par Barton Gold Holdings Limited (isin : AU0000153215)

Tunkillia Gold Project - Positive Initial Scoping Study

Potential large-scale operation; multiple optimisation opportunities

EXECUTIVE SUMMARY

Initial Scoping Study completed for Barton's South Australian Tunkillia Gold Project (100%), for potential 5Mtpa bulk open pit mining and processing model targeting capital economies of scale

Initial 6.4 year life-of-mine (LoM) and total ~8 year project life (including construction), with a total of 30.7Mt processed materials grading an avg 0.93 g/t gold (Au) and 2.52 g/t silver (Ag)

Initial LoM estimates include:

total payable metal of ~833koz Au and ~1,993koz Ag

avg annual production of ~130koz Au and ~311koz Ag

avg operating cashflow of ~A$1,626 / oz Au (net of by-product Ag credits), and

avg All-in Sustaining Cost (AISC) ~A$1,917 / oz Au (net of by-product Ag credits), would currently rank Tunkillia #17 of 47 Australian gold operations reporting AISC / oz Au produced.

Higher-grade ‘Starter' pit during first ~18 months of mining and processing:

4.9Mt mill feed averaging 1.26 g/t Au and 3.32 g/t Ag

total production of ~181koz Au and ~420koz Ag, and

avg operating cashflow of ~A$2,265 / oz Au (~A$396m total) (net of Ag credits).

~A$374m initial capital cost (incl. ~A$70m EPC), before owner costs, pre-strip and contingencies

Initial Net Present Value (NPV)7.5% ~A$512m, 40% IRR and 1.9 year payback (unlevered, pre-tax)

ADELAIDE, AUSTRALIA / ACCESSWIRE / July 15, 2024 / Barton Gold Holdings Limited (ASX:BGD, OTCQB:BGDFF, FRA:BGD3) (Barton or Company) is pleased to announce the results of an initial scoping study for its Tunkillia Gold Project (Tunkillia) (Scoping Study).

Commenting on the initial Scoping Study results, Barton Managing Director Alex Scanlon said:

"We are pleased to announce these preliminary results which validate our strategy to target economies of scale and outline a project that, were it in operation today, would rank favourably among Australian gold producers.

"Even based upon initial processing cost assumptions that Barton considers to be fairly conservative, and only a 6 year initial mine life, Tunkillia delivers strong returns, competitive AISC performance and a 1.9 year payback.

"This is only a preliminary study and we have already identified multiple areas for potential optimisation in terms of process design, capital costs, operating costs and growth in the life of mine and materials schedule.

"In only 3 years' time we have grown Tunkillia to a 1.5Moz Au JORC Resource and demonstrated a viable, large-scale standalone operation. We believe this is just the start for Tunkillia and its neighbouring assets, and with over A$10m cash we are very well positioned to continue systematically building up their combined potential."

CAUTIONARY STATEMENTS

Preliminary Scoping Study

The Scoping Study referred to in this announcement has been undertaken by Barton as a preliminary assessment of Barton's Tunkillia project for prospective development on a large-scale, 5 million tonne per annum model, and to identify key drivers of value and opportunities for subsequent optimisation.

The Scoping Study is a preliminary technical and economic study of Tunkillia's potential viability. It is based on low level technical and economic assessments insufficient to support the estimation of Ore Reserves. Further exploration and evaluation work and appropriate studies are required before Barton will be in a position to estimate any Ore Reserves or to provide any assurance of an economic development case.

Basis of Study (Key Geological and Cost Estimation Factors)

This announcement has been prepared in compliance with the JORC Code 2012 Edition (JORC) and the ASX Listing Rules. All material assumptions on which the forecast financial information is based have been provided in this announcement and are also outlined in the annexed JORC table disclosures.

The capital cost estimate for the process plant and associated infrastructure has been prepared by GR Engineering Services Limited with a nominal accuracy of ±35%, with mining costs estimated by Mining Associates Pty Ltd at a scoping study level of accuracy from first principles on a bench-by-bench basis.

Production is based on Tunkillia's JORC Mineral Resources Estimate (MRE). The JORC MRE underpinning the production target have been prepared by a competent person in accordance with JORC, with ~66% of materials classified ‘Indicated' and ~34% ‘Inferred'. There is a low level of geological confidence associated with Inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources or that the production target itself will be realised.

~74% of the JORC Mineral Resources scheduled during the first five (5) years of the production target are classified as Indicated. Given a projected 1.9 year payback period (from start of production), Barton considers that Tunkillia's financial viability does not depend upon inclusion of Inferred Resources, and therefore that a reasonable basis exists for disclosing a production target including Inferred Resources.

Funding Requirements

The Scoping Study is based on the material assumptions outlined in this announcement. These include assumptions about the availability of funding. Barton's leadership has a strong track record of raising funding as required on attractive terms, and a significant combined professional track record in the and development of resources projects. However, while Barton considers all of the material assumptions to be based on reasonable grounds, there is no certainty that they will prove to be correct or that the range of outcomes indicated by the Scoping Study will be achieved.

