par NOA Lithium Brines Inc. (isin : CA6393571022)

NOA Lithium Reports High-Grade Results from its Fifth Hole at Rio Grande With Intercepts Averaging 471 mg/l Lithium over 530 Meters And Provides Financial Update

BUENOS AIRES, ARGENTINA / ACCESSWIRE / April 12, 2024 / NOA Lithium Brines Inc. (TSX-V:NOAL)(FSE:N7N) ("NOA" or the "Company") is pleased to report positive lithium results from brine samples from RG23-005, the fifth hole of the Phase 1 diamond drill program at its Rio Grande project ("Rio Grande" or the "Project"). The hole, located at the Juana Azul claim within the salar, completed to a depth of 602 meters ("m"), intersected a high-grade lithium (" Li ") brine aquifer of significant thickness starting from a down-hole depth of only 1 m.

Highlights from the fifth drill hole include:

- Near-Surface: Lithium brine-saturated geological units were encountered starting at only 1 meter below surface , indicating the Project's vast potential.

- Extensive Brine-Bearing Units: Approximately 530 m of lithium brine-bearing units were identified through 41 packer tests, affirming substantial lithium content within the salar.

- Average concentration of 464 mg/l Li in the upper 350 m, while the remainder of the hole averaged a high-grade concentration of 474 mg/l Li; and

- Encountered highest-grade concentration of 607 mg/l Li at 203 m.

NOA's Chief Executive Officer Gabriel Rubacha states: "The results of this 5 th hole reaffirm the potential of our Rio Grande project. We are now focused on the next stages where we expect to expand the resource drilling areas not explored yet and start our pumping holes campaign to support the development of the project. We expect to start this second stage during Q2 this year".

Hole RG23-005 was executed with diamond drilling (HQ-size), permitting the extraction of core samples of the salar basin formations and collection of brine samples, where available. Drilling was carried out by Salta-based Hidrotec S.A., under the supervision of NOA's geologists.

Diamond drill hole RG23-005 was completed at a depth of 602 m. At a depth of 1 m, the formations saturated with brine began. The lithology of the well is composed mainly by sand with sulfate intercalations and a lower proportion of crystalline halite, with contents that are variable along the depth of the well. Packer test sampling was carried out and almost the entire depth of the +600 m well returned brine-saturated units (approximately 530 m of the 602 m drilled), except for one horizon ranging 40 m in thickness.

Brine packer samples have been sent for laboratory analyses, including multi-element geochemical analysis for lithium and other relevant elements, and results are expected in the coming weeks. Selected drill core samples were sent to an accredited laboratory for physical property tests, including drainable porosity.

