par Northern Superior Resources Inc. (isin : CA6658043089)

Northern Superior and ONGold Announce Closing of Spinout Transaction Related to TPK and Ontario Projects

NOT FOR DISSEMINATION IN THE UNITED STATES OR THROUGH U.S. NEWSWIRE SERVICES

TORONTO, ON / ACCESSWIRE / April 30, 2024 / Northern Superior Resources Inc. ("Northern Superior" or the "Company") (TSXV:SUP)(OTCQB:NSUPF) and ONGold Resources Ltd. (formerly 1348515 B.C. Ltd.) ("ONGold") (TSXV:ONAU) are pleased to announce that further to the news releases dated July 10, 2023, September 6, 2023, and April 2, 2024, ONGold has completed the previously announced acquisition of Northern Superior's mining projects located in Ontario (the "Transaction") following receipt of conditional approval to list the Common Shares (as herein after defined) on the TSX Venture Exchange (the "TSXV"). It is anticipated the common shares of ONGold (the "Common Shares") will begin trading under the symbol "ONAU" on the TSXV on May 3, 2024 (the "Trading Date"), subject to final approval of the TSXV.

ONGold has now completed the Financings (as hereinafter defined) for gross proceeds of $5.2 million and escrow release conditions of the ONGold Subscription Receipt and Finco Subscription Receipt (both as hereinafter defined) have been satisfied resulting in the issuance of 10,108,843 Common Shares. The Financings and subsequent conversions into Common Shares resulted in a deemed issue price of $0.51 per Common Share.

The Transaction was undertaken pursuant to the letter agreement (the "Letter Agreement") dated July 10, 2023, between Northern Superior and ONGold. Following the closing of the Transaction, ONGold now holds a 100% interest in the Ti-pa-haa-kaa-ning Project (the "TPK Project"), the October Gold Property ("October Gold Project"), as well as certain other exploration properties (collectively, the "Ontario Assets") previously held by Northern Superior.

As result of the Transaction, Northern Superior now holds 35,686,686 Common Shares of ONGold or 72.35% of the issued and outstanding Common Shares.

Simon Marcotte, Chief Executive Officer of Northern Superior, stated: "The spinout of the Ontario Assets will allow Northern Superior and ONGold to unlock the considerable value of these world-class assets. Based on the Financings completed, the value of Northern Superior's 72.35% interest in ONGold is $18.2 million, and we see a great opportunity for value creation as ONGold advances the TPK Project and deploys its Ontario strategy. ONGold is now well-funded and led by a highly experienced management team. Northern Superior will remain a strategic shareholder and support ONGold in the execution of its ambitious strategy."

Rodney Barber, President of ONGold, added: "We are very pleased to have completed this transaction as we believe it is the first step to unlocking the value of the Ontario Assets. With a dedicated management team, we will be able to focus our time and attention on the large portfolio of assets in highly prospective geological environments. We are committed to working closely with our First Nations partners such that we uphold the highest standards of Indigenous consultation and work hand in hand to deliver economic opportunity and development to the communities at our projects."

Financings

As previously announced on April 2, 2024, the escrow release conditions of all 5,882,356 subscription receipts (the "ONGold Subscription Receipt") of ONGold have been satisfied and the proceeds from the purchase of the subscription receipts have been released from escrow (the "ONGold Financing"). As a result, the subscription receipts have converted into a total of 5,882,356 Common Shares in the capital of ONGold for gross proceeds of $3,078,605.56.

As previously announced on March 8, 2024, ONGold's wholly-owned subsidiary 1462356 B.C. Ltd ("Finco") closed its first tranche of its non-brokered private placement financing through the issuance of an aggregate of 3,575,901 subscription receipts of Finco (each, a "Finco Subscription Receipt") at a price of $0.51 per Subscription Receipt for gross proceeds of $1,823,709.51 (the "Finco Financing", together with the ONGold Financing, the "Financings").