To achieve the range of outcomes indicated in the Scoping Study, funding in the order of ~A$492 million will likely be required (inclusive of all capital, owner's, and other costs associated with an Engineering, Procurement and Construction (EPC) contract, and all factored contingencies). This funding may take the form of debt and/or equity. Investors should note that there is no certainty that Barton will be able to raise that amount of funding when needed. It is also possible that such funding may only be available on terms that may be dilutive to or otherwise affect the value of Barton's existing shares. It is also possible that Barton could pursue other ‘value realisation' strategies such as a sale, partial sale or joint venture of Tunkillia. If it does, this could materially reduce Barton's proportionate ownership of the project.

Reasonable Basis

Barton considers that it has a reasonable basis for providing the forward-looking statements in this announcement, and to expect that it will be able to complete the development of Tunkillia as outlined in the Scoping Study. However, given the uncertainties involved, investors should not make any investment decisions based solely on the results of the Scoping Study.

Background & Study Approach

Barton acquired Tunkillia in December 2019 with the view that the project had significant growth potential due to limited historical exploration during periods of lower gold prices. During the ~3.5 year period from October 2020 to March 2024, Barton completed multiple rounds of reverse circulation (RC) and diamond (DD) drilling, identified several extensions and new gold zones, and delivered four JORC MRE updates.[1]

Following Tunkillia's latest JORC MRE upgrade to ~1.5Moz Au (51.3Mt @ 0.91 g/t Au)[2] in March 2024, Barton commissioned GR Engineering Services Limited (GRES) and Mining Associates Pty Ltd (Mining Associates) to lead a scoping study for Tunkillia's development on a 5 million tonne per annum (Mtpa) model.[3] The Scoping Study is a preliminary technical and economic assessment of Tunkillia's prospective viability for potential development on a large-scale, bulk open pit basis, the primary objectives of which include to:

evaluate indicative capital costs, operating costs and mine design optimisation on a 5Mtpa basis;

validate prospective economies of scale and identify key drivers of cost and value; and

identify key opportunities for subsequent optimisation and growth.

The Scoping Study has evaluated Tunkillia on a ‘standalone' basis, with the process plant and associated process infrastructure delivered via an EPC contract and mining performed by a third-party contractor.

Key Assumptions & Outcomes

Development & Operations Model

The Scoping Study has considered Tunkillia's development as a bulk open pit mining operation sourcing materials from two large-scale pits (Area 223 and Area 51), using a third-party mining contractor model and processing via a newly built adjacent 5Mtpa carbon-in-leach (CIL) processing plant. Project delivery (development and commissioning) has assumed EPC contract basis for the delivery of the processing plant and associate process infrastructure. See ‘Capital Costs' for further detail.

Key Assumptions

The key physical, operating and financial assumptions for the Scoping Study are set out in Table 1 below. Barton notes the conservative assumptions utilised for comminution, specifically bond ball mill and bond rod mill work indices. The 100% percentile (highest) of historical test work results for all mineral domains was selected for the Scoping Study. These are material drivers of operating costs and represent a significant opportunity for optimisation. See ‘Operating Costs' and ‘Key Opportunities' for further detail.

Metric | Units | |||||||

Project | ||||||||

Project Life | Years | 7.7 | ||||||

Development Period | Weeks | 104 | ||||||

Processing Duration | Years | 6.4 | ||||||

Mining Optimisation | ||||||||

Assumed LoM Gold Price | A$ /oz | $ | 3,000 | |||||

Assumed LoM Silver Price | A$ /oz | $ | 37.50 | |||||

Mining Duration | Years | 6.4 | ||||||

Waste & Low-Grade Mined | Mt | 191.5 | ||||||

Initial Pre-Strip | Mt | 29.0 | ||||||

Mineral Resources Mined | Mt | 30.7 | ||||||

Project Strip Ratio | waste:ore | 6.23 | ||||||

Operating Strip Ratio | waste:ore | 5.29 | ||||||

Processing Physicals | ||||||||

Plant Throughput Capacity | Mtpa | 5.0 | ||||||

Material Processed | Mt | 30.7 | ||||||

Bond Ball Mill Work Index | kWh/t | 25.5 | ||||||

Bond Rod Mill Work Index | kWh/t | 26.7 | ||||||

Gold Recoveries (Oxide Materials) | % | 92.0 | % | |||||

Gold Recoveries (Fresh Materials) | % | 90.0 | % | |||||

Silver Recoveries (All Materials) | % | 80.0 | % | |||||

Average LoM Gold Grade | g/t Au | 0.93 | ||||||

Average LoM Silver Grade | g/t Ag | 2.52 | ||||||

Processing Costs | ||||||||

Oxide Materials | A$ / t | $ | 23.57 | |||||

Fresh Materials | A$ / t | $ | 25.57 | |||||

Royalties (Public & Private) | % | 6.0 | % | |||||

Selling Costs | A$/oz Au | $ | 37.32 | |||||

General & Administrative | A$ / t | $ | 2.56 | |||||

Financial Assumptions | ||||||||

Discount Rate | % | 7.5 | % | |||||

Gold Price | A$ / oz | $ | 3,500 | |||||

Silver Price | A$ / oz | $ | 45.00 | |||||

Table 1 - Key physical, operating and financial assumptions

Key Financial Results

The key estimated LoM production and financial results of the Scoping Study are detailed in Table 2 below.