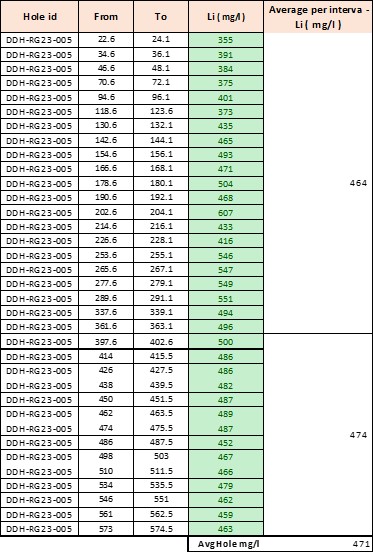

Results for Hole RG23-005

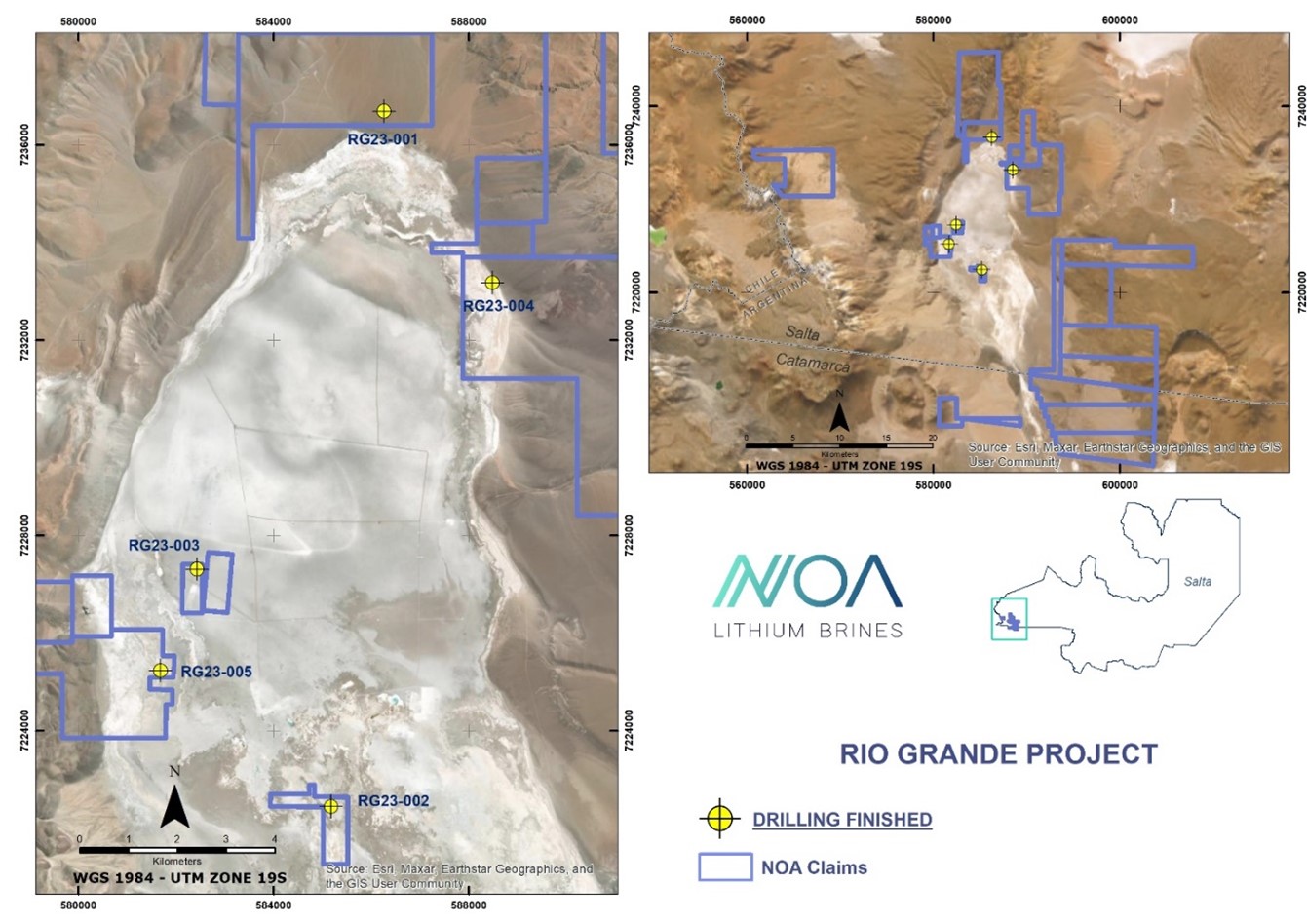

The results of the brine analyses and the respective intervals are shown in Table 1 below and drill collar information is presented in Table 2 below. Hole RG23-005, drilled at the Juana Azul claim (shown in Figure 1 below) reached a depth of 602 m.

Table 1: Interval Data & Li Assays (double packer sampling) For Drillhole DDH-RG23-5

Figure 1: Plan Map Showing Well RG23-005 And Previous Completed Wells

Table 1: RG23-005 - Drill collar information

Hole #: | RG23-005 | Azimuth: | 0 deg. |

Claim name: | Juana Azul | Inclination: | -90 deg. |

| Coordinates (UTM 19J South): | E: 588494 m N: 7233176 m, Z: 3669 m | Contractor: | Hidrotec S.A. |

Machine type: | HT07 LF-90 | ||

Drill type: | Diamond | ||

Hole diameter: | HQ |

Bridge Loan Financing

The Company also announces that it has entered into a short-term unsecured loan agreement (the "Agreement") with Mr. Gabriel Rubacha (the "Lender"), the Company's Chief Executive Officer and a Director. Under the Agreement and on or about April 8, 2024 ("Disbursement Date"), the Lender will advance the Company a USD $1 million (the "Loan Amount") term loan (the "Bridge Financing") with repayment terms as disclosed below. The Bridge Financing is expected to be repaid to the Lender in 60-90 days from the date hereof, as the Company is in advanced discussions with strategic investors regarding longer term capital financing for the Company. The Company plans to use the proceeds from the Bridge Financing to pay incurred capital expenditures and for general corporate working capital.

The Bridge Financing will have a maturity date of December 31, 2024 ("Maturity Date") and may be repaid by the Company with interest, if any ("Repayment Amount") in whole or in part with no penalty at any time before the Maturity Date (the "Repayment Date"). The Repayment Amount will be determined by using the value of 142,000 common shares of Lithium Americas Corp. ("LAC"), as traded on the New York Stock Exchange ("NYSE ) under the symbol "LAC", multiplied by the closing price of the LAC common shares on the NYSE on the Disbursement Date, which equals the Loan Amount; and the exact Repayment Amount to be paid on the Repayment Date will be the aggregate value of the 142,000 LAC common shares multiplied by the closing price of the LAC common shares on the NYSE on the Repayment Date.