Today, ONGold and the Company are further pleased to announce that Finco has closed its final three tranches of Finco Financing through the issuance of an aggregate of 650,586 Finco Subscription Receipts for gross proceeds of $331,798.86. Together with the subscription funds representing the proceeds of the first tranche of the Finco Financing and interest thereon, ONGold received aggregate gross proceeds of $2,157,543.10 from the Finco Financing.

The Finco Subscription Receipts issued pursuant to the Offering automatically converted, without payment of any additional consideration or further action on the part of the holder thereof, into one common share in the capital of Finco (each, a "Finco Share"), as the satisfaction of certain conditions precedent have been met. The Finco Subscription Receipts were created and issued pursuant to, and are governed by, the terms and conditions of a subscription receipt agreement dated March 1, 2024 (the "Subscription Receipt Agreement") between ONGold, Finco and Endeavor Trust Corporation, in its capacity as subscription receipt agent and escrow agent.

The net proceeds derived from the Financings will be used by ONGold to fund exploration and development of ONGold's mineral properties, as well as for working capital requirements and other general corporate purposes. ONGold paid certain eligible persons (each, a "Finder") a finder's fee of $25,160.94 in cash, and 43,382 warrants payable upon closing of the Financings. Each finder's warrant is exercisable for one Common Share at $0.51 for 2 years following the Trading Date.

The securities distributed pursuant to the Offering have not and will not be registered under the U.S. Securities Act of 1933 or any U.S. state securities laws and may not be offered or sold in the United States unless the securities have been registered under the U.S. Securities Act of 1933 and any applicable state securities laws, or in compliance with the requirements of an exemption therefrom.

The Transaction

In connection with the Transaction, ONGold has changed its name from "1348515 B.C. Ltd." to "ONGold Resources Inc." (the "Name Change").

Following the closing of the Offering and issuance of the Finco Shares, ONGold, Finco and 1477825 B.C. Ltd. ("BC Subco"), a wholly-owned subsidiary of ONGold, completed a three-cornered amalgamation under the laws of the Province of British Columbia, pursuant to which Finco shareholders (including former holders of the Subscription Receipts) received one Common Share in exchange for each Finco Share held, and Finco and BC Subco amalgamated (the "Amalgamation"). Immediately following the Amalgamation, the resulting entity, 1478091 B.C. Ltd. ("Amalco") became a wholly owned subsidiary of ONGold.

Upon closing of the Transaction, the board of directors and management of ONGold were reconstituted as follows in place of the previous directors and officers of ONGold:

- Rodney Barber - President

- Greg Duras - Chief Financial Officer

- David Beilhartz - Director

- Tom Gallo - Director

- Michael Gentile - Director

- David Medilek - Director

- Thomas Morris - Director

Rodney Barber, President

Mr. Barber is a registered Professional Geoscientist with over 35 years of exploration and mining experience, mostly focused on gold. He has extensive experience throughout Ontario and Quebec. He joined Williams Operating Corporation (now Barrick-Hemlo) in 2000, holding various positions of increasing responsibilities. As head of the Geology Department, he led a team that discovered and defined over 4.5 million ounces of gold reserves and resources. Mr. Barber joined Northern Superior Resources in 2021 as Vice President Exploration. He is also a director of Tashota Resources Inc. and Trojan Gold Inc.

Greg Duras, Chief Financial Officer

Mr. Duras is a senior executive with over 25 years of experience working in the resource sector in corporate development, financial management, cost control positions, and spearheaded large corporate transactions and financings. He's held the position of Chief Financial Officer at several publicly traded companies, including Consolidated Uranium Inc., which was recently acquired by IsoEnergy Ltd. in a C$200M transaction. Mr. Duras is currently the Chief Financial Officer of Northern Superior Resources Inc. He holds a Bachelor of Administration degree from Lakehead University and completed his Chartered Professional Accountant (CPA) designation in 1998.

David Beilhartz, Director

David Beilhartz, B.Sc., is a registered Professional Geoscientist with almost 40 years of experience in mineral exploration. Most recently, Mr. Beilhartz has been providing consulting services to several mining companies on a contract basis. From 2014 to 2015, he served as VP Exploration for Kerr Mines Inc. From 2010 to 2012, he served as VP Exploration for Trelawney Mining and Exploration Inc. and from 2007 - 2008 he was VP Exploration at Lake Shore Gold Corp. In 2011 Mr. Beilhartz and Trelawney Mining were awarded the Ontario prospector of the year award for the discovery of the Cote' Gold deposit.