Tunkillia is estimated to produce a total of ~833,000oz recovered gold and ~1,993,000oz recovered silver during a 6.4 year processing period, for average annual production of ~130koz Au gold and ~311koz silver. Estimated LoM revenue is ~A$3 billion, with an estimated operating pre-tax cash margin of ~A$1.3 billion.

Net of by-product silver, Tunkillia's average estimated operating cash cost is ~A$1,874 / oz Au, with an average estimated operating cash margin of ~A$1,626 / oz Au, and an All-in Sustaining Cost (AISC) of ~A$1,917 / oz Au (see ‘Additional Financial Analysis' for further information). According to Aurum Analytics, this would rank Tunkillia #17 of 47 Australian gold operations reporting AISC per ounce of gold produced.[4]

The project has an estimated ~A$374m initial capital cost (incl. ~A$70m EPC), before owner costs, pre-strip and contingencies. An additional allowance of ~A$60m is made for capitalised pre-strip, with further allowances totalling ~A$9m for owner's costs and ~A$50m for owner's and design contingencies. Please refer to the ‘Operating Costs', ‘Capital Costs' and ‘Additional Financial Analysis' sections for further detail.

Metric | Units | |||||||

Mining Production | ||||||||

Contained Gold | oz Au | 919,868 | ||||||

Contained Silver | oz Ag | 2,491,148 | ||||||

Metal Production | ||||||||

Payable Gold | oz Au | 832,852 | ||||||

Payable Silver | oz Ag | 1,992,919 | ||||||

Avg Annual Gold Production (Processing Period) | oz Au | 130,133 | ||||||

Avg Annual Silver Production (Processing Period) | oz Ag | 311,394 | ||||||

Operating Financials | ||||||||

LoM Revenues | A$ | $ | 3.005 billion | |||||

LoM Cash Operating Costs | A$ | $ | 1.710 billion | |||||

LoM Operating Cashflow (EBITDA) | A$ | $ | 1.295 billion | |||||

LoM Operating Margins (excluding initial pre-strip, net of Ag credits) | ||||||||

