sur EUROPLASMA (EPA:ALEUP)

Europlasma: Drawing of the first two tranches of bond financing

Europlasma, a company specializing in the treatment of hazardous waste, announces that it has drawn down the first two tranches of its bond financing. This drawdown concerns 400 bonds convertible into new shares, representing a total amount of €2 million. This operation is part of a bond issue of up to €30 million over 36 months, announced in April 2024.

The funds will be mainly used to acquire MG-Valdunes assets, modernize production sites, and develop the Forges de Tarbes. Europlasma aims to support its intensive growth through this fundraising, by strengthening its industrial capacities and ensuring the autonomy of production of various products.

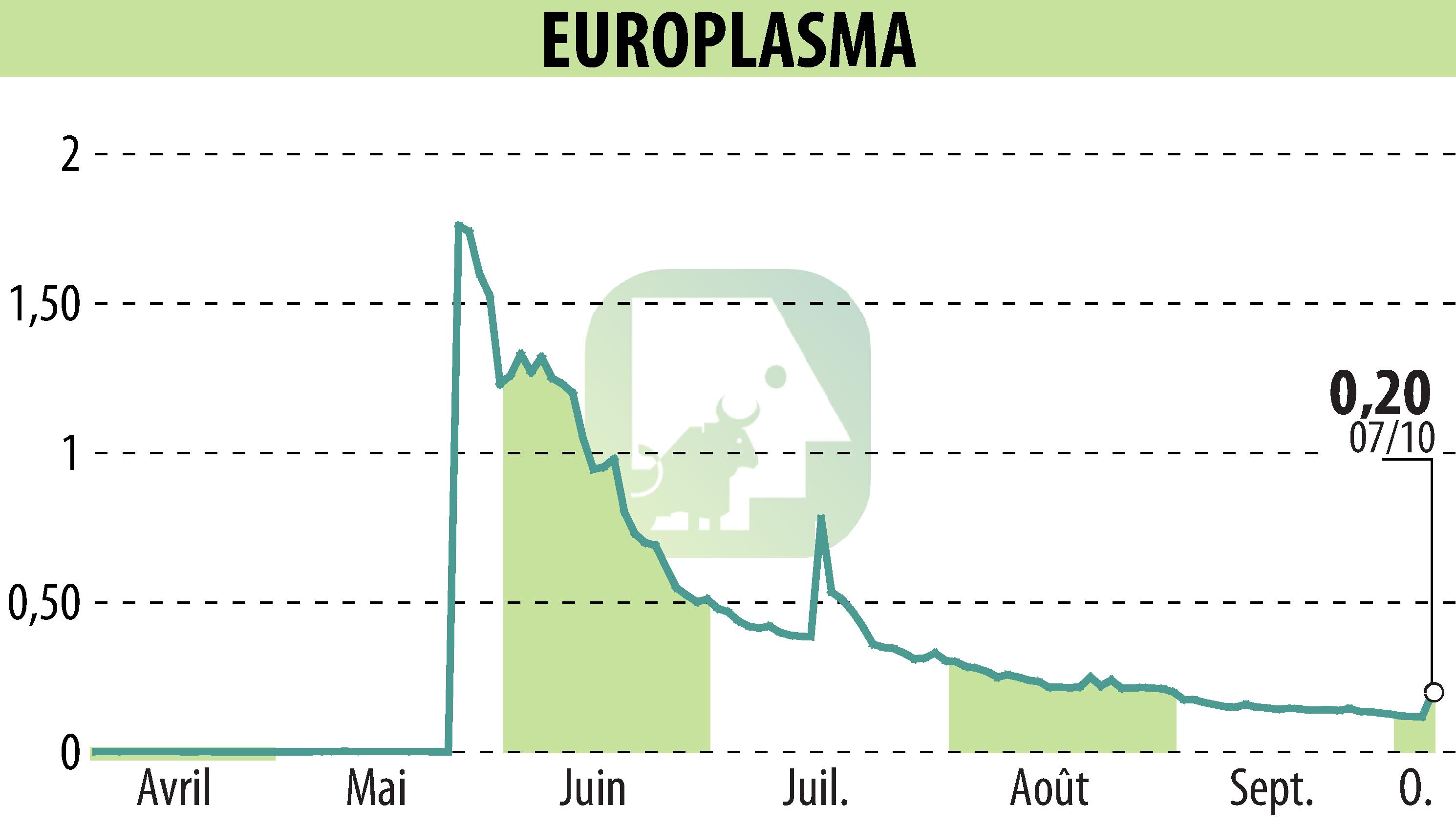

On the other hand, the issuance of new shares could generate downward pressure on the Europlasma share price, creating a risk of dilution for current shareholders. The securities resulting from the conversion of the bonds will generally be sold quickly on the market. Investors are advised to be aware of the potential risks associated with this transaction.

R. P.

Copyright © 2024 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de EUROPLASMA