Tom Gallo, Director

Mr. Gallo has over 10 years of experience in the mining industry as an Executive, Geologist and Research Analyst. He is currently Senior Vice President, Growth for Calibre Mining, a multi asset gold producer. Prior to joining the Calibre team, Mr. Gallo was Vice President Equity Research at Canaccord Genuity, where he covered a variety of small cap mining companies in the precious metal sector. In 2020 Mr. Gallo was ranked in the top five Canadian equity analysts by TipRanks Market Research. Mr. Gallo holds a Bachelor of Science degree from the University of Western Ontario.

Michael Gentile, Director

Mr. Gentile is considered one of the leading strategic investors in the junior mining sector, owning significant positions in over 20 small-cap mining companies. Mr. Gentile is currently a strategic advisor to Arianne Phosphate (DAN-V), Geomega Resources (GMA-V) and a director of Northern Superior Resources (SUP-V), Roscan Gold (ROS-V), Radisson Mining Resources (RDS-V) and Solstice Gold (SGC-V). Mr. Gentile recently co-founded Bastion Asset Management, an investment management firm based out of Montreal, Quebec and was previously a Senior Portfolio Manager with Formula Growth Limited.

David Medilek, Director

Mr. Medilek is a mining professional with over 16 years of mining capital markets, corporate strategy and technical operating experience. He is currently the President of producer K92 Mining Inc. Previously, Mr. Medilek was an equity research analyst covering precious metals companies, with Macquarie Group Limited; a mining investment banker with Cormark Securities Inc.; and a mining engineer with Barrick Gold Corporation in Western Australia. Mr. Medilek holds a Bachelor of Applied Science in Mining Engineering with Distinction from the University of British Columbia, a Professional Engineer designation in the Province of British Columbia, and is a CFA® charterholder.[1]

Thomas Morris, Director

Dr. Morris is a registered, Professional Geoscientist with over 40 years of experience, successfully managing a variety of exploration programs for provincial and federal governments, private sector and publicly traded companies. Under his management, Northern Superior was recognized as one of the top 50 companies listed on the TSX-V (2011), was awarded the Ontario Business Achievement Award for Corporate Governance (2011), was awarded the Québec Prospector of the Year Award by the Association de L'Exploration Minière du Québec (2012) and attained Progressive Aboriginal Relations "Par Committed" status from the Canadian Counsel for Aboriginal Business (2013, 2014). Dr. Morris has also obtained the Institute of Corporate Directors (ICD.D) designation.

In connection with the completion of the Transaction, McGovern Hurley LLP, will replace Stern & Lovrics LLP as the auditor of ONGold.

Capitalization

On closing of the Transaction, ONGold has 49,324,529 Common Shares issued and outstanding, of which Northern Superior holds 35,686,686 Common Shares or 72.35% of the issued and outstanding Common Shares. In addition, ONGold has 43,382 warrants, with each warrant exercisable for one Common Share at $0.51 for 2 years following the Trading Date.

The TPK Project

The TPK Project is a gold-silver-copper mineral exploration property, located in northwestern Ontario. The TPK Project is comprised of 2,431 post-conversion cell claims covering an area 47,796 hectares within a highly favourable geological setting. The TPK Project hosts two large independent mineralized systems and is situated in Nibinamik First Nation and Neskantaga First Nation traditional territories.