Silver By-Product Credit | A$/oz Au | $ | 108 | |||||

Operating Cash Cost | A$/oz Au | $ | 1,874 | |||||

All-in Sustaining Cost (AISC) | A$/oz Au | $ | 1,917 | |||||

Operating Cashflow | A$/oz Au | $ | 1,626 | |||||

LoM Capital Costs | ||||||||

Processing & Infrastructure (incl. ~$70m EPC) | A$m | $ | 374 | |||||

Capitalised pre-strip | A$m | $ | 60 | |||||

Owner's Costs | A$m | $ | 9 | |||||

Owner's Contingency | A$m | $ | 18 | |||||

Design Growth Contingency | A$m | $ | 32 | |||||

Sustaining Capital | A$m | $ | 34 | |||||

Mine Closure & Rehabilitation | A$m | $ | 20 | |||||

Total | A$m | $ | 546 | |||||

Project Returns (Unlevered, Pre-Tax) | ||||||||

Project Free Cash Flow (undiscounted) | A$m | $ | 806 | |||||

Project NPV(7.5) | A$m | $ | 512 | |||||

Project IRR | % | 40 | % | |||||

Payback Period (from start of gold production) | Years | 1.9 | ||||||

Table 2 - LoM production and financial results summary

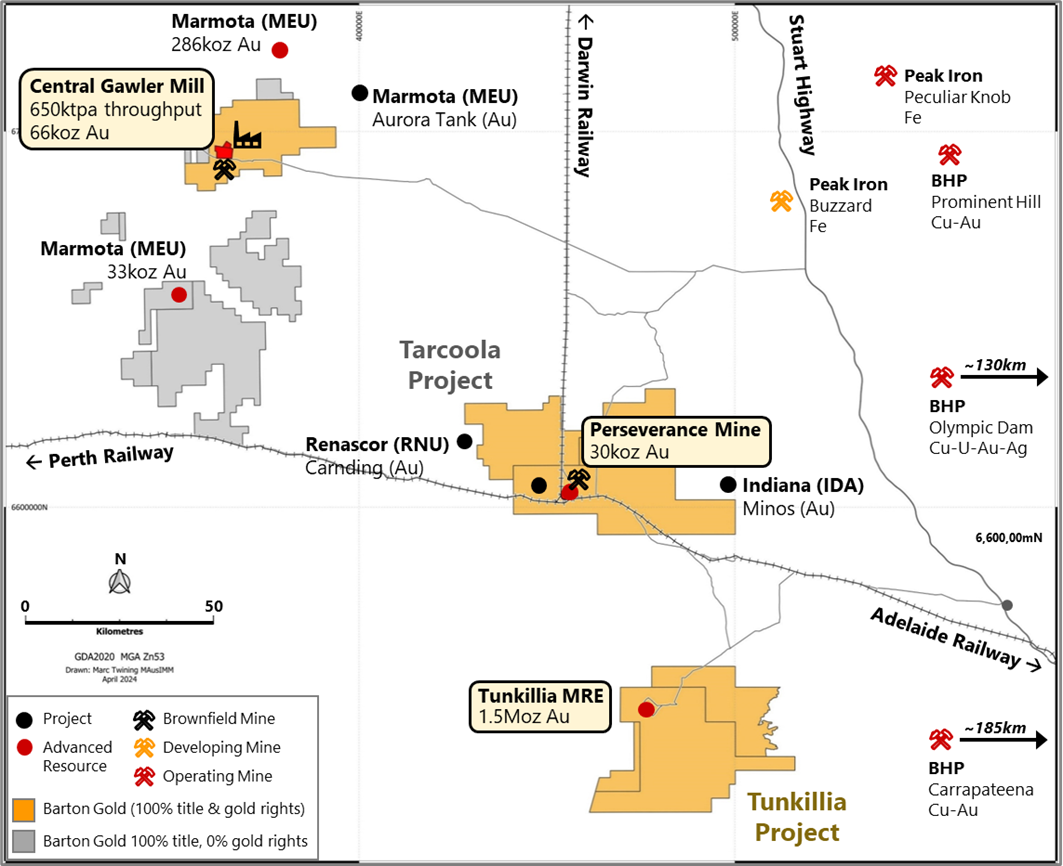

Site Access & Layout

Tunkillia is located ~550km northwest of Adelaide, South Australia and is accessible by existing access tracks on North Well Station connecting Tunkillia to the Tarcoola Road near Kingoonya, South Australia, and from there to the Stuart Highway (which connects Adelaide in the south to Darwin, NT in the north).

