par Temas Resources Corp. (CVE:TMAS)

Temas Announces La Blache Titanium-Vanadium-Iron Project PEA Demonstrates CAD $6.8B NPV8 55.1% IRR Post-Tax Return

Strong Economics Supported by $23.1B EBITDA over a 14-year Mine Life in Canada's Mining Friendly Jurisdiction of Quebec

VANCOUVER, BC / ACCESSWIRE / February 7, 2024 / Temas Resources Corp. ("Temas" or the "Company") (CSE:TMAS) is pleased to report positive results of an Independent Technical Report and Preliminary Economic Assessment ("PEA") for the wholly-owned La Blache Ti-V-Fe Project located in the Cote Nord region of Quebec.

Project economics were estimated assuming market demand supports constant prices of USD $2,200/tonne ("t") for titanium dioxide (97.8% purity TiO2), USD $14,200/t for vanadium pentoxide (V205) and USD $125/t iron oxide (Fe2O3). The PEA to be filed on SEDAR will present a complete description and list of assumptions. Capital and operating cost estimates were prepared based on current and expected long-term pricing assumptions and to a PEA level +/- 35% level of accuracy.

Tim Fernback, President of Temas Resources comments, "We are extremely pleased with the strong economics presented in this PEA on the La Blache Titanium-Vanadium-Iron Project in Quebec. Titanium has been trading well above our assumptions of USD $2,200 per tonne for over three years at over USD $3,000 per tonne since August 2022, and we believe this trend will continue due to the increasing demand for TiO2, major global supply coming to end of life, and lack of both brownfield expansion and new projects coming online in North America. The PEA further increases our confidence in the Project and showcases our proprietary, environmentally friendly extraction technology. With a current market cap of CAD $5M, I am excited to engage with all our stakeholders to unlock the value of this highly robust Project as we advance the asset forward."

PEA HIGHLIGHTS

| Parameter | Units | Value |

| Post-tax Net Present Value (NPV8) | CAD $ Billion | 6.8 |

| Post-tax IRR | % | 55.1 |

| Initial capital cost (Capex) (including 15 % contingency) | CAD $ Billion | 1.2 |

| Capex payback from commercial production | Months | 25 |

| Pre-production Development | Years | 2 |

| Life of Mine ("LOM") | Years | 14 |

| Gross Project Revenue | CAD $ Billion | 37.2 |

| Net Revenue (Revenue less transport offsite) | CAD $ Billion | 31.8 |

| EBITDA (Operating Profit) | CAD $ Billion | 23.1 |

| Net Project Cash Flow (pre-tax) | CAD $ Billion | 21.8 |

| Net Project Cash Flow (post-tax) | CAD $ Billion | 15.9 |

| Average Annual Gross Revenue | CAD $ Billion | 2.7 |

| LOM average annual EBITDA | CAD $ Billion | 1.6 |

| Net operating margin | % | 62.0 |

| Average Post-tax Operating Cost per tonne of concentrate | CAD $/t | 278.04 |

| Weighted average revenue per tonne of product (net shipping) | CAD $/t | 633.49 |

| LOM Sustaining Capital (including 15% contingency) | CAD $ Billion | 0.6 |

| LOM average gross production of concentrate | Million tpa | 3.58 |

| Profitability Index (NPV8 / Initial Capex) Post Tax | Ratio | 5.71 |

| LOM Capital Intensity Index (Initial Capex/ROM tonnage) | CAD $ / tpd capacity | 49,801 |

| LOM average C1 cost / tonne run-of-mine production (incl. royalty, no tax) | CAD $/t | 79.24 |

| LOM average AISC / tonne run-of-mine production | CAD $/t | 85.05 |

| LOM average C1 cost / tonne concentrate (incl. royalty, no tax) | CAD $/t | 170.23 |

| LOM average AISC / tonne concentrate | CAD $/t | 182.72 |

| Average annual production TiO2 | Ktpa | 660 |

| LOM mining production (Mill Feed) | Mt | 108 |

| LOM mining production (Mill Feed + Waste) | Mt | 486 |

| LOM average grade TiO2 | % | 12.2 |

| LOM average grade TiO2 Equivalents | % | 16.8 |

Note:

All values in this news release are reported in CAD unless otherwise noted.

Assumed prices for LOM: USD $2,200/t TiO2, USD $14,200/t V2O5, USD $125/t Fe2O3.

Units expressed in metric tonnes.

MINERAL RESOURCES

The basis for the PEA is the Mineral Resource Estimate ("MRE") prepared by Samer Hmoud, (P.Geo. PGO), currently holding Special Authorization from OGQ, under the supervision of QP Jacques Dumouchel, P.Geo., OGQ.

