par Snowline Gold Corp. (isin : CA83342V1040)

Snowline Gold Consolidates 100% of Its Einarson Project and Acquires Adjacent Gold Target With Historical Drill Result of 9.7 Grams per Tonne Gold Over 38.7 M

- Snowline consolidates 100% ownership of its district-scale Einarson Project, including its drill discovery of an orogenic gold system at the Jupiter target.

- Consolidation agreement also includes acquisition of adjacent, privately held gold target with historical drill results reported up to 9.67 g/t Au over 38.7 metres.

- Recent staking bolsters Snowline's Yukon land position by 22,000 ha to >360,000 ha (>3,600 km2), with expansions to its Rogue and Einarson projects.

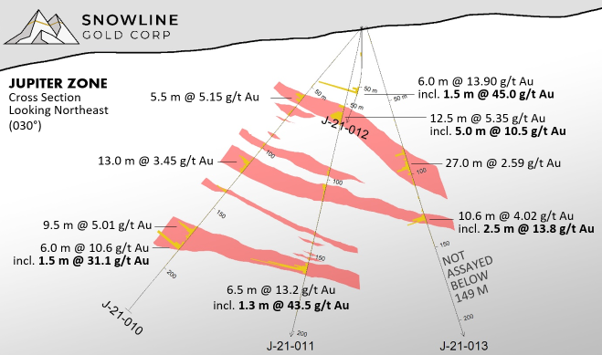

VANCOUVER, BC / ACCESSWIRE / April 25, 2024 / SNOWLINE GOLD CORP (TSXV:SGD) (OTCQB:SNWGF) (the "Company" or "Snowline") is pleased to announce that it has entered into a purchase agreement that will result in the consolidation of 100% ownership of its Einarson Project through purchase of a privately held 30% interest in 3,003 mineral claims (~61,000 ha). Einarson includes the Company's Jupiter discovery, which saw 2021 Phase 1 drill results of 13.2 g/t Au over 6.5 metres (m), including 43.5 g/t Au over 1.3 m, and 10.4 g/t Au over 5.0 m within the same hole (see Snowline press release dated August 25, 2021) alongside other well-mineralized drill holes spanning 1.1 kilometres (km) of open strike length. Additionally, Einarson hosts multiple untested, kilometers-scale gold targets defined by prospecting and surface geochemistry. Einarson sits immediately to the north of and is contiguous with Snowline's 100% owned Rogue Project, which hosts the Company's flagship Valley discovery. In addition to the consolidation, the Company will acquire a 100% interest in the Venus target, a privately held gold target adjacent to Einarson with a reported 2012 drill intersection of 9.67 g/t Au over 38.7 m (true width unknown; results have not been directly verified by the Company).

"We are thrilled to consolidate the Einarson Project and to acquire a full 100% interest in our Jupiter discovery alongside other promising targets," said Scott Berdahl, CEO & Director of Snowline. "The quantity and scale of the gold targets identified at Einarson through regional baseline work and follow-up prospecting were a big part of our motivation for launching Snowline Gold in 2021. The targets themselves are compelling, and they indicate strong regional gold fertility across Einarson, Rogue and our surrounding projects. The results of our Phase 1 drilling at Einarson's Jupiter target underscore this potential, and we are excited to follow up on that discovery and other targets in the upcoming 2024 exploration season, which will soon be underway.

"To be clear: our primary focus remains on the expansion and advancement of our Valley gold discovery on the Rogue Project. This district-level consolidation marks the realization of a long-term objective, further bolstering Snowline's exploration pipeline and expanding our opportunity to establish a new Canadian gold camp. Following this acquisition, Snowline will have 100% ownership of its entire >3,600 km2 mineral tenure, with no royalties above 1% following buy-down. Our significant land position has the added benefits of reducing regional competition and potential for cumulative impacts, thus streamlining permitting and allowing us to approach exploration and development in a responsible, holistic fashion. We are excited to bring to our shareholders the full discovery upside potential of numerous targets within a long-life exploration portfolio."