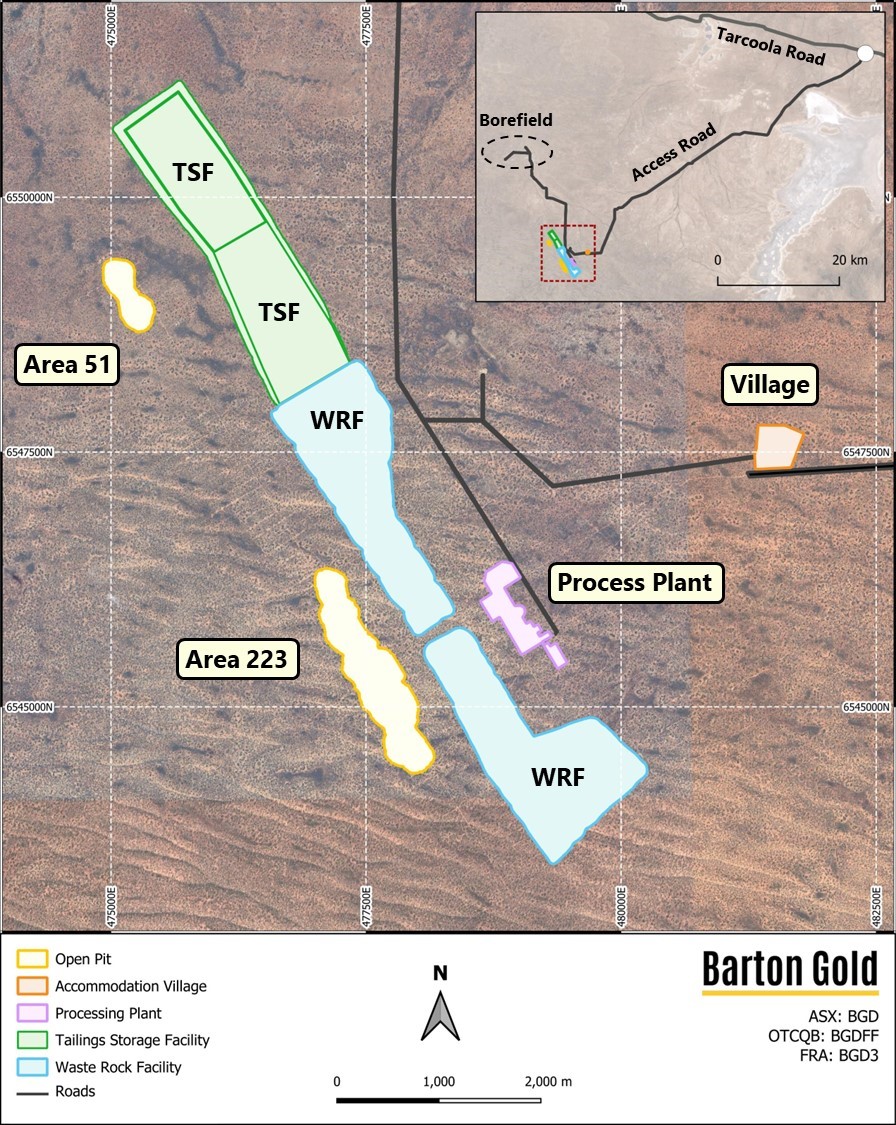

65.5km of existing access tracks will be upgraded to an unpaved access road leading to a 300-person accommodation village. Two open pit areas (Area 223 and Area 51), each with a 500m blast exclusion zone, are located ~5km southwest of the village along the western margin of the Yarlbrinda Shear Zone.

Raw water will be sourced from a borefield ~20km north of the project site. A tailings storage facility (TSF) designed to accommodate a total 39.5Mt of tailings (with expansion possible) will be established east of Area 51 open pit with an initial 24 months (10Mt) capacity. A waste rock facility (WRF) will be established east of the Area 223 open pit, between the open pit and a 5Mtpa carbon-in-leach (CIL) process plant.

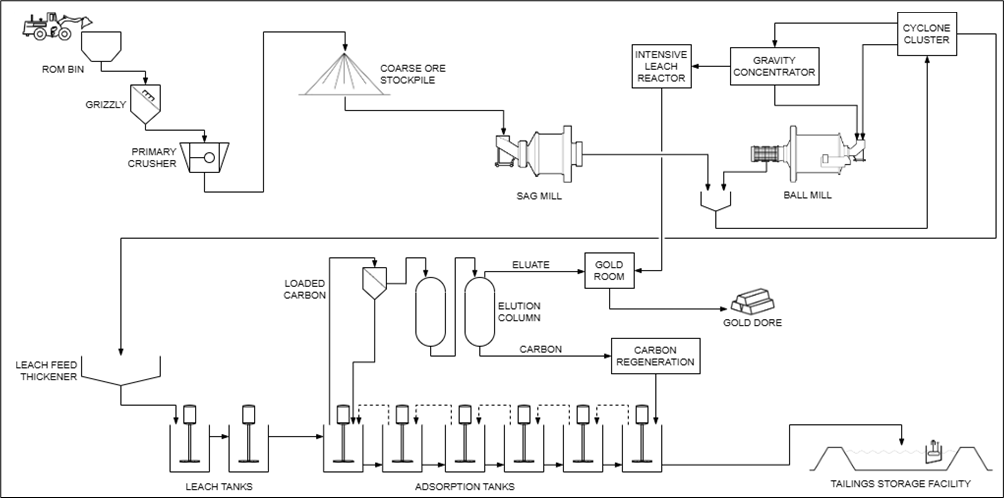

Processing & Recovery Circuit

Comminution is via single stage primary crushing to 80% passing 150mm, followed by two stage grinding in semi-autogenous grinding (SAG) and ball (SABC) mills to 80% passing 75µm. Materials are discharged to a cyclone cluster, with underflow reporting to a gravity circuit feeding concentrates to an intensive leach reactor (ILR). Cyclone overflow reports to a leaching circuit with two leach tanks and six adsorption tanks. Total retention (leaching) time is 24 hours, followed by an elution circuit with an ~18 hour cycle time. ILR and elution circuit outputs are passed through electrowinning cells and then smelted to produce doré. Silver is a material gold production by-product. Tunkillia doré is expected to have ~3 parts silver to 1 part gold (~75% Ag / ~25% Au in doré).

Staged Mine Design

Mining Associates completed a pit optimisation and mine scheduling for Tunkillia utilising processing cost estimates prepared by GRES, and mining costs estimated by Mining Associates from first principles. Further details of these costs are set out in sections entitled ‘Capital Costs' and ‘Operating Costs' below.

A gold price of US$2,000 / oz, a silver price of US$25 / oz, and an AUD / USD exchange rate of 0.6667 were used in the optimisation, equivalent to AUD prices of A$3,000 / oz for gold and A$37.50 / oz for silver.