Big Dam and New Growth Areas

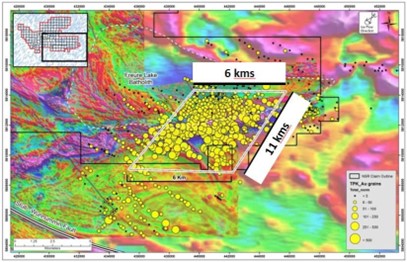

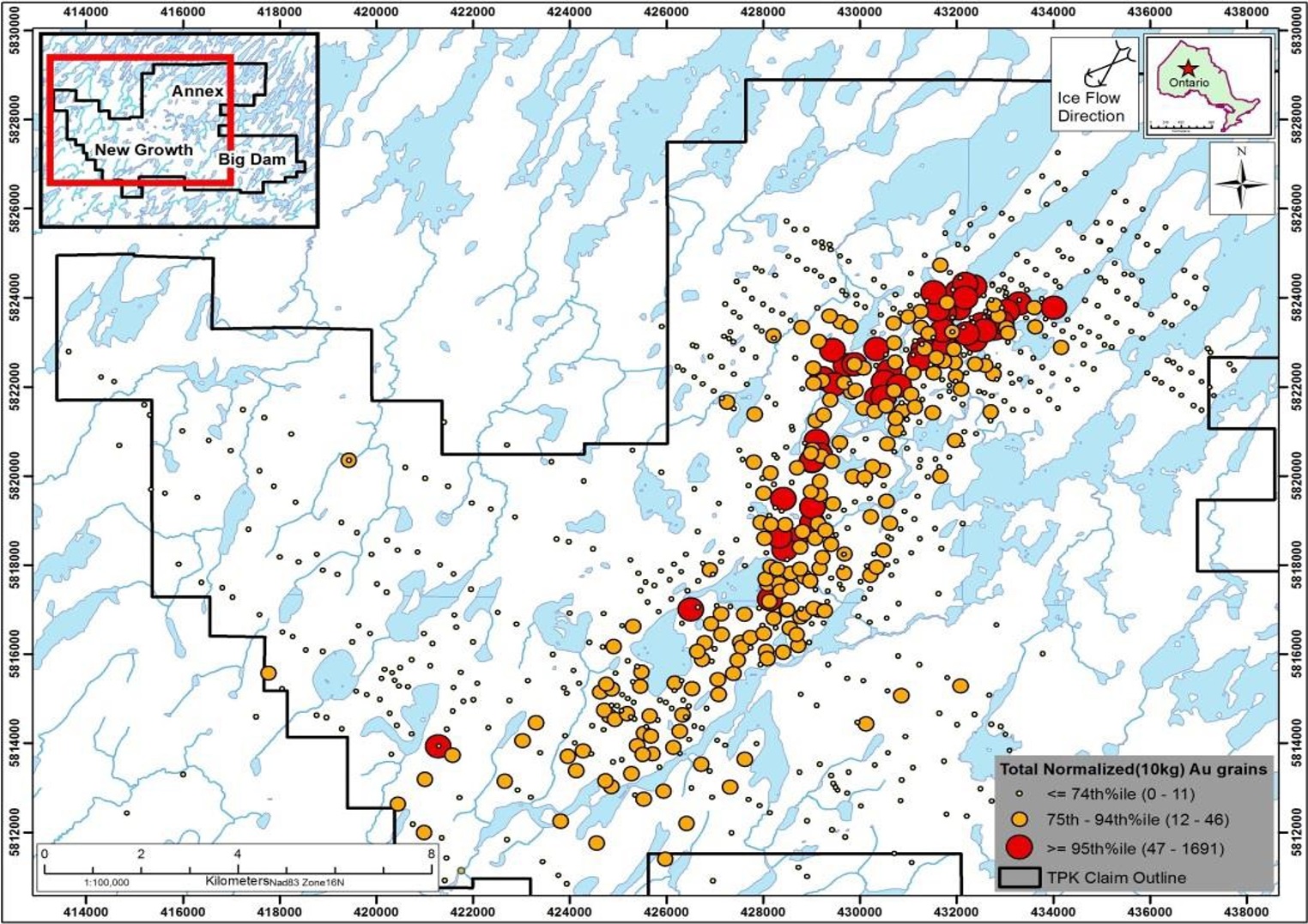

The first gold-bearing area is contained within the Big Dam and New Growth areas of the property and is a laterally extensive mineralized shear system stretching 35 km across the southern portion of the property. Several phases of exploration have seen a property-wide airborne magnetometer survey completed, extensive surface till sampling and boulder tracing, prospecting, limited induced polarization (IP) and diamond drilling of 29,577 metres in 139 shallow holes.