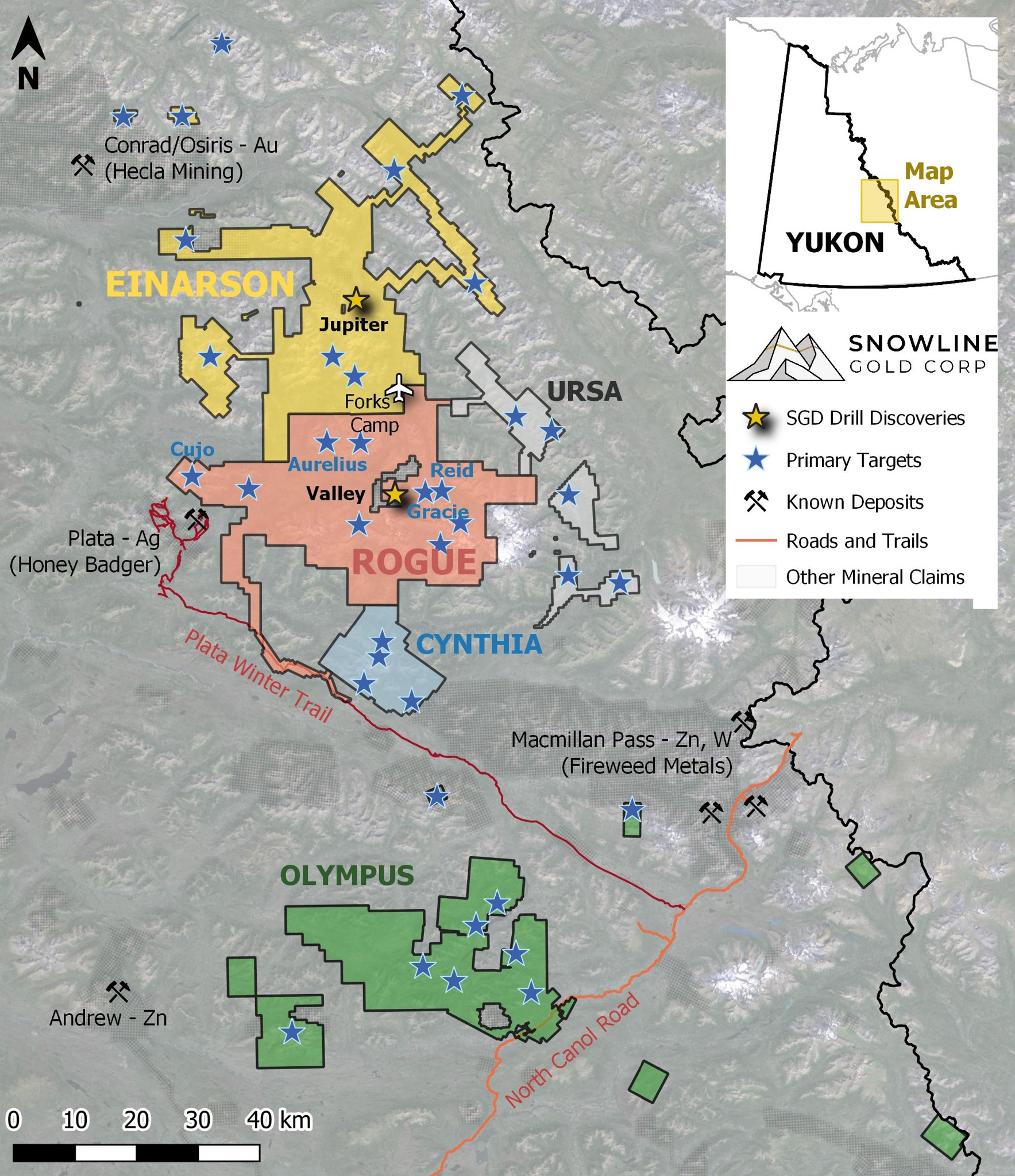

Figure 1 - Map of the consolidated Einarson Project, the newly acquired Venus target, and newly staked mineral claims in the vicinity of the Rogue and Einarson projects. Multiple kilometers-scale exploration targets have been identified at Einarson, including the "Golden Lane," a 30 km linear trend of consistently elevated to anomalous gold in soils which includes the Company's "Neptune" and "Luna" targets (formerly "Misty" and "B2"), along with Avalanche Creek, a 1 km mineralized float train with grab samples of up to 34.2 g/t Au located 12 km south of Jupiter along the same structural trend.

As consideration for the acquisition of the outstanding 30% interest in Einarson, 100% interest in Venus, 100% interest in several additional claims, and the purchase of physical assets in the area, Snowline will make a cash payment of C$1,200,000 and a one-time share payment of 1,012,000 Snowline shares, subject to a four-month hold period, to an arm's length private third party (the "Vendor"). The Vendor will retain a 2% Net Smelter Return (NSR) royalty on the Venus claim block (Figure 1). In connection with the agreement, the Vendor will grant Snowline the right to repurchase 50% of the Venus NSR (equivalent to 1% NSR interest) from the Vendor at any time following the closing of the agreement, to be satisfied by the delivery of 1,000 ounces of gold or the cash equivalent at the time of exercise of the buydown right. The Vendor will also be entitled to up to seven (7) individual, one-time cash bonus payments of C$1,000,000 in the event of a resource estimate prepared in accordance with NI 43-101 standards which delineates total measured and indicated resources exceeding 1 million ounces of gold on any of six specified mineral claim groupings within the consolidated claims and one additional claim grouping covering the Venus claim block. The purchase agreement is subject to a number of standard conditions, and it is anticipated that closing will occur prior to May 15, 2024.

JUPITER

Snowline's Jupiter Target hosts an epizonal orogenic gold system, discovered through a Phase 1 drilling program completed by the Company in 2021 (e.g. Figure 2). Widespread gold mineralization was encountered across 1.1 km of strike length within an open geochemical anomaly spanning roughly 3 km along a structural trend. Follow-up drilling on this discovery was postponed until consolidation of 100% ownership of the underlying claims could be resolved.