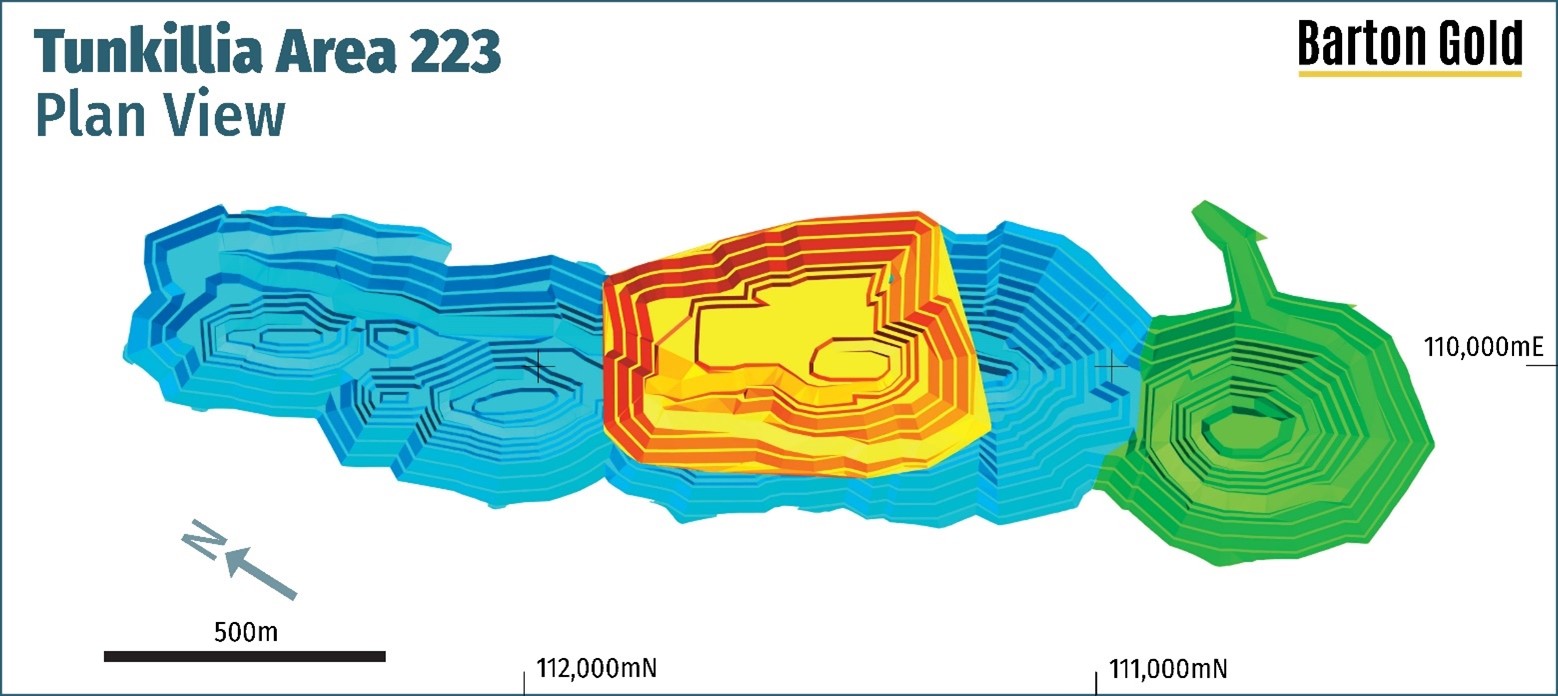

A mine design was then completed using the optimal shells as a basis. Four pit areas (‘Starter', ‘Main', ‘South 1' and ‘Area 51') contain a total of ~30.7Mt materials for processing, with ~191.5Mt of waste and low-grade materials of which ~29Mt are capitalised pre-strip. The project strip ratio (Waste : Resource) is 6.23 and the operating strip ratio is 5.29 excluding capitalised pre-strip.

