par RightCapital Inc.

RightCapital Introduces RightFlows(TM), the Industry’s First Financial Planning Workflow Tool with Direct Client Collaboration

RightFlows Helps Financial Advisory Firms Scale Financial Plan Implementations Efficiently by Managing Client and Advisor Tasks Within the Same Workflows

SHELTON, CT / ACCESSWIRE / January 22, 2024 / RightCapital, the fastest-growing financial planning software for financial advisors, today introduced RightFlows, the industry's first financial planning workflow tool that incorporates direct collaboration with clients. RightFlows helps growing financial advisory firms scale financial plan implementations and manage planning processes consistently and efficiently across the organization by automating tasks for advisors, assistants and, most importantly, clients.

As a firm's client base grows, they often turn to a generic project management tool or manual spreadsheet to manage their planning processes. While a standalone workflow tool can be useful for keeping advisors and assistants on the same page, advisors are forced to use a different tech tool to communicate client tasks as clients typically do not, and should not, have access to the complex internal workflow tool.

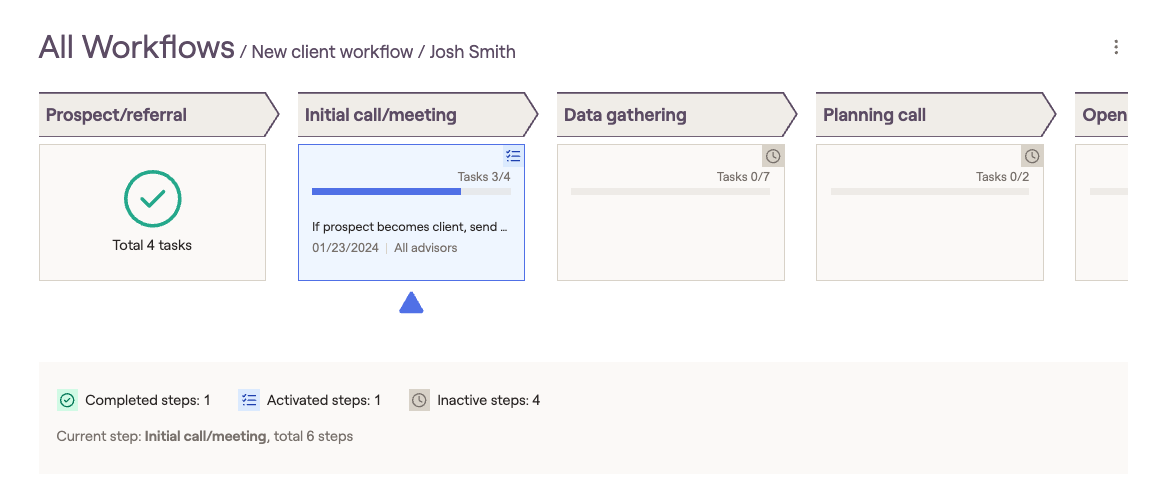

With RightFlows, pre-defined tasks can be automatically assigned to advisors, assistants or clients as part of a workflow. Clients can review and complete the tasks assigned to them within RightCapital's secure client portal or mobile app. Once the tasks are completed, RightFlows automatically triggers the next step in the workflow, reducing human errors and saving valuable time for advisors.

"RightCapital has been at the forefront of innovating the financial planning experience, and we've seen firsthand how many advisors struggle to stay on top of planning processes and collaborate with clients," said Shuang Chen, co-founder and CEO of RightCapital. "RightFlows is the result of countless hours of feedback from advisors on what they need to implement financial plans and manage client workflows at scale."