Figure 2 - Drill section showing holes J-21-010 to J-21-013, with gold assays represented as yellow bar plots downhole (see Snowline press release dated October 13, 2021). A preliminary schematic interpretation suggests mineralized zones (red) dip roughly east-northeast, though this basic interpretation is unlikely to capture structural complexity suggested by fold and fault structures observed in drill core, and the continuity between holes remains to be seen. Hole J-21-012 was drilled towards the viewer and is truncated where it pierces 50 m in front of section. It was only assayed in a few select intervals below this point. True widths of reported intersections are not yet known but are expected to be between 50 to >90% of reported intervals.

Additional areas of orogenic gold mineralization are present on parallel fault structures in the vicinity of Jupiter. Twelve kilometres south of Jupiter, the Avalanche Creek target hosts a mineralized boulder train (Figure 3) similar to that discovered at Jupiter, with mineralized quartz cobbles and boulders returning up to 34.2 g/t Au. Four kilometres to the west, a parallel fault structure is associated with the Mars target, a 4-kilometre geochemical anomaly that has seen limited historical drilling at its extreme south end. Jupiter, Avalanche Creek, Mars, and other targets are now fully owned by Snowline.

Figure 3 - Gold-bearing quartz float boulders at Einarson Project targets Jupiter (left) and Avalanche Creek (right), present as persistent float trains dispersed for at least 1 km in each case. Both targets are associated with the same property-scale fault structure roughly 12 km apart from each other, and 4 km from the Mars target which is situated on a parallel property-scale fault. The Jupiter target float train was drill tested in 2021 (Figure 2), revealing a robust orogenic gold system which remains open. Avalanche Creek was discovered in late 2020 and has not yet been drill tested. The prominent nature of the previously unidentified mineralized boulder trains highlights the underexplored nature of the Einarson Project and the surrounding mineral district.

