-259 | Red Star | 38.6 | 49.7 | 11.1 | 3.7 |

including | Red Star | 44.8 | 48.5 | 3.7 | 9.6 |

GC 24-260 | Red Star | 18.6 | 19.6 | 1.0 | 15.9 |

GC 24-258 | H-Vein | 294.6 | 295.2 | 0.6 | 13.5 |

GC 24-254 | Intermediate/H-Vein | 157.1 | 157.9 | 0.8 | 8.4 |

GC 24-259 | Intermediate/H-Vein | 280.3 | 286.8 | 6.5 | 7.1 |

including | Intermediate/H-Vein | 285.8 | 286.8 | 1.0 | 38.5 |

GC 24-253 | Popcorn | 81.3 | 82 | 0.7 | 13.3 |

GC 24-252 | Un-named | 102.2 | 102.9 | 0.7 | 10.4 |

GC 24-258 | Un-named | 28.8 | 31 | 2.2 | 4.3 |

GC 24-259 | Un-named | 53.2 | 61.0 | 7.8 | 1.6 |

including | Un-named | 57.0 | 59.7 | 2.7 | 2.5 |

GC 24-253 | 31-Vein | 4.5 | 4.8 | 0.3 | 36.8 |

Due to the recent discovery of the Red Star Vein, the Company made the decision to reroute the drill rig intended for the Company's Eastern Star property this fall, to the Golden Chest to accelerate additional near-mine discovery potential. It total, there are three drill rigs onsite at the Golden Chest, two are drilling targets from the surface while one is drilling targets from underground. During the upcoming fall and winter months, the Company is planning to develop a new underground drill station at the 888 level of the Golden Chest Mine to allow for better positioning to angle back toward the vein(s) and an expanded target area for further delineation of the Intermediate/H-Vein, Red Star Vein, and potential additional discoveries.

IDR's President and CEO, John Swallow commented, "Once again - the table of high-grade intercepts listed above is even more impressive considering their relative proximity to current production, not to mention the reality of each drill hole having the ability to test for multiple targets (known and unknown). Years ago, as we drilled towards the Idaho Vein, we encountered the H-Vein; and it eventually became our primary mining area. Now we are drilling towards the H-Vein and have encountered the Red Star Vein and hope that it will also add to future production. The unprecedented level of activity at and near the mine is a testament to the shared vision and cooperation of our crews and the overall flexibility provided by increased cash flows and a steady throughput at the mill.

Going forward, we expect to drill our Eastern Star property as soon as practicable following the winter months and expand our current drilling at the Golden Chest to include multiple targets in the broader Murray Gold Belt District. Given Idaho Strategic's recently increased cash balance and cash flow, along with strong gold prices, it makes sense to accelerate our exploration programs, both organically in the Murray Gold Belt and at Eastern Star, as well as look broader at additional opportunities that we believe may fit our team's skillsets and corporate strategy. Our business plan has allowed IDR to side-step many of the ‘bifurcated market' discussions of late and if our incoming traffic is any indicator, some are rethinking what was once the accepted approach toward building a business/investment vehicle in this industry."

The third quarter has been the busiest quarter in the Company's history. Along with coordinating three drill rigs at the Golden Chest Mine, the Company has been hard at work constructing its paste backfill plant onsite and making the necessary upgrades to the New Jersey Mill to facilitate planned back-haulage of tailings to the mine. The paste backfill plant is progressing on schedule and on budget and the Company is opportunistically looking for milling equipment to potentially begin its build out of the new mill onsite at the Golden Chest (located in the same building as the paste backfill plant). While a new mill onsite is certainly no guarantee, the Company feels that it is an important piece to unlock the potential of its 7,000+ acres of mineral properties in the broader Murray Gold Belt District.

Figure 1

Qualified person

IDR's Vice President of Exploration, Robert John Morgan, PG, PLS is a qualified person as such term is defined under S-K 1300 and has reviewed and approved the technical information and data included in this press release.

About Idaho Strategic Resources, Inc.

Idaho Strategic Resources (IDR) is an Idaho-based gold producer which also owns the largest rare earth elements land package in the United States. The Company's business plan was established in anticipation of today's volatile geopolitical and macroeconomic environment. IDR finds itself in a unique position as the only publicly traded company with growing gold production and significant blue-sky potential for rare earth elements exploration and development in one Company.

For more information on Idaho Strategic Resources, visit https://idahostrategic.com/presentation/, go to www.idahostrategic.com or call:

Travis Swallow, Investor Relations & Corporate Development

Email: tswallow@idahostrategic.com

Phone: (208) 625-9001

Forward-Looking Statements

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended that are intended to be covered by the safe harbor created by such sections. Often, but not always, forward-looking information can be identified by forward-looking words such as "intends", "potential", "believe", "plans", "expects", "may", "goal', "assume", "estimate", "anticipate", and "will" or similar words suggesting future outcomes, or other expectations, beliefs, assumptions, intentions, or statements about future events or performance. Forward-looking information includes, but are not limited to, The potential operational and economic viability of mining the Red Star Vein, the potential for the H-Vein and the Intermediate Vein to be the same, the potential for additional discoveries from drilling, the Company's plans to drill its Eastern Star property at any point next year, the Company's plans to drill the broader Murray Gold Belt next year, the potential for the paste backfill plant to continue to advance on schedule and on budget, the Company's plans to build out a new mill at the Golden Chest Mine, and the Company's potential for future organic growth and/or growth via additional broader opportunities. Forward-looking information is based on the opinions and estimates of Idaho Strategic Resources as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of IDR to be materially different from those expressed or implied by such forward-looking information. Investors should note that IDR's claim as the largest rare earth elements landholder in the U.S. is based on the Company's internal review of publicly available information regarding the rare earth landholdings of select companies within the U.S., which IDR is aware of. Investors are encouraged not to rely on IDR's claim as the largest rare earth elements landholder in the U.S. while making investment decisions. The forward-looking statement information above, and those following are applicable to both this press release, as well as the links contained within this press release. With respect to the business of Idaho Strategic Resources, these risks and uncertainties include risks relating to widespread epidemics or pandemic outbreaks; interpretations or reinterpretations of geologic information; the accuracy of historic estimates; unfavorable exploration results; inability to obtain permits required for future exploration, development or production; general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms; the ability to operate the Company's projects; and risks associated with the mining industry such as economic factors (including future commodity prices, and energy prices), ground conditions, failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in ore grade or recovery rates, permitting timelines, capital and construction expenditures, reclamation activities. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forwardâlooking information is available in Idaho Strategic Resources filings with the SEC on EDGAR. IDR does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law.

SOURCE: Idaho Strategic Resources, Inc.

View the original press release on accesswire.com