The updated Mineral Resource Statement generated for La Blache is as follows:

Units | Semi-Massive Oxide | Massive Oxide | TOTAL | |

Resource Category | Inferred | Inferred | Inferred | |

Resource | Mt | 99.7 | 108.8 | 208.5 |

TiO2 | % | 6.3 | 17.8 | 12.3 |

V2O5 | % | 0.1 | 0.3 | 0.2 |

Fe2O3 | % | 22.0 | 59.4 | 41.5 |

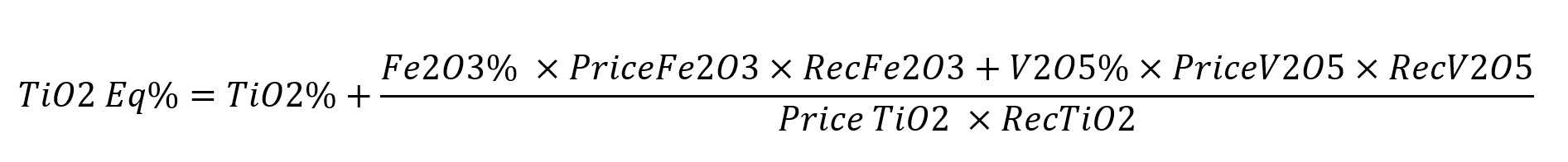

TiO2 Eq | % | 8.3 | 24.3 | 16.7 |

Contained TiO2 | Mt | 6.2 | 19.4 | 25.6 |

Contained V2O5 | Mt | 0.1 | 0.3 | 0.4 |

Contained Fe2O3 | Mt | 21.9 | 64.6 | 86.5 |

Reported at a cut-off grade of 4.9 % TiO2, at a minimum mining block size of 10x10x10 meters ("m"), considering 3.51:1 strip ratio, bench height 5m, pit slope of 45° processing and selling technical parameters and costs benchmark against similar projects and a selling price of USD $2,200/t (TiO2), USD $14,200/t (V2O5) and USD $125/t (Fe2O3). All figures are rounded to reflect the relative accuracy of the estimates. Mineral Resources are not Mineral Reserves and do not have a demonstrated economic viability. The contained TiO2 represents estimated contained metal in the ground and has not been adjusted for metallurgical recovery and may have discrepancies due to rounding.

An Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated based on limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that most of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

SUMMARY OF PRELIMINARY ECONOMIC ASSESSMENT

Project economics were estimated assuming a constant price of USD $2,200/t for titanium dioxide (97.8% purity), USD $14,200/t for vanadium pentoxide and USD $125/t iron oxide. The PEA will present a complete description and list of assumptions. Capital and operating cost estimates were prepared based on current and expected long-term pricing assumptions and to a PEA level +/- 35% level of accuracy.

In summary, the Project has a post-tax LOM net project cashflow (pre-finance) of CAD $15.9 billion which returns a pre-tax NPV8 of CAD $9.4 billion, post-tax NPV8 of CAD $6.8 billion and an IRR of 55.1%. The following table presents the summary LOM cash flow resulting from the Technical Economic Model.

Metric | CAD $ Millions | USD $ Millions |

Gross Revenue | 37,223 | 27,573 |

Deductions (Off-Site Shipping) | 5,454 | 4,040 |

Net Revenue | 31,769 | 23,532 |

Operating Costs | 8,076 | 5,982 |

Total LoM Project Capital excluding Closure | 1,638 | 1,214 |

Start Up Project Capital excluding Working Capital | 1,012 | 750 |

Start Up Project Capital including Working Capital | 1,195 | 885 |

Start Up Plant and Infrastructure Capex | 261 | 193 |

Start Up Mine and Equipment Capex | 186 | 138 |

Start Up Capitalized Pre-stripping | 296 | 219 |

Sustaining Capital | 626 | 464 |

Owners and Indirects excluding Working Capital | 339 | 251 |

Pre-Production Contingency | 113 | 84 |

Sustaining Capex Contingency | 130 | 96 |

Working Capital | 183 | 135 |

Closure Cost | 300 | 222 |

Project Free Cashflow (EBITDA) | 23,067 | 17,087 |

Corporation Tax (Canada and Quebec) | 5,868 | 4,346 |

Royalties | 461 | 342 |

Net Project Cashflow (post-tax, undiscounted) | 15,887 | 11,768 |

NPV8 (pre-tax, discounted 8%) | 9,454 | 7,003 |

NPV8 (post-tax, discounted 8%) | 6,830 | 5,059 |

Exchange Rate: 1.35 CAD : 1.00 USD

SENSITIVITIES

The following table shows the pre-tax and post-tax NPV8 at varying discount rates.

The base case discount rate of 8% returns a pre-tax NPV8 of CAD $9.4 billion (USD $7.0 billion) and post-tax NPV8 CAD $6.8 billion (USD $5.0 billion) post-tax.

Discount Rate | Pre-Tax NPV (CAD $ Million) | Post-Tax NPV (CAD $ Million) |

5% | $12,726 | $9,241 |

8% (base case) | $9,454 | $6,830 |

10% | $7,825 | $5,629 |

12% | $6,519 | $4,667 |

15% | $5,012 | $3,556 |

Discount Rate | Pre-Tax NPV (USD $ Million) | Post-Tax NPV (USD $ Million) |

5% | $9,427 | $6,845 |

8% (base case) | $7,003 | $5,059 |

10% | $5,796 | $4,170 |

12% | $4,829 | $3,457 |

15% | $3,713 | $2,634 |

Exchange Rate: 1.35 CAD : 1.00 USD

The following table and figure show the effect on the post-tax NPV8 at varying revenue, Opex, Capex, and material price levels (from -50% to +50%):

Sensitivities: Post Tax NPV8 (8% discount rate) | |||||||||||