VENUS

The Venus claim block comprises 270 claims (5,600 ha) covering a Carlin-style gold discovery made by a private company in 2012. Surface showings of orpiment and realgar occur in the vicinity of outcropping silicified dolomite. Selective grab samples of this zone returned assays of up to 191 g/t Au. 4,159 m of diamond drilling on the target in 2012 and 2013 by the private company revealed widespread but thus far relatively inconsistent gold mineralization. The best hole returned 9.67 g/t Au over 38.7 m (including 30.64 g/t Au over 6.4 m) from 41.5 m downhole. These results have not been directly verified by Snowline, and the true width of this interval is not known.

In the context of the orogenic gold mineralization at the Einarson Project's Jupiter target and the reduced-intrusion style gold mineralization at Rogue Project's Valley target, the Company considers the presence of Carlin-style gold mineralization in the district an encouraging confirmation of a robust regional metallogenic framework with a propensity to form large gold systems.

STAKING

The Company has secured through staking an additional 1,071 mineral claims covering roughly 22,000 ha (220 km2) in the vicinity of its Einarson and Rogue projects (Figure 1). This staking bolsters the Company's district-scale position in the region, infilling and strategically expanding its previous land position, covering prospective structural corridors, and adding buffers around existing targets and project areas. This staking, together with the acquisition of the Venus target, will bring the Company's total Yukon Territory mineral tenure holdings to >360,000 ha (3,600 km2).

Roughly 11% of the 1,071 newly staked claims fall within or partly within the fixed 2 km areas of interest (AOIs) defined in Snowline (formerly Skyledger Tech Corp)'s December 1, 2020 agreement with Yukon-based company 18526 Yukon Inc., through which Snowline acquired its extensive Yukon datasets and its initial Yukon mineral properties. Claims staked within the AOIs are subject to a 2% NSR royalty and are incorporated into existing buy-down provisions which allow Snowline to reduce the NSR to 1% on a project-by-project basis. 18526 Yukon Inc. is a privately held project generation company that is owned 40% by Snowline's CEO and Director Scott Berdahl. The remaining 89% of newly staked claims have no underlying royalties.

ABOUT SNOWLINE GOLD CORP.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with an eight-project portfolio covering >360,000 ha (>3,600 km2). The Company is exploring its flagship >110,000 ha (>1,100 km2) Rogue gold project in the highly prospective yet underexplored Selwyn Basin. Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits including Kinross's Fort Knox Mine, Newmont's Coffee deposit, and Victoria Gold's Eagle Mine. The Company's first-mover land position and extensive database provide a unique opportunity for investors to be part of multiple discoveries and the creation of a new gold district.

Figure 4 - Project location map for Snowline Gold's eastern Selwyn Basin properties: Rogue, Einarson, Ursa, Cynthia and Olympus. The Valley target is one of several prospective reduced intrusion-related gold system (RIRGS) targets on the broader 30 x 60 km Rogue Project, complemented orogenic, Carlin-type, RIRGS and other sediment hosted gold targets on surrounding projects.

QUALIFIED PERSON

Information in this release has been prepared under supervision of and approved by J. Scott Berdahl, M.Sc., P. Geo., CEO & Director of Snowline Gold Corp, as Qualified Person for the purposes of National Instrument 43-101.

ON BEHALF OF THE BOARD

Scott Berdahl

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

info@snowlinegold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements regarding the consolidation of the Einarson Project, the acquisition of the Venus target, the significance of analytical results, the prospectivity of various gold targets, and the potential for investors to participate in multiple future discoveries, the creation of a new gold district and the Company's future plans and intentions. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View the original press release on accesswire.com