Exploration Highlights in Big Dam Area

- Discovery and definition of the gold grain-in-till dispersal apron: defined as 6 km wide by 11.5 km long, with gold grain-in-till anomalies up to 1263 grains per 10 kilogram till sample (see Northern Superior Resources press release, May 15, 2019). The size and scope of this dispersal train (one of the largest in North America) suggests multiple bedrock sources.

- Discovery of several gold-bearing boulder dispersal trains returning gold assay values of up to 94.21 g/t Au.

- Discovery of significant gold-bearing mineralization:

- Drill hole TPK-10-004 returned 25.9 g/t Au over 13.5 m, including 46.0 g/t Au over 0.5 m, 139.4 g/t Au over 1.7 m, 749.0 g/t Au over 0.3 m and 127.0 g/t Au over 0.7 m (see Northern Superior Resources press release, February 27, 2018)

- Drill hole TPK-11-013 returned 4.74 g/t Au over 6.8m, including 15.52g/t Au over 1.50m and 33.90g/t Au over 0.50m (see Northern Superior press release, April 13, 2011)

- Drill hole TPK-13-030 intersected 59.60g/t Au, 92.30g/t Ag and 3.19% Cu over 0.50m

- Discovery of eight gold-bearing shear/alteration zones, hosting up to 20 m wide intervals of anomalous gold values within envelopes of alteration and/or shearing within the Freure Lake Batholith (see Northern Superior Resources press release, May 15, 2019).

Annex Area

The second gold-bearing system is contained within the Annex area of the property. This system is defined by a gold grain-in-till dispersal corridor. As with the Big Dam dispersal train, the size of the anomaly and the distribution of pristine grains suggests multiple bedrock sources.

Exploration Highlights in Annex Area

- Mineralized boulders returned assay values of up to 727 g/t gold, 111 g/t silver, 4.1% copper (see Northern Superior Resources press release, June 25, 2012).

- Drill hole NG-12-003C returned grades of up to 4.62 g/t gold over 5.5 m, including 20.8 g/t Au over 1.0m (see Northern Superior Resources press releases, June 25 and 26, 2012).

- Drill hole NG-12-005C intersected 13.40 g/t Au over 1.90m (see Northern Superior Resources press releases, June 25 and 26, 2012).

The October Gold Project

The October Gold Project is a district scale property consisting of 1,281 claims covering an area of 265km2 located in northeastern Ontario, 105 km southwest of Timmins and within the Swayze Greenstone Belt. The property is accessible via an all-season highway and network of forestry roads. This property is situated approximately 35km northwest of IAMGold's Côté Lake project and approximately 50 km southeast of Newmont's Borden Lake mine.

The October Gold Project is in the traditional territory of the Flying Post and the Chapleau Cree First Nations. The October Gold property is thought to occur on a western extension of the Cadillac-Larder Lake break, straddling an approximate 15 km portion of the Ridout Deformation zone. Aside from a favorable structural association for gold mineralization and close proximity to an operating gold mine and a second in development, evidence for economic gold potential associated with the property includes widespread anomalous gold values from surface sampling (up to 11.50 g/t, obtained by NSR) and previous diamond drilling and two strong gold soil gas hydrocarbon anomalies (1.5 km x 3.0 km and 2.0 by 2.0 km).

In October 2021, a multifaceted exploration program was undertaken to define drill targets including: i) initial geological mapping; ii) prospecting; iii) rock sampling and channel sampling program; iv) property wide LiDAR survey; v) surficial (Quaternary) geological mapping; vi) orientation biogeochemical and geochemical survey; and vii) a detailed property wide helicopter magnetic survey.