Key Benefits of RightFlows

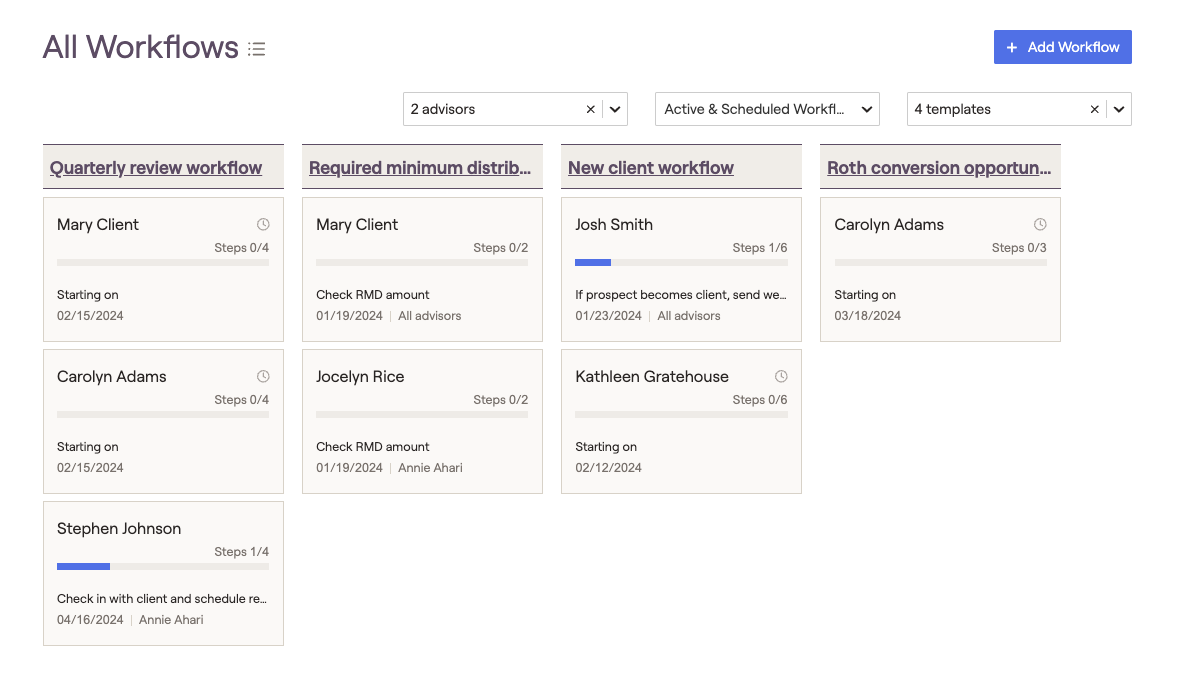

- Financial planning workflows with client collaboration: RightFlows makes it easy for advisors to include clients in a financial planning workflow such as quarterly plan reviews or Roth conversions. RightFlows provides a place where workflows can be created, monitored and executed with tight collaboration across advisors, assistants and clients.

- Time savings for advisors: From a centralized RightFlows dashboard, advisors can see where each client's financial plan stands and their next steps. Advisors can simply click the client name within a workflow to review and adjust the assigned and upcoming tasks as needed.

- Consistent financial planning processes across the organization: A workflow is comprised of specific steps, with each step containing a set of tasks. With RightFlows, firms can ensure their planning processes are followed across the organization, while still providing flexibility for advisors to adjust specific steps or tasks when needed.

RightFlows Availability

RightFlows is available now for a free trial and can be purchased as an add-on to RightCapital's core financial planning software platform. RightFlows is currently being offered at introductory pricing until April 26, 2024. To learn more, contact RightCapital Sales at sales@rightcapital.com, rightcapital.com/book-demo or (888) 982-9596 Opt 2.

About RightCapital

RightCapital's mission is to create Right Plans for Real People™. RightCapital is used by thousands of financial advisors to grow their practices and set their clients on the path to financial success. Founded in 2015, RightCapital is the fastest-growing financial planning software with the highest user satisfaction among advisors (Source: The Kitces Report - 2023 AdvisorTech Study). For more information, visit https://www.rightcapital.com.

RightCapital media contact: marketing@rightcapital.com

SOURCE: RightCapital Inc.

View the original press release on accesswire.com