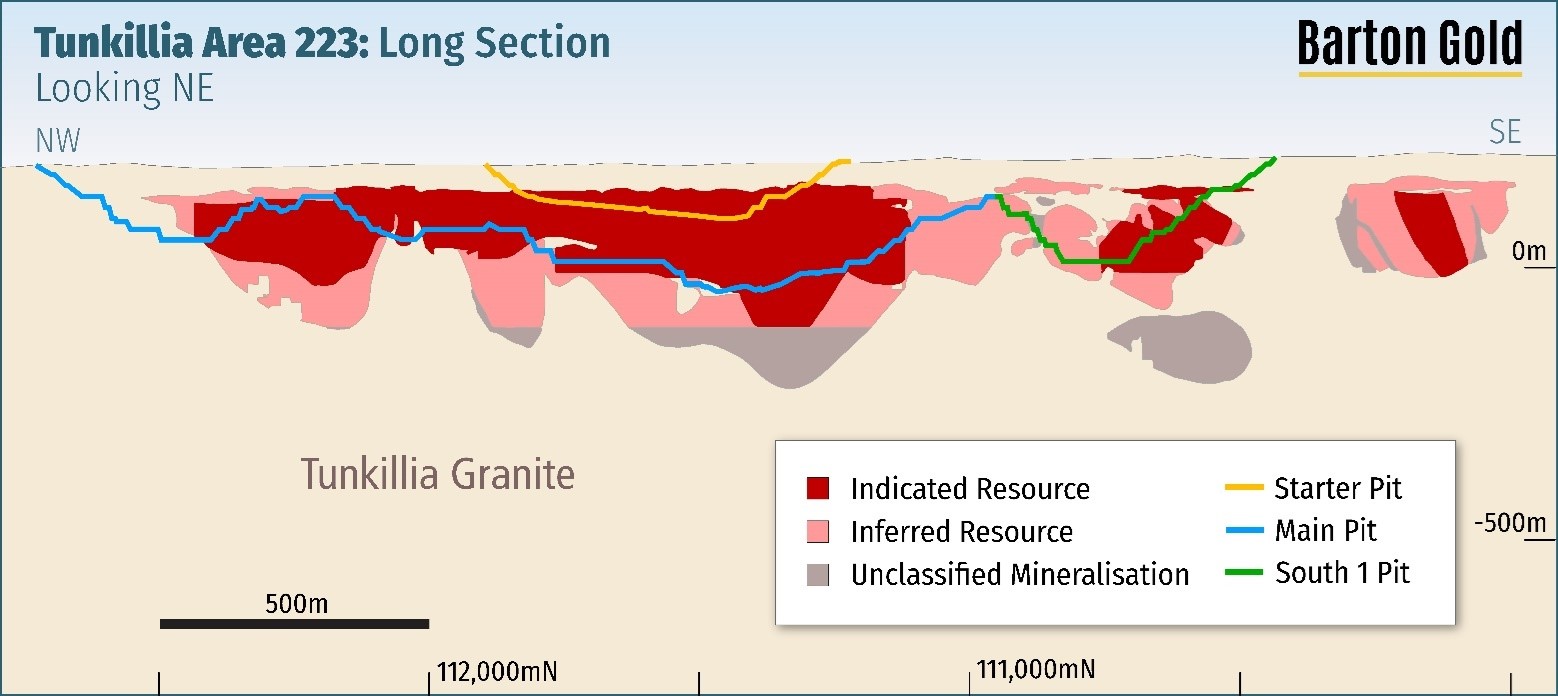

There is potential for optimisation, including infill drilling, to smooth the profile within and between pits, noting the potential for pit extensions into areas with existing JORC Indicated Resources (see Figure 5).

The maximum vertical mining depth is 256m in the ‘Main' pit shown below.