From August to October 2022, reconnaissance geological mapping and prospecting were carried out by NSR. Anomalous gold values up to 0.65 g/t were found in three new areas and the historic Woman River Showing was located and sampled, yielding assays up to 11.50 g/t Au. Also, grab samples from the southwestern part of the property assayed up to 0.55 g/t Au, 1650ppm Cu and 4100ppm Zn, in separate samples. These results suggest the property is prospective for both gold and base metal deposits. Consequently, ground magnetometer surveys were completed in two areas: the South Benton grid for 176.45 line km and the Mallard West grid, for 132.55 line km. In addition, 4 diamond drill holes were drilled, for a total of 853m to better understand the geology around the Ridout Deformation Zone. Although intervals of sericite and silica alteration and pyrite mineralization were encountered, no significant gold assays were returned.

Option to Evolution Mining

On November 6, 2023, Northern Superior announced that it had granted Evolution Mining Limited an option to acquire a 75% undivided interest in the Company's October Gold Project (the "Option") by incurring an aggregate of $7 million in expenditures and making cash payments totaling $1.1 million. From the date herein, the payments related to the Option will be made to ONGold. Specific conditions are as follows:

| a) | incurring an aggregate of $7,000,000 in expenditures on the October Gold Project as per the following schedule: (i) an amount of at least $1,500,000 on or before the second anniversary of the Earn-In Agreement; (ii) an additional amount of at least $1,000,000 on or before the third anniversary of the Earn-In Agreement; (iii) an additional amount of at least $2,000,000 on or before the fourth anniversary of the Earn-In Agreement; and (iv) an additional amount of at least $2,500,000 on or before the fifth anniversary of the Effective Date; |

| b) | paying to Northern Superior an aggregate cash payment of $1,100,000 as per the following schedule: (i) an amount of $350,000 within 20 Business Days following the execution of the Earn-In agreement; (ii) an amount of $300,000 within 60 Business Days following the third anniversary of the Earn-In Agreement; and (iii) an amount of $450,000 within 60 Business Days following the fifth anniversary of the Earn-In Agreement. |

In the event that Evolution completes the Option and acquires a 75% undivided interest in the October Gold Project, a joint venture shall be formed in accordance with the terms of the Agreement.

Other Properties

ONGold holds a 100% interest in additional Properties in northwestern Ontario, known as Rapson Bay, Thorne-Ellard and Meston Lake. Together, these comprise 2,334 cell claims, covering 43,791 ha.

Work on these properties by Northern Superior in 2011/2012 consisted of an airborne magnetometer survey, till sampling, geology, prospecting, limited induced polarization (IP) surveys and diamond drilling. This work was highlighted by the intersection of 0.83 g/t Au, 3.07 g/t Ag, 0.55% Cu and 0.028% Mo over a core length of 52.5 metres, including 1.83 g/t Au, 6.65 g/t Ag, 1.08% Cu and 0.059% Mo over 18.0 metres in hole WB-11-008C on the Rapson Bay Property (Norther Superior news release, Jan. 11, 2012). The property has lain idle since that time.

Technical Information

The scientific and technical content of this press release has been reviewed and approved by Rodney Barber, P. Geo. for ONGold, who is a "Qualified Person" as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects. Mr. Barber is the President of ONGold and is not considered independent.

Early Warning Disclosure Pursuant to National Instrument 62-102

Following completion of the Transaction, Northern Superior holds 35,686,686 Common Shares or 72.35% of the issued and outstanding Common Shares. The Common Shares issued to Northern Superior and now held were issued at the equivalent of $0.51 per Common Share, or an aggregate of approximately $18.2M. Prior to the Transaction and prior to ONGold becoming a reporting issuer, Northern Superior didn't hold any Common Shares.

All Common Shares held by Northern Superior are held for investment purposes. In the future, Northern Superior (directly or indirectly), may acquire and/or dispose of securities of ONGold through the market, privately or otherwise, as circumstances or market conditions may warrant. Northern Superior's head office is located at 1410-120 Adelaide St. W., Office, Toronto, Ontario, M5H 1T1. Northern Superior is incorporated under the Business Corporations Act (British Columbia) and its business is described below under the heading "About Northern Superior Resources Inc."