The Lender has also agreed to share in any such depreciation that may occur of the LAC common shares between the Disbursement Date and the Repayment Date and for clarity only the same number of LAC common shares as of the Disbursement Date will be required to be repaid by the Company to the Lender on the Repayment Date.

Further and pursuant to the Agreement, beginning on the date that is 150 days from the Disbursement Date and until the Maturity Date, the Repayment Amount may be converted into common shares of the Company at a price per security that is the maximum allowable discount permitted by the TSX Venture Exchange at the time the conversion is made and the accrued interest, if any, becomes payable, and such convertible terms shall comply with the Policies of the TSX Venture Exchange and be subject to approval by the TSX Venture Exchange.

NOA's Executive Director, Hernan Zaballa, states regarding the Bridge Loan: "This financial commitment provided by Mr. Rubacha continues to show the support and confidence of management in the vast potential of the Rio Grande project."

The Bridge Financing obtained from the Company's Chief Executive Officer and Director constitutes a "related party transaction" under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). This transaction is exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 pursuant to sections 5.5(a) and 5.7(1)(a) of MI 61-101 as neither the fair market value of the transaction, nor the consideration paid to the lender of the Bridge Financing, who is a related party of the Company, would exceed 25% of the Company's market capitalization. The Company will file a material change report with respect to the Bridge Financing, however, the material change report will be filed less than 21 days prior to the advancement of proceeds under the Bridge Financing.

The entering into of the Bridge Financing was considered and approved by the disinterested Directors of the Company. The disinterested Directors voted unanimously to approve the Bridge Financing and Mr. Rubacha declared a conflict and abstained from voting on the Bridge Financing. The Bridge Financing remains subject to requisite approvals by the TSX Venture Exchange.

About NOA Lithium Brines Inc.

NOA is a lithium exploration and development company formed to acquire assets with significant resource potential. All NOA's projects are located in the heart of the prolific Lithium Triangle, in the mining-friendly province of Salta, Argentina, near a multitude of projects and operations owned by some of the largest players in the lithium industry. NOA has rapidly consolidated one of the largest lithium brine claim portfolios in this region that is not owned by a producing company, with key positions on three prospective salars, being Rio Grande, Arizaro, Salinas Grandes, and totalling over 140,000 hectares.

On Behalf of the Board of Directors,

Gabriel Rubacha

Chief Executive Officer and Director

For Further Information On The Company

Website: www.noalithium.com

Email: info@noalithium.com

Telephone: +54-9-11-5060-4709

Alternative Telephone: +1-403-571-8013

Sample Analysis & QA/QC Program

The Company has a robust QA/QC and sample management program. Brine samples were collected by a single / double packer system (in-hole inflatable) to isolate specific intervals down the drillhole. The packer sampling method allows the collection of brine samples at specific depths while sealing the hole at the top and bottom of the interval. The packer system was run several times to flush the hole after drilling to clear / clean the hole prior to sampling and four samples for each interval were collected (main sample, duplicate sample, check sample, reserve sample). The drillhole of the current release was inclined vertically (90 degrees) and the salar strata are believed to be flat-lying resulting in reported intervals approximating true thickness.

Samples of brine were submitted by courier for analysis to Alex Stewart NOA, subsidiary of Alex Stewart International Argentina, member of the Alex Stewart International group, an accredited laboratory for the analysis of lithium and other elements. Alex Stewart employed Inductively Coupled Plasma Optical Emission Spectrometry as the analytical technique for the primary constituents of interest, including: boron, calcium, potassium, lithium, and magnesium. Measurements in the field included pH, conductivity, temperature and density. The quality of sample analytical results was controlled and assessed with a protocol of blank, duplicate and standard samples included within the sample sequence. Differences between original and duplicate samples and results for standards and blanks are considered within the acceptable range for lithium.

Qualified Person

David O'Connor P.Geo., is the Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects , and he has reviewed and approved the scientific and technical information in this news release.

Cautionary Note Regarding Forward-Looking Statements

This news release may include forward-looking statements that are subject to inherent risks and uncertainties. All statements within this news release, other than statements of historical fact, are to be considered forward looking statements. Forward-looking statements including, but not limited to NOA's future plans and objectives regarding its projects, which constitute forward looking information that involve various risks and uncertainties. Although NOA believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those described in forward-looking statements. Factors that could cause actual results to differ materially from those described in forward-looking statements include fluctuations in market prices, including lithium prices, continued availability of capital and financing, Loan Repayment Amounts and timing of such repayment, and general economic, market or business conditions. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. NOA does not assume any obligation to update any forward-looking statements except as required under applicable laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: NOA Lithium Brines Inc.

View the original press release on accesswire.com