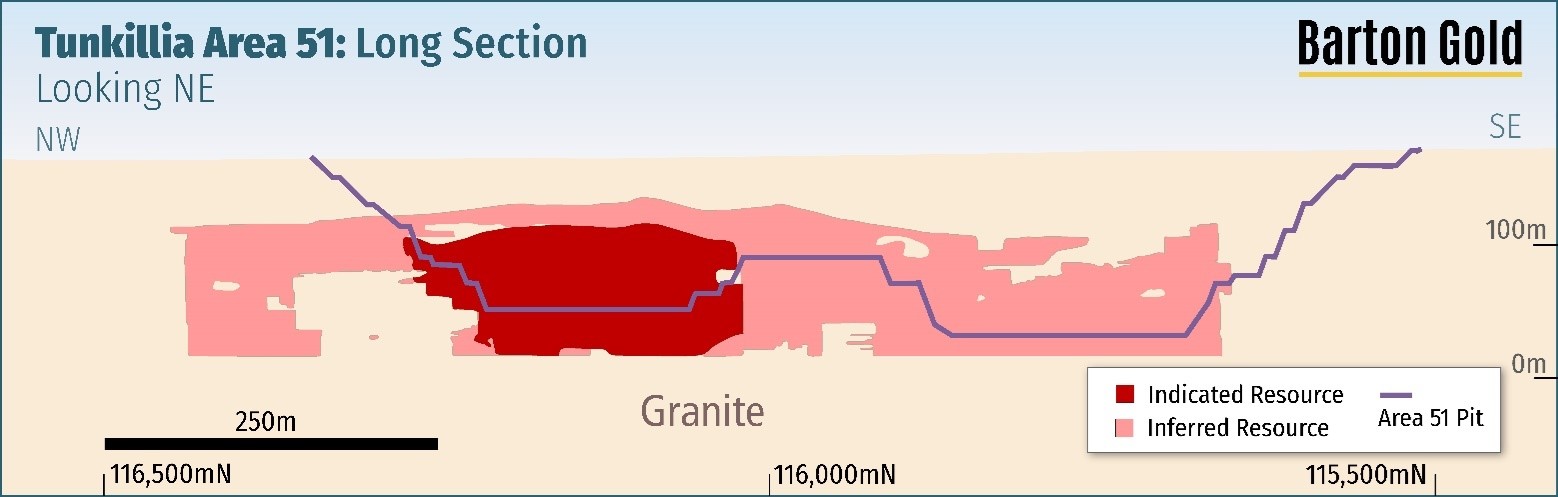

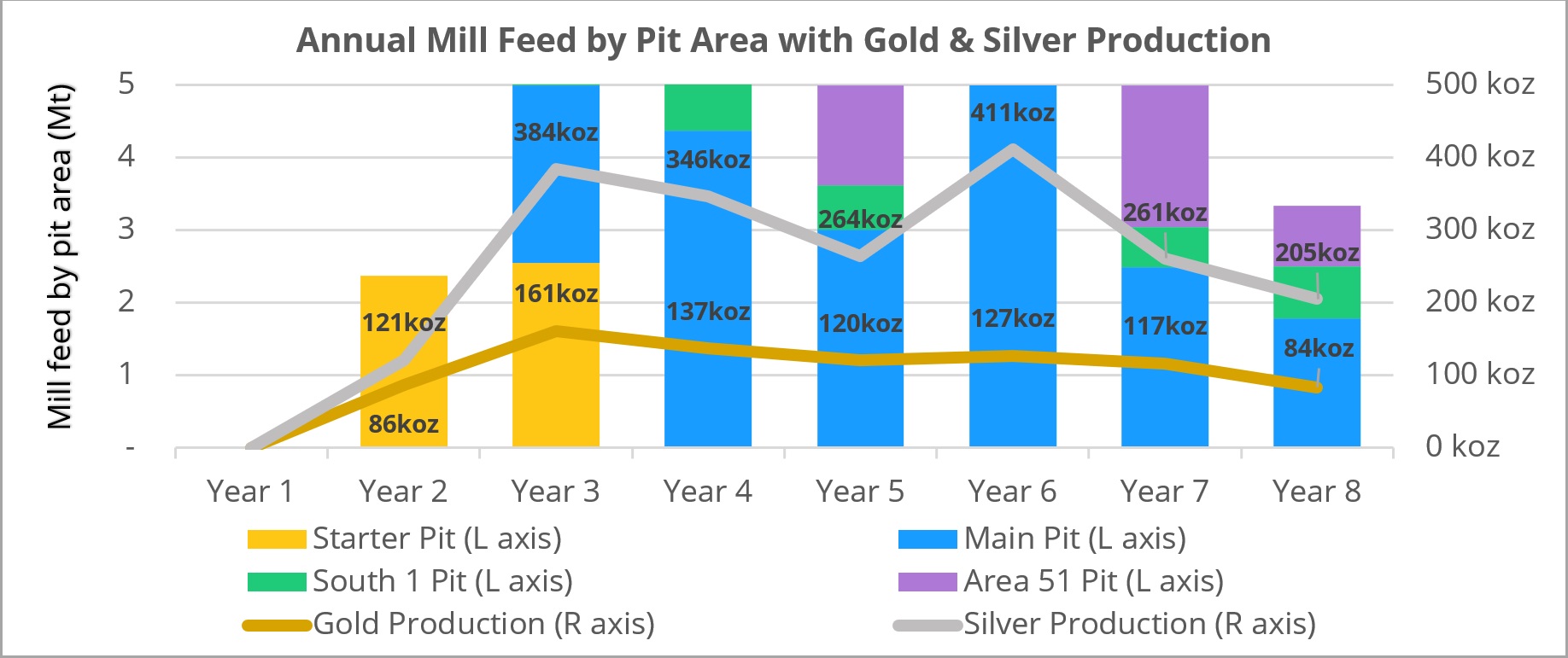

The Area 51 pit is separate to the Area 223 pit(s) and is located ~5km northwest of Area 223. Most of the scheduled materials mined from the Area 51 pit are mined during the 6th and 7th years of mining and processing (see Figure 8), with a lesser proportion mined during the 4th year of mining and processing.

As with the Area 223 pits, there is potential for optimisation to smooth the pit floor profile, and also noting the potential for extensions into areas with existing JORC Indicated Resources (see Figure 7).

Target Production & Materials by Year

An equipment-based schedule was developed by Mining Associates with planned mill feed constrained to 5Mtpa. Mining operations are estimated for 6.4 years (project years 2 - 8), with 5Mtpa mill feed production during years 3 - 7 and less than 5Mtpa during years 2 and 8 (production ramp up and ramp down).

The mining schedule is based on Tunkillia's JORC Mineral Resources Estimate (MRE). 65.6% of materials are classified as ‘Indicated' and 33.7% ‘Inferred' on a LoM basis. Approximately 0.8% of materials are of grade above the MRE's 0.4 g/t Au cut-off grade but are not JORC classified. These are materials ancillary to the JORC MRE which are captured in mine design optimisation and are immaterial to results.

As ~74% of the JORC Mineral Resources scheduled during the first five (5) years of the production target are classified as Indicated, and the project has a projected 1.9 year payback period (from start of production), Barton considers the inclusion of such Inferred and unclassified materials to be reasonable.

Classification | Units | Year 2 | Year 3 | Year 4 |