This portion of this news release is issued pursuant to National Instrument 62-103 - The Early Warning System and Related Take-Over Bid and Insider Reporting Issues, which also requires an early warning report to be filed with the applicable securities regulators containing additional information with respect to the foregoing matters. A copy of the early warning report of Northern Superior will be available under ONGold's profile on SEDAR+ (www.sedarplus.ca) or contact Rodney Barber at the phone number or email noted below.

In addition, as a result of the increase in the number of issued and outstanding Common Shares pursuant to the Transaction, L5 Capital Inc. ("L5"), Red Point Capital Inc. ("Red Point") and Jennifer Goldman ("Goldman"; together with L5 and Red Point, the "Outgoing Insiders") announce that their respective ownership of Common Shares decreased to below 10% on an undiluted and fully-diluted basis.

Prior to the closing of the Transaction, each Outgoing Insider held the following securities:

| a) | Goldman of Toronto, Ontario, held (i) 966,666 Common Shares, being 33.33% of the then issued and outstanding Common Shares; |

| b) | Red Point, a corporation with a head office in Toronto, Ontario, held (i) 966,667 Common Shares, being 33.33% of the then issued and outstanding Common Shares; and |

| c) | L5, a corporation with a head office in Vancouver, British Columbia, held (i) 966,667 Common Shares, being 33.33% of the then issued and outstanding Common Shares. |

Following the closing of the Transaction, each Outgoing Insider now holds the following securities:

| a) | Goldman now has ownership or control over the same number of Common Shares; however, as a result of the additional Common Shares issued pursuant to the Transaction, Goldman now has ownership or control over 1.96% of the issued and outstanding Common Shares and holds no securities convertible into Common Shares; |

| b) | Red Point now has ownership or control over the same number of Common Shares; however, as a result of the additional Common Shares issued pursuant to the Transaction, Red Point now has ownership or control over 1.96% of the issued and outstanding Common Shares and holds no securities convertible into Common Shares; |

| c) | L5 now has ownership or control over the same number of Common Shares; however, as a result of the additional Common Shares issued pursuant to the Transaction, L5 now has ownership or control over 1.96% of the issued and outstanding Common Shares and holds no securities convertible into Common Shares; |

The Common Shares held by each of the Outgoing Insiders are being held for investment purposes and are subject to escrow restrictions as required by the TSXV. In the future, each Outgoing Insider may evaluate its investment in ONGold from time to time and may, depending on various factors including, without limitation, ONGold's financial position, the price levels of the ONGold Shares, conditions in the securities markets and general economic and industry conditions, ONGold's business or financial condition, applicable escrow restrictions required by the TSXV, and other factors and conditions that each Outgoing Insider may deem appropriate, increase, decrease or change its ownership over the Common Shares or other securities of ONGold.

An early warning report prepared pursuant to the requirements of National Instrument 62-103 The Early Warning System and Related Take-Over Bid and Insider Reporting Issues by the Outgoing Insiders will be filed on SEDAR+ at www.sedarplus.com under ONGold's profile. For further information, including a copy of the early warning report required under applicable Canadian securities laws to be filed by each of the Outgoing Insiders as a result of the Transaction referred to in this press release, please contact Grant Duthie at 416-869-1234.

Additional Information Regarding the Transaction

For additional details regarding the Transaction please see the listing statement available on ONGold's SEDAR+ profile at www.sedarplus.ca.

Sponsorship

The TSXV provided an exemption from the sponsorship requirements in connection with the Transaction.

Corporate Matters

Northern Superior has entered into a 3-month marketing and consulting contract with Toronto based marketing firm, Outside The Box Capital Inc. ("Outside The Box"). Outside The Box specializes in various social media platforms and will be able to facilitate greater awareness and widespread dissemination of Northern Superior's news. Outside The Box operates under the direction of Mr. Jason Coles, Chief Executive Officer. Northern Superior will pay a total of CAD$100,000 plus applicable taxes to Outside The Box, which does not currently own any shares of Northern Superior.

About Northern Superior Resources Inc.

Northern Superior is a gold exploration company focused on the Chibougamau Camp in Québec, Canada. The Company has consolidated the largest land package in the region, with total land holdings currently exceeding 62,000 hectares. The main properties include Philibert, Lac Surprise, Chevrier and Croteau.

The Philibert Project is located 9 km from IAMGOLD Corporation's Nelligan Gold project which was awarded the "Discovery of the Year" by the Québec Mineral Exploration Association (AEMQ) in 2019. Philibert host a new maiden 43-101 inferred resource of 1,708,800 ounces Au and an indicated resource of 278,900 ounces of Au[2]. Northern Superior holds a majority stake of 75% in the Philibert Project, with the remaining 25% owned by SOQUEM, and retains an option to acquire the full 100% ownership of the project. Chevrier hosts an inferred mineral resource of 652,000 ounces Au (underground and open pit) and an indicated mineral resource of 260,000 ounces Au.[3] Croteau hosts an inferred mineral resource of 640,000 ounces Au.[4] Lac Surprise hosts the Falcon Zone Discovery, interpreted to be the western strike extension of IAMGOLD Corporation's Nelligan Deposit.

Northern Superior is a reporting issuer in British Columbia, Alberta, Ontario and Québec, and trades on the TSX Venture Exchange under the symbol SUP and the OTCQB Venture Market under the symbol NSUPF. For further information, please refer to the Company's website at www.nsuperior.com or on SEDAR+ (www.sedarplus.ca).

Northern Superior Resources Inc. on Behalf of the Board of Directors

Simon Marcotte, CFA, President and Chief Executive Officer

Contact Information

Simon Marcotte, CFA

President and Chief Executive Officer

Tel: (647) 801-7273

info@nsuperior.com

About ONGold Resources Ltd.

ONGold Resources Ltd (formerly 1348515 B.C. Ltd.) is a reporting issuer in the provinces of British Columbia and Alberta with no current activities or operations. ONGold owns significant exploration assets in Northern Ontario highlighted by the district scale TPK Project and October Gold Project.

Contact Information

Rodney Barber

President

Telephone: 1 (855) 525-0992

Email: info@ongoldresources.com

Not for distribution to United States newswire services or for release, publication, distribution, or dissemination, directly or indirectly, in whole or in part, in or into the United States. Unless otherwise noted, references to "$" or dollars in this news release are to Canadian dollars.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. Listing of the Common Shares is subject to a number of conditions, including but not limited to TSX Venture Exchange acceptance. There can be no assurance that the listing of the Common Shares will be completed as proposed or at all. Investors are cautioned that, except as disclosed in ONGold's listing statement dated April 26, 2024, any information released or received with respect to the Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of the Company and ONGold should be considered highly speculative.

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. The information in this news release about the proposed transaction; and any other information herein that is not a historical fact may be "forward-looking information". Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "interpreted", "management's view", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward- looking information and are intended to identify forward-looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Company and Finco, at the time it was made, involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the companies to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, risks relating to the ability of ONGold to list the Common Shares on the TSXV. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, the parties cannot assure shareholders and prospective purchasers of securities that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither party nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. Neither party undertakes, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

[1] CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

[2] Northern Superior announces 1,708,809 gold ounces in inferred category and 278,921 gold ounces in indicated category at 1.10 g/t in maiden NI 43-101 pit constrained resource estimate at Philibert; Northern Superior Resources Inc. press release dated August 08, 2023.

[3] NI 43-101 Technical Report Mineral Resource Estimation for the Chevrier Main Deposit, Chevrier Project Chibougamau, Quebec, Canada, October 20, 2021, Prepared in accordance with National Instrument 43-101 by Lions Gate Geological Consulting Inc. IOS Services Géoscientifiques Inc. for Northern Superior Resources Inc.

[4] Chalice Gold Mines Limited and Northern Superior Resources Inc. Technical Report on the Croteau Est Gold Project, Québec, September 2015, Prepared in accordance with National Instrument 43-101 by Optiro Pty Ltd ("Optiro") to Chalice Gold Mines Limited and Northern Superior Resources Inc.

SOURCE: Northern Superior Resources Inc.

View the original press release